- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Issues with HSA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

I've been told by my employer, in health insurance, that "there is no requirement to spend the money amount per year in my HSA"

But while for taxes, I've told on turbotax that I have an excess contribution. And I'd have to withdraw money from my HSA. I went to a taxpreparer instead yesterday and I've been told that I needed to withdraw more from my HSA in order not to owe more in taxes. She said "every year what I don't use gets added into my income"

I am so confused. Because I thought an HSA the point of it was to save up money towards retirement. So why do I have to spend it/spend a certain amount? My cap was 3,850 in 2023. I spent 2,519.28 in my gross distribution. How do I go about this? I'm being told different things from turbotax, to my tax preparer, to my HSA employer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

Your HSA can be used now, the following years or even when you're retired.

One of the great advantages of an HSA is that you’re not required to take money out of it by any given date, you can save and may even be able to invest your balance until you need it.

Even if you leave the employer that originally sponsored your HSA, you can keep that HSA, or transfer or roll the balance over to another HSA — one offered by your new employer or an HSA you open yourself.

Also, distributions from an HSA that are used to pay qualified medical expenses aren’t taxed.

However, if you overfunded or weren't eligible to contribute to your HSA in 2023, you'll need to withdraw the excess amount by April 15, 2024 to avoid a penalty (October 15 if you filed an extension).

These withdrawals will be considered taxable income.

You also need to take out any income earned on the withdrawn contributions during the year they were made. This will also be taxable income.

For 2023, the maximum combined total that you, your employer, and/or any other eligible person can contribute to your HSA account is: $3,850 if you're under 55 at the end of 2023 and are covered by an individual (self-only) HDHP;

The above limit is prorated depending on the number of months you were covered by an HDHP and had no additional health coverage.

Why am I showing an excess HSA contribution?

Your HSA contribution is reported in box 12 of your W-2 with the code W.

Code W reports the combined HSA contributions from you and your employer. Don't report that amount again on your return. That will cause excess contribution on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

The total contributions between me and my employer is 3,850 and it's saying I went over on turbotax. I didn't, and my employer has told me that they make it so it's impossible to go over my limit.

So I don't understand why turbotax is having me withdraw when I didn't go over the limit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

As I mentioned, your W-2 box 12 code W shows the amount that you and your employer contributed to your HSA.

When you enter your W-2, TurboTax automatically records this amount in the 1099-SA, HSA, MSA section. Don't enter that amount again in the Medical section in the Deductions and Credits section on your return. That will cause the excess contribution.

If you did, make sure to delete that amount.

To revisit that section:

- Open (continue) your return in TurboTax. In the search bar, search for hsa and select the Jump to link in the search results.

- On the screen Tell us about the health-related accounts you had in 2023, check the box next to Health Savings Account (HSA) and select Continue.

Or;

Go to Deductions and credits.

Scroll down to Medical

Click Review/Edit next to 1099-SA, HSA, MSA

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

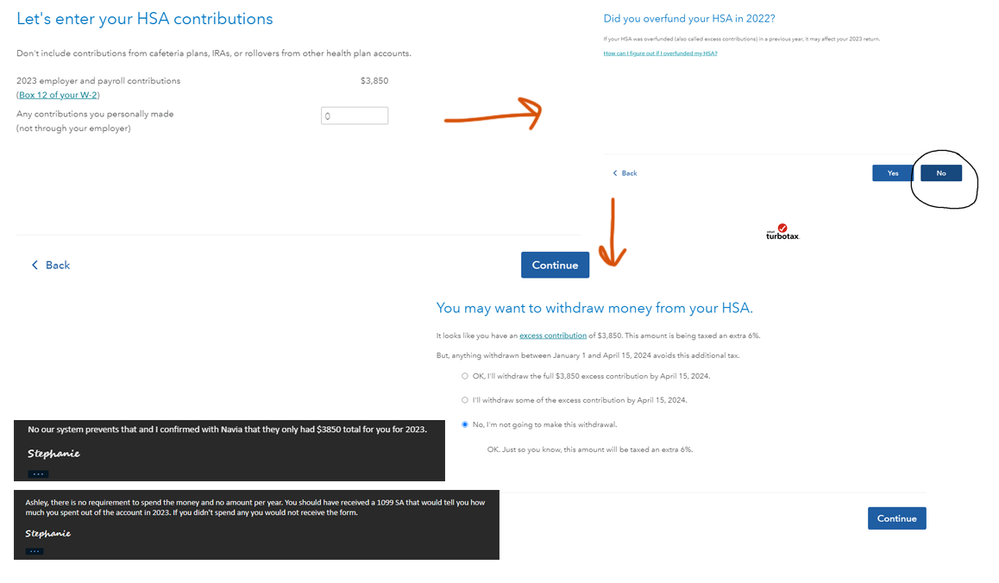

"In the search bar, search for hsa and select the Jump to link in the search results." I don't see this jump to link. These are the steps I've been taking, and even though I submitted 0 for contributions, it's still acting like I overfunded it. Included a screenshot below of this, as well as the email from my employer saying it wasn't overfunded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

@Ashley D wrote:

The total contributions between me and my employer is 3,850 and it's saying I went over on turbotax. I didn't, and my employer has told me that they make it so it's impossible to go over my limit.

So I don't understand why turbotax is having me withdraw when I didn't go over the limit?

Let's start over. First, some definitions and an explanation.

You can take money out of the HSA at any time, this is a regular distribution. If you use the money for qualifying care, it is tax-free. If you use the money for something else, you will pay income tax, and if you are under age 65 you will also pay a 20% penalty. You are never required to take a regular distribution and you can leave money in the account for as long as you like. If someone told you that you must spend the account down to zero each year, this is incorrect. (That is true for an FSA, or flexible spending account, but is not true for an HSA, Health Savings Account.)

There is also something called a corrective distribution. If you contribute more than you are allowed, you will pay income tax and a penalty unless you correct the situation by making a special withdrawal called a corrective distribution. This must be done before April 15 of the year after the excess contributions were made.

-----

Now, $3850 is the correct amount of eligible contributions if you were covered by a single HDHP for the entire year and had no other coverage, or you were covered by a single HDHP for the last month of the year and plan to be covered for all of the next year (using something called the last month rule).

In turbotax, there are two common reasons why the program will think you made an excess contribution when you did not.

1. You fail to tell the program that you had qualifying HDHP insurance and no other coverage for the entire year.

2. You double-counted your contributions. Contributions made via payroll deduction are recorded on your W-2 only and are detected automatically. When you are asked in the HSA interview, "did you make any other contributions" that only refers to direct contributions you made to the bank outside of payroll deductions. If you only contributed via payroll deduction then your answer here is no or zero additional contributions.

For both errors, run the HSA interview on the deductions and credits page again and double-check your answers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issues with HSA

You are also not allowed to make any HSA contributions if you can be claimed as a dependent by another taxpayer. If you can be claimed, then you are out of luck and either pay the penalty or withdraw the excess contribution (but it does not have to be returned to the employer even if it contains matching funds.)

If you can't be claimed as a dependent, check your personal interview again to make sure that box was not accidentally checked.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Ashley3191989

New Member

martintrailjr

New Member

jl_brooks

Level 1

Astephens0429

New Member

epicanthony

New Member