- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Greetings @dmertz

Well as luck would have it ... my HSA Custodian (at least the first level reps I have talked to) are stating the back-office claims they cannot figure out the amount of earnings that should be removed as a result of the Excess Contribution. What a bunch of bozos!

That being said, am going to wait to see what my 1099-SA states in Box 2 before submitting yet another request to remove the Net Income on the earnings associated with the Excess Contribution. Per IRS rules, I have till 15 APR 2024 to get that adjustment to avoid any penalties or excess contribution excise tax of 6%.

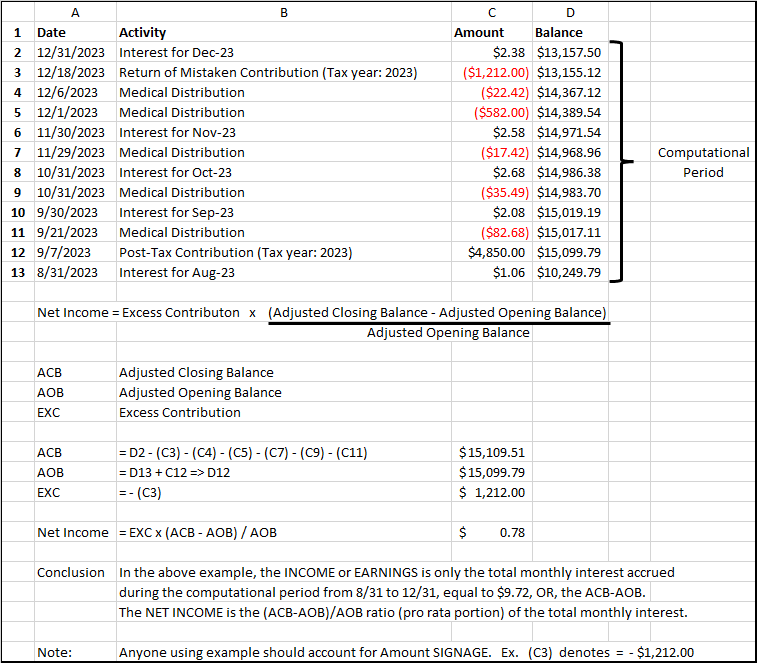

And just for posterity sake ... here is an example of how I am applying the 26 CFR § 1.408-11 - Net income calculation for returned or recharacterized IRA contributions, against this situation! 🙂 Numbers are fictitious but in the same order of magnitude.

The laughable part of all this is for such an example, the amount is less than $1.00! The amount of time I have spent on this (and you) WAS NOT WORTH IT!!!! LOL!

Thanks for your help @dmertz !

LGinMO