- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State: If I received STAR credit and I'm itemizing, how do I "reduce federal property tax deduction by the amount of New York savings received"

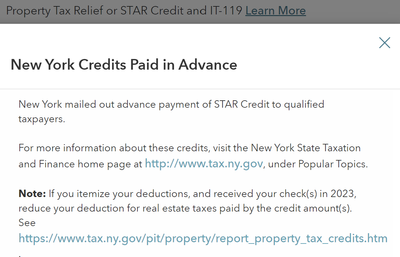

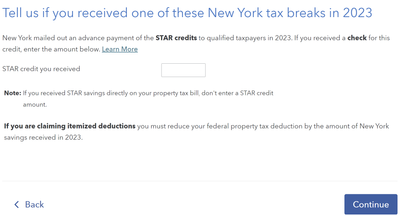

When entering STAR credit you're prompted with the messages below:

If you itemize your deductions, and received your check(s) in 2023, reduce your deduction for real estate taxes paid by the credit amount(s).

If you are claiming itemized deductions you must reduce your federal property tax deduction by the amount of New York savings received in 2023.

(Note: These are not exactly consistent. One says "reduce your reduction", which can be interpreted as on your state taxes. Then you see the next one, which says says "reduce your federal property tax". I included screenshots at the end of this post).

1. Where am I supposed to make this reduction? From above it seems like it would be in our federal taxes, which then makes it's way to state, but it isn't completely clear based on these prompts.

2. Exactly where in turbo tax can I enter it? There is no place I've seen in any of the steps. In the FEDERAL section, it get's the taxes from our 1098 and then there is not place where it asks to enter STAR or reduce it manually. In the STATE section, it does eventually ask for STAR but does not consider it when filling out IT-196, Line 6 (State and local real estate taxes). It is not subtracting it from my property taxes here.

This all started when I noticed STAR isn't being subtracted from IT-196, Line 6 (State and local real estate taxes). It appears to be subtracting Real Property Tax Relief Credit (IT-229), but not my STAR credit.

I've talked to 3 tax experts from TurboTax today, none of whom knew why.

Prompts from turbo tax: