- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- New or Changed tax credits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New or Changed tax credits

Hello,

As a sole proprietor/self-employed individual, I receive income from my job, which I receive on a 1099-NEC, and additional income from investments. Are there any new or changed tax credits and deductions for this year 2023 that I should be aware of before I file?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New or Changed tax credits

Take a look at the following article for some information about tax law changes for 2023:

Key tax changes for your 2023 taxes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New or Changed tax credits

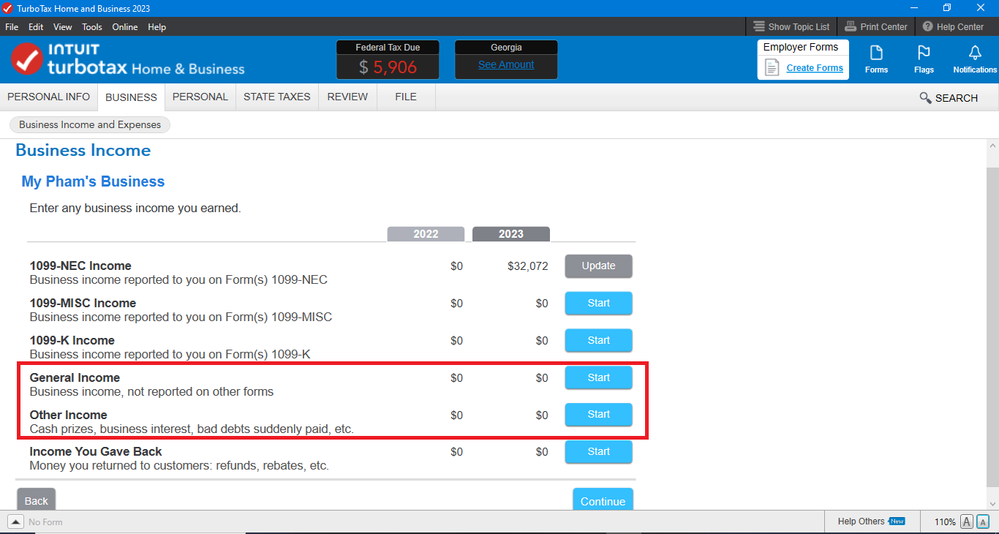

I received a check for under $600, but I haven't received a Form 1099-NEC. Is it okay if I don't report this income?

If I want to report it, where should I report it? Should I include it as general income or other income? Or they're both ok to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New or Changed tax credits

Was it for your self employment business? Yes enter it under General Business Income.

You don't need to get a 1099MISC, 1099NEC or 1099K. Even if you did you can enter all your income as Cash or General Income. Only the total goes to schedule C. You should be entering the income from your own records.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

evan-scott1

New Member

ericag569

New Member

dmraye

New Member

e-wlawrence

New Member

reeree1121

New Member