- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I’m currently pregnant and I’m due to have my baby in December of 2022. What child tax credit do I qualify for? What should I know about having a baby in 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m currently pregnant and I’m due to have my baby in December of 2022. What child tax credit do I qualify for? What should I know about having a baby in 2022?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m currently pregnant and I’m due to have my baby in December of 2022. What child tax credit do I qualify for? What should I know about having a baby in 2022?

@jessiehill03 - Assuming the baby is born in 2022, you are eligible for up to a $2,000 tax credit (and this would occur each year based on current law)

it does assume you (or your spouse) works and earns at least $2500.

Depending on your family income you may also be eligible for the Earned Income Tax credit. How much is more complicated to explain, but if this is your first child and your income is under $49,200 (filing joint) or $43,500 (for other filing status'), you would be eligible for this credit as well.

Also, be sure to apply for the social security number at the same time you sign the birth certificate. That SSN is required to file the tax return and must be issued by April 18, 2023 for you to be eligible for these credits. if for some reason it is NOT issued by April 18, DO NOT FILE YOUR TAX RETURN, but rather file for an extension, which gives you until Oct 15, 2023 to file. THe way Congress passed the law is that if the SSN is not issued by the due date, you give up the right to the credit for the year. Filing the extension gives you an additional 6 months to obtain the card from Social Security and still get the credit.

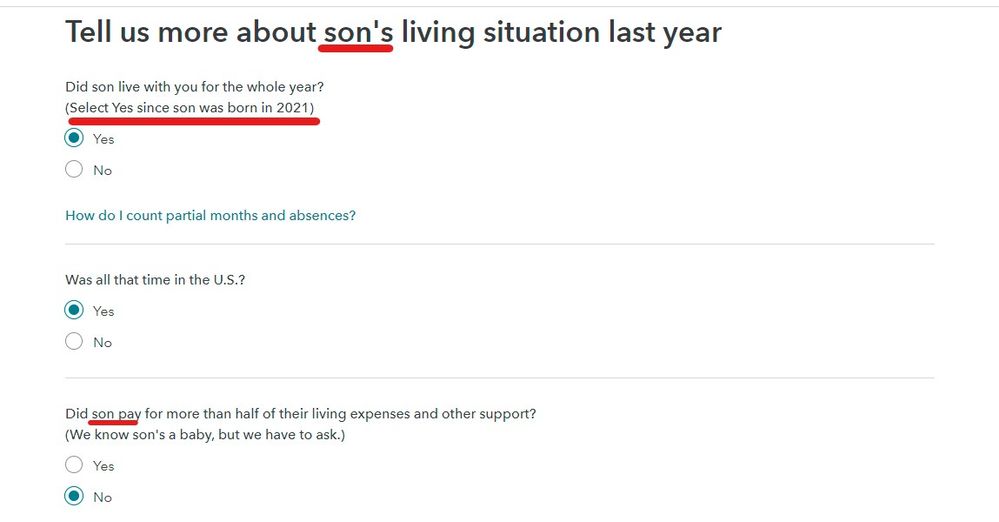

when you complete your tax return, there is a question asking how long Baby lived with you in 2022. You are to answer 'all year' or 12 months. Answering "1 month" is NOT the correct respond for a new born and will result in the tax credit not being applied at all.

Congratulations!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m currently pregnant and I’m due to have my baby in December of 2022. What child tax credit do I qualify for? What should I know about having a baby in 2022?

Even in your sleep deprived state please READ the interview screens carefully ... the correct answer is given to you ...

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fj7

Level 1

nrc07

New Member

Tetiberryzzz

New Member

donaldjsa

Returning Member

donaldjsa

Returning Member