Are you filing Nebraska?

If so, as you progress through the Nebraska interview, you will come to a screen with the title "Property Tax or Other Nebraska Credits?". Check the box for "Property Owned by an Individual Tax Credit".

You will answer YES to this question: Do you have any Nebraska School District Property Tax or Nebraska Community College Property Tax Paid?, if you own property.

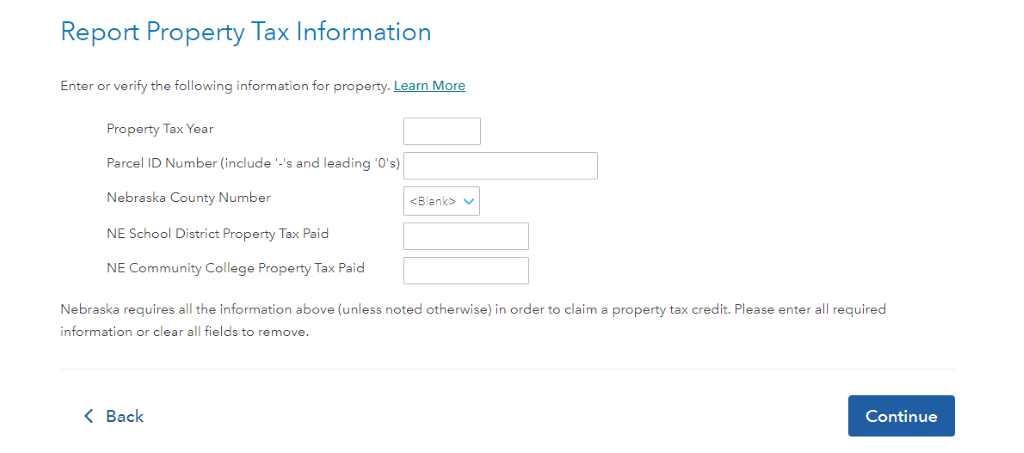

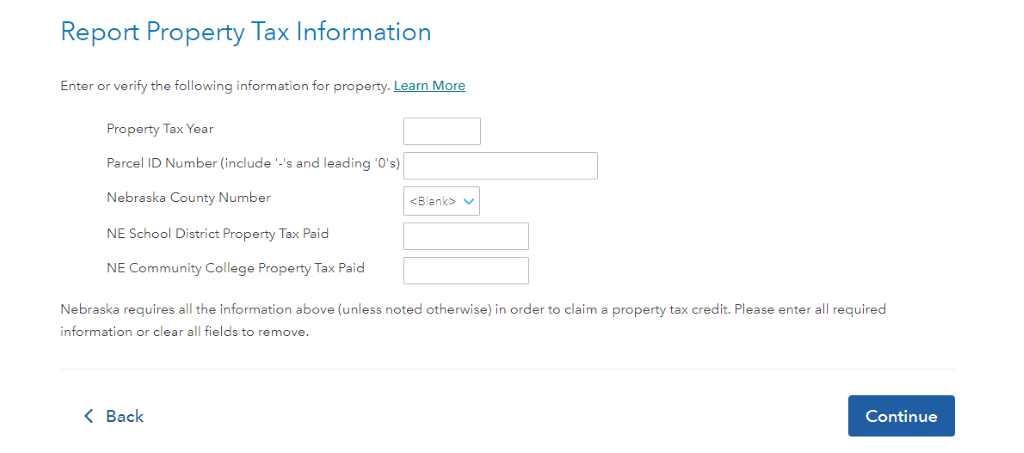

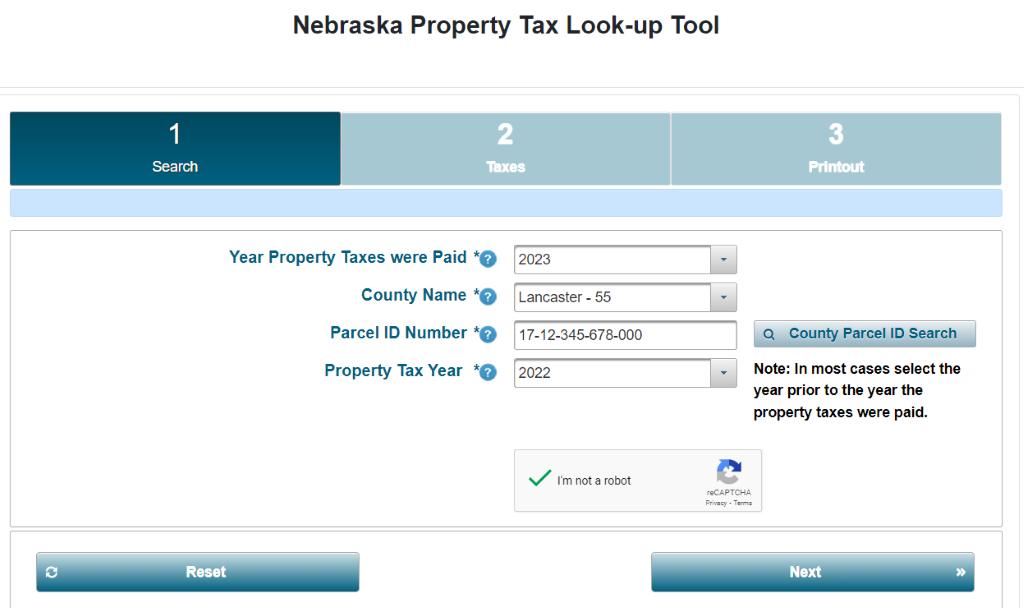

On the screen below, you will enter 2022 for the Property Tax Year since we pay property tax in arrears. Enter your Parcel ID, which can be found on your real estate tax bill or you can find it here: Nebraska School District Property Tax Look-up Tool. Your county number IS NOT the county number used by the DMV. For instance, Lancaster County's Department of Revenue County number is 55. You will find your county number, NE School District Property Tax Paid, and NE Community College Property Tax Paid using the Look-up Tool link above. You can click on Learn More for additional instructions.

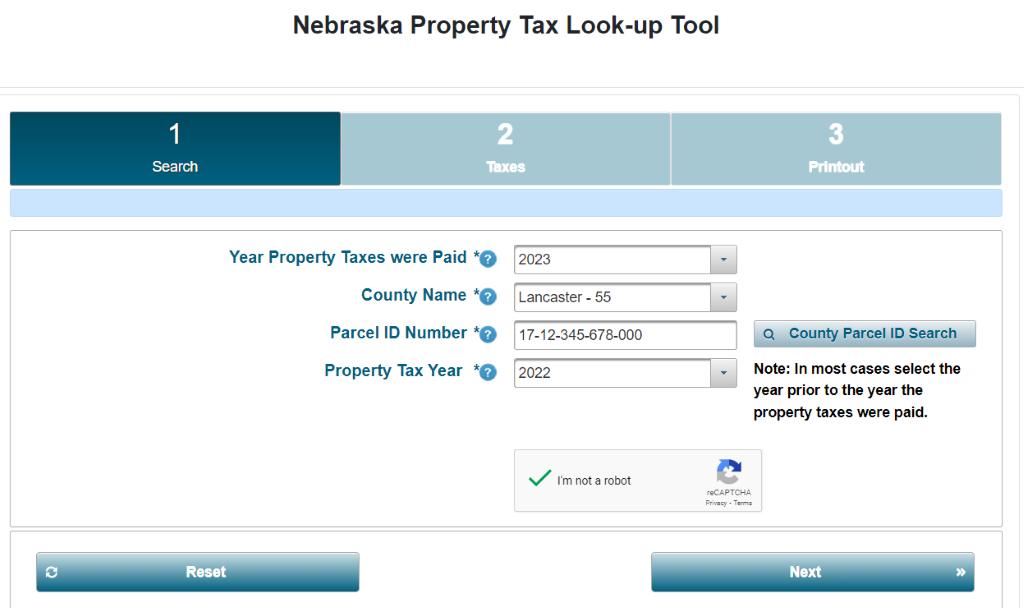

In the Look-up Tool, make sure you enter 2023 for the year the property tax was paid, since we are filing 2023 taxes. Your county name, which will include your county number to Enter in TurboTax. Your Parcel ID. This number is formatted differently by county, my example is showing a parcel in Lancaster County. The property tax year in 2022 since we pay 2022 taxes in 2023.

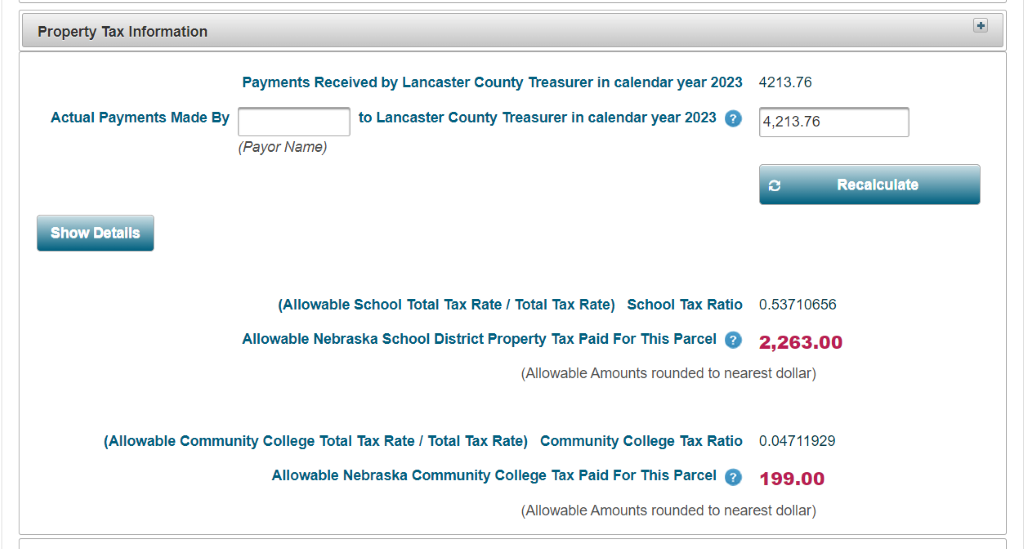

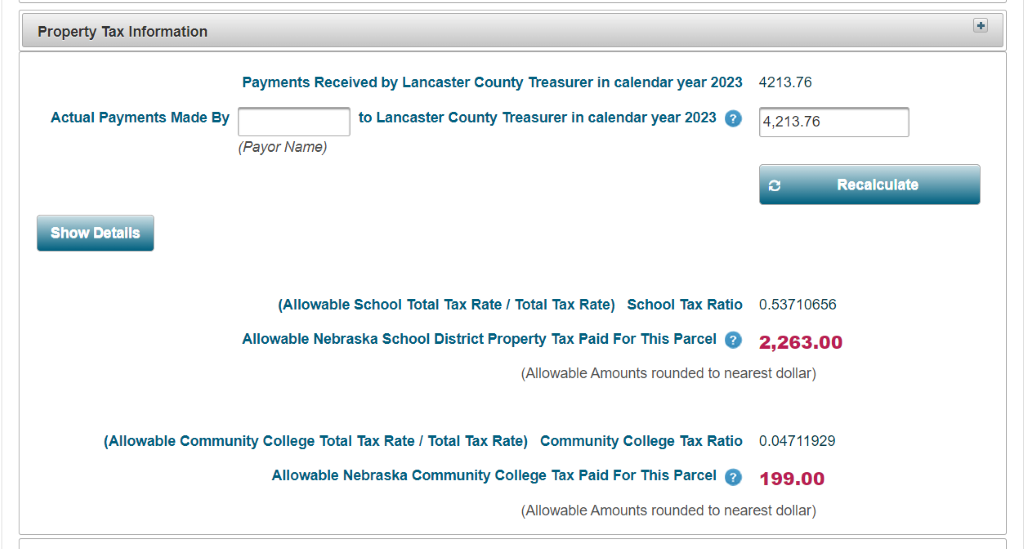

Make sure the Parcel Information is for your property, scroll down and you will see the pink amounts based on your particular parcel. For this example you would enter $2,263 and $199 into TurboTax for the Taxes Paid in the appropriate boxes.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"