- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 1099 K includes cash back

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 K includes cash back

I have received a 1099K from Paypal that included my cashback from Rakuten. Based on IRS and Rakuten the cashback is not taxable. How can I exclude it on my tax return if it is already on 1099K?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 K includes cash back

Yes, discounts or cash back rewards are not taxable. To exclude them when they are included on Form 1099-K, follow what @DawnC describes. Otherwise, the Cash Back Rewards will need to be included in the expenses.

To enter the discounts/rebates/rewards so they are subtracted in TurboTax:

- Go to Self-employment income & expenses and Edit/Add

- At Your 2020 self-employed work summary, select Edit

- Scroll down to EXPENSES and click in the lower left hand corner, Add expenses for this work

- Scroll to Other miscellaneous expenses select the toggle, scroll to the bottom of the page and click Continue

- Enter a Description in reference to the tax form if you wish, such as Form 1099-K Cash Back from Rakuten, the amount, and Continue

[Edited 01/25/2021 | 12:47 PM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 K includes cash back

Thank you for your response. Unfortunately, TurboTax doesn't let you enter negative amounts in the 1099-k area.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 K includes cash back

In some cases, the total gross payment amount on Form 1099-K may not belong to your business. If the cashback was not part of your business, you can exclude that amount when you enter the 1099-K and only enter the receipts for your business. Keep records in the unlikely event you receive an inquiry.

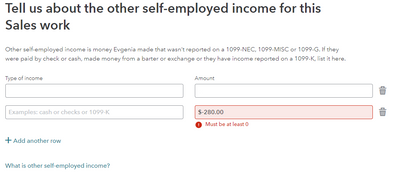

If it is part of your business, report the full amount of the 1099-K and then use the Rebates and Refunds income category under Self-Employment income as a positive number. You won't see this option until after you have entered some kind of self-employment income. See image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jimm-wisc

Level 1

barbnich

Level 2

Mhua326

New Member

pinkadelica

New Member

magnetic430

Returning Member