- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

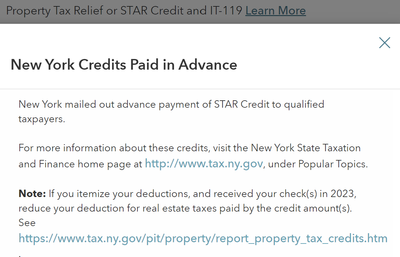

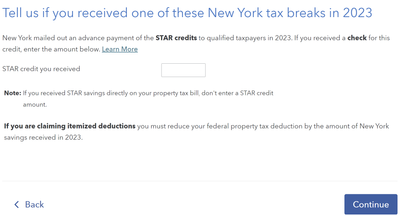

When entering STAR credit you're prompted with the messages below:

If you itemize your deductions, and received your check(s) in 2023, reduce your deduction for real estate taxes paid by the credit amount(s).

If you are claiming itemized deductions you must reduce your federal property tax deduction by the amount of New York savings received in 2023.

(Note: These are not exactly consistent. One says "reduce your reduction", which can be interpreted as on your state taxes. Then you see the next one, which says says "reduce your federal property tax". I included screenshots at the end of this post).

1. Where am I supposed to make this reduction? From above it seems like it would be in our federal taxes, which then makes it's way to state, but it isn't completely clear based on these prompts.

2. Exactly where in turbo tax can I enter it? There is no place I've seen in any of the steps. In the FEDERAL section, it get's the taxes from our 1098 and then there is not place where it asks to enter STAR or reduce it manually. In the STATE section, it does eventually ask for STAR but does not consider it when filling out IT-196, Line 6 (State and local real estate taxes). It is not subtracting it from my property taxes here.

This all started when I noticed STAR isn't being subtracted from IT-196, Line 6 (State and local real estate taxes). It appears to be subtracting Real Property Tax Relief Credit (IT-229), but not my STAR credit.

I've talked to 3 tax experts from TurboTax today, none of whom knew why.

Prompts from turbo tax:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

If the property tax was entered via the 1098 reporting Home Mortgage Interest, you would edit the amount by going back to that form and editing the amount (subtracting the amount of the Star Credit).

Deductions & Credits

Your Home

Mortgage Interest, Points, Refinancing, and Insurance START or UPDATE

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

@KrisD15 So I have to go back to my federal section, edit any one of the 1098s for my mortgage lenders and subtract the STAR credit from it?

If yes, then I have a note for turbotax (not directning this at you @KrisD15, I thank you for the quick help. Maybe you can forward this to the appropriate person at TT?)

This seems awfully manual and easy to miss for most users. It originally asked us what's in our 1098 forms (or read it automatically from our scans). But then we have to go back after our state taxes are done (if TurboTax recommends we itemize) and then change it from it's original value?

It just seems off that we're asked to put in values from our 1098 and it specifically lists them for each lender. Then we go ahead and change it to something different later on.

If anything I'd expect the software to either go back and subtract STAR automatically or add a line or note anywhere showing that it removed the STAR credit from our property taxes on the federal forms after it runs it's automatic "check/validation" at the end of the state form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

In order to get this correct you do have to manually edit the 1098 and enter it into your federal deductions that way.

I will pass your suggestion on. Thank you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

81rxv1te

New Member

Opus 17

Level 15

TaxGal7

New Member

laoxai

New Member

kjsommer67

Returning Member