- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Options After Failing Test Period for Trad IRA distro to HSA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Options After Failing Test Period for Trad IRA distro to HSA

Already now I screwed this up ... but looking for a soundboard here on any potential options to minimize the damage.

Scenario ...

1) Retired Feb 2022 using employer COBRA to continue same HDHP.

2) Fast forward to JUL/AUG 2023, looking at insurance plan options since COBRA ends 01 OCT 2023.

3) Original plan was to use an ACA HDHP plan so initiated a "ONE TIME TRAD IRA DISTRO TO HSA" in early SEP 2023 for full max amount $3850 (single) + $1000 over 55 (but not 59 1/2 yet) given no 2023 contributions had been made. According to information, no 10% penalty for under 59 1/2 so long as you meet the test period requirements.

4) Prior to COBRA end, opted for a non-ACA Tri-Term plan (non-HDHP) for its national coverage and better emergency coverage. What I understand from my insurance broker, outside of your ACA bubble, ER is covered for "life threatening emergencies only". I spend alot of time outside what would be my ACA bubble doing things with higher risk of injury than while home.

5) Therefore, I have failed the test period (12 months AFTER contribution) and the dubious "60-day return option" has lapsed. So the $4850 contribution will be considered an "early IRA distribution (without exception)" to which I will pay normal income tax plus the 10% "before 59 1/2" penalty ($485).

6) And to rub salt in the wound, since am not on an HDHP plan the last three months of 2023, my max contribution for 2023 would be $3638, so there will now be an excess-contribution for 2023. My understanding, the excess will need to be withdrawn prior to 15 APR 2024. Am assuming tax penalty if it remains? And just for posterity sake, TT does take into account age so it is pro-rating the max contributions based on "catch-up" maximum ... meaning 9/12*4850 = $3638.

7) Conclusion: This will now be considered a prior to 59 1/2 Traditional IRA distribution to an qualified HSA vs the "one-time no-tax penalty any age rollover". From an IRA perspective, it will incur income tax and 10% penalty. From the HSA perspective, I will need to withdraw the excess-contribution prior to 15 APR 2024. The withdraw would just come back to me as cash, not a return to the IRA.

😎 Did I miss anything? (:-p)

9) ARE THERE ANY OPTIONS TO REDUCE THE IMPACT OF THIS SCREWUP?

Thank you.

LGinMO

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Options After Failing Test Period for Trad IRA distro to HSA

You have a good grasp of the situation.

Because an HSA Funding Distribution is an otherwise ordinary distribution (it only becomes an HFD if reported as such on your tax return), if it was done within 60-days a rollover of $4,850 back to a traditional IRA could have been done if you had been able to come up with funds to do so. That would have eliminated the 10% early-distribution penalty. However, if you were able to come up with such funds, it probably would have made no sense to do an HFD in the first place rather than make a deductible HSA contribution, so that may not have been an option.

Since it's too late to do a rollover, you've failed to complete the testing period for the HFD and the $4,850 is subject to a 10% penalty and inclusion in income no matter what you do, it makes no sense to report the IRA distribution as being an HFD. By reporting it as an ordinary IRA distribution not deposited it into an HSA, at least you'll be able to claim the permissible portion of the HSA contribution ($3,638) as a regular personal HSA contribution for which you get a deduction on Schedule 1.

You really do want to obtain a return of the excess contribution. If the excess is not corrected by a return of contribution before the due date of your 2023 tax return, including extensions, you'll owe a 6% excess-contribution penalty with your 2023 tax return. After that you'll continue to owe a 6% on this excess each year until you can either apply the excess as a contribution for a subsequent year or you obtain a regular taxable contribution from the HSA equal to the amount of the excess with no adjustment for investment gain or loss. If that distribution is obtained before age 65 (which you would want to do to keep the 6% penalties from piling up), it will be subject to a 20% additional tax. (You could also spend your HSAs to zero on qualified medical expenses to eliminate the penalty but doing so does not seem to actually eliminate the excess).

Be aware that one or more HSA custodians (I don't know which ones) shirk their responsibility to calculate the investment gain or loss attributable to the amount of excess contribution being returned required to adjust the amount distributed, so you may have to do that calculation yourself. If your HSA custodian is one of those, you'll tell the custodian the amount of gain or loss amount in addition to telling the custodian the exact amount to distribute after applying the gain/loss adjustment to $1,212.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Options After Failing Test Period for Trad IRA distro to HSA

You have a good grasp of the situation.

Because an HSA Funding Distribution is an otherwise ordinary distribution (it only becomes an HFD if reported as such on your tax return), if it was done within 60-days a rollover of $4,850 back to a traditional IRA could have been done if you had been able to come up with funds to do so. That would have eliminated the 10% early-distribution penalty. However, if you were able to come up with such funds, it probably would have made no sense to do an HFD in the first place rather than make a deductible HSA contribution, so that may not have been an option.

Since it's too late to do a rollover, you've failed to complete the testing period for the HFD and the $4,850 is subject to a 10% penalty and inclusion in income no matter what you do, it makes no sense to report the IRA distribution as being an HFD. By reporting it as an ordinary IRA distribution not deposited it into an HSA, at least you'll be able to claim the permissible portion of the HSA contribution ($3,638) as a regular personal HSA contribution for which you get a deduction on Schedule 1.

You really do want to obtain a return of the excess contribution. If the excess is not corrected by a return of contribution before the due date of your 2023 tax return, including extensions, you'll owe a 6% excess-contribution penalty with your 2023 tax return. After that you'll continue to owe a 6% on this excess each year until you can either apply the excess as a contribution for a subsequent year or you obtain a regular taxable contribution from the HSA equal to the amount of the excess with no adjustment for investment gain or loss. If that distribution is obtained before age 65 (which you would want to do to keep the 6% penalties from piling up), it will be subject to a 20% additional tax. (You could also spend your HSAs to zero on qualified medical expenses to eliminate the penalty but doing so does not seem to actually eliminate the excess).

Be aware that one or more HSA custodians (I don't know which ones) shirk their responsibility to calculate the investment gain or loss attributable to the amount of excess contribution being returned required to adjust the amount distributed, so you may have to do that calculation yourself. If your HSA custodian is one of those, you'll tell the custodian the amount of gain or loss amount in addition to telling the custodian the exact amount to distribute after applying the gain/loss adjustment to $1,212.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Options After Failing Test Period for Trad IRA distro to HSA

@dmertzThank you for the quick response and thorough explanations.

To answer a couple of your questions and alternative approaches ...

Original post-COBRA health insurance plans (ie ACA HDHP) lent itself to an opportunity to use the one-time HFD option so figured what the heck, vs out-of-pocket. Seemed like a good thing to do especially given zero contributions had been made in 2023.

Already called and submitted form to HSA company. Their policy if its a "post-tax" excess contribution to use their RETURN OF MISTAKEN CONTRIBUTION Form. Apparently their DIST OF EXCESS CONTRIBUTION Form is for a valid "pre-tax" excess contribution. Given my situation shifted from "pre-tax" to "post-tax" due to failing the test period, that made sense. They also, according to the Member Service Rep talked to, will adjust for the appropriate interest to the excess so I will not have to do the math.

Noted your other possible scenarios to handle the excess, but agree a return is the simplest and cleanest. That way I do not have to continually track it for years to come. Applying it to another tax year would probably have been a good solution but again, no idea when/if I will get back to an HDHP, so return of excess is best.

After reading several other related posts ... figured DMERTZ might be the expert that responded!

Thank you,

LGinMO

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Options After Failing Test Period for Trad IRA distro to HSA

Greetings @dmertz

Well as luck would have it ... my HSA Custodian (at least the first level reps I have talked to) are stating the back-office claims they cannot figure out the amount of earnings that should be removed as a result of the Excess Contribution. What a bunch of bozos!

That being said, am going to wait to see what my 1099-SA states in Box 2 before submitting yet another request to remove the Net Income on the earnings associated with the Excess Contribution. Per IRS rules, I have till 15 APR 2024 to get that adjustment to avoid any penalties or excess contribution excise tax of 6%.

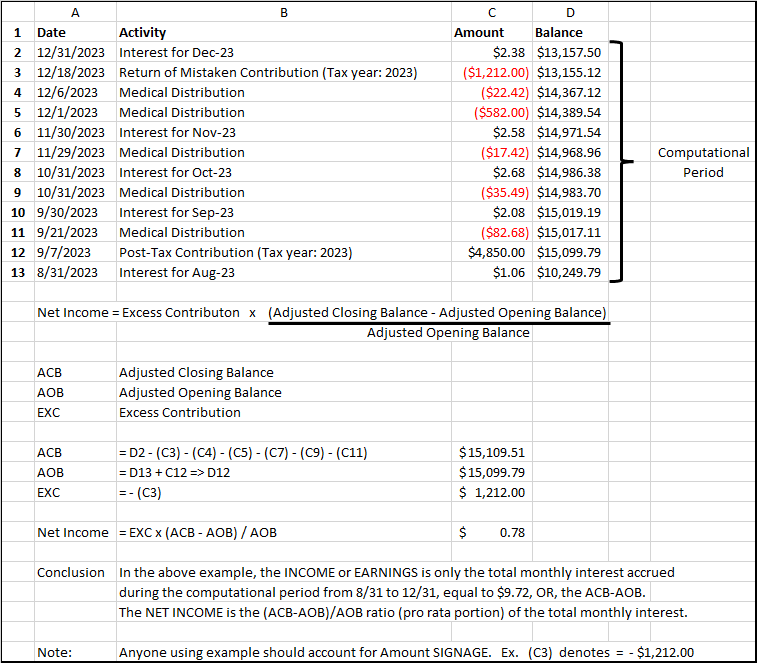

And just for posterity sake ... here is an example of how I am applying the 26 CFR § 1.408-11 - Net income calculation for returned or recharacterized IRA contributions, against this situation! 🙂 Numbers are fictitious but in the same order of magnitude.

The laughable part of all this is for such an example, the amount is less than $1.00! The amount of time I have spent on this (and you) WAS NOT WORTH IT!!!! LOL!

Thanks for your help @dmertz !

LGinMO

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

BruceW21

New Member

hustonfamily

New Member

lgreene1964

Level 1

DesertPhoenix

New Member

premjanchhzz23

New Member