- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- HSA excess contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

TurboTax is telling me that I am having an excessive contribution to my HSA of $7,750. On my W2, Box 12 W is showing 8,750.00 (this includes $1000 employer contribution). The maximum for a family contribution for 2023 is $7750, and I had additional $1000 as a catch-up contribution (older than 55). I am not sure how Turbo Tax see I am having an excessive contribution and asking to withdraw money from my HSA. My filing status is Married filing separate.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

did you get to the section for the HSA form 8889? until then Tutbotaxx thinks the contributions reported on your w-2 are an excess. To not have an excess you must either be covered by a High Deductible Health Plan (no FSA, no medicare, no other full coverage health insurance that isn't a high deductible plan ). for every month of the year. There is a special rule if you were not covered every month by a HDHP but you were on December 1st that allows a full year's contribution. On the Turbotax screens for the HSA, you must indicate the type of coverage you and the months you had it. Do not enter your payroll deduction as personally made. your deduction comes from the fact that your gross wages in box 1 of your w-2 was reduced by your HSA contributions,

to get to the form go to the deduction and credits section

scroll down to medical subsection

click the link to start or update on the line that has "HSA"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

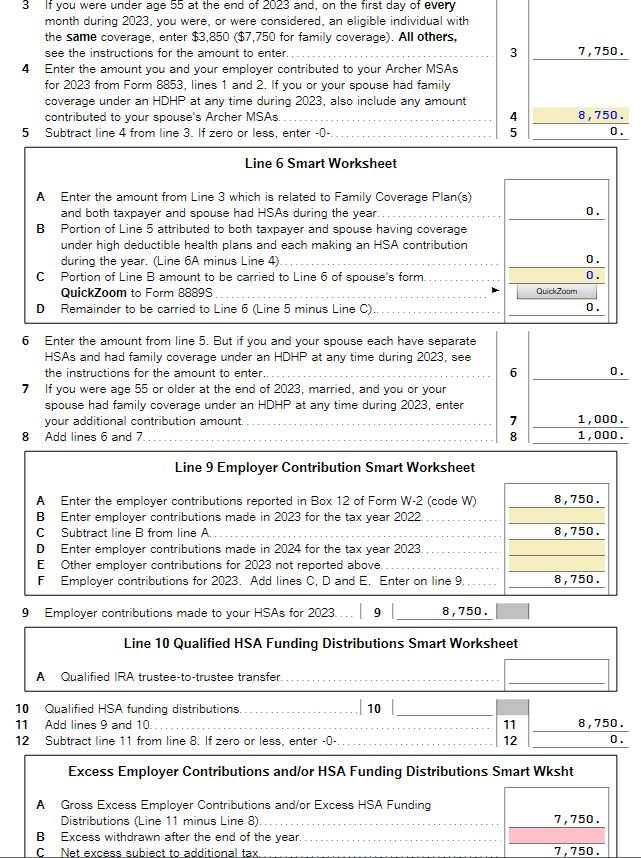

I finished the "Wages & Income" section where I included the amount of 8,750 in my W2 box 12. I also went through all the Deductions steps including the Medical section for HSA where I entered Form 1099-SA ($2,417.13) and then I checked on "Yes, I only used it for medical expenses", then I checked "did not inherit this HSA", then next screen showed $8,750 for my "2023 employer and payroll contributions", I had $0 for "Any contributions you personally made", then selected Yes for "I was covered by an HDHP" and selected "I was covered by a Family plan every month on the year", then selected No for "Did you overfund your HSA in 2022" (since year 2023 was my first year having an HSA account). Then, Turbo Tax displayed "It looks like you have an excess contribution of $7,750" and it is asking me to choose from three different options of withdrawing or not withdrawing full/some of the amount by April 15,2024. Did not know where I should go from there.

See below for Summary:

Deduction $0

Total distributions $2,417

Taxable distributions $0

Taxable earnings on excess contributions $0

Taxable employer contributions $7,750

Tax-free employer contributions $1,000

Excess employer contributions $0

I clicked on "Forms" and I see under the "Forms in My Return" section that Form 8889 is Not Done. I did not come across Form 8889 and don't know where is that in the process. Please help.

See attached below for more information.

[PII image removed]

Thanks for your time!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

The initial problem is hat TurboTax thinks that you have contributed 8,750 to an Archer MSA, which I assume that you did not (see line 4). Contributions to Archer MSAs are grouped with contributions to your HSA to calculate any excess.

So how to fix?

1. Go back into the HSA interview and make sure that you did not check that you have an MSA (the first screen).

2. Second, make sure that you did not have an entry with a code of R in box 12 on your W-2.

3. Next, since you appear to have the desktop software, go into Forms mode, look at the Forms list on the left, then click on form 8853. Delete it (button is at the bottom of the panel).

4. Now go back through the HSA interview, and see if it's OK.

5. Go through the Federal Review and see if there are any complaints.

6. Come back here if there are.

We are going to delete your screen shots, because they contain personally identifiable information (PII). We love screen shots, but please redact any personal information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

I didn't have MSA checked on the first screen (only HSA was checked). I also checked and found no R in box 12 on my W2. I went to the Forms on the left and found that Form 8853 had an X check on the NO option for line B "Were any employer contributions made to your MSA". As you suggested, I deleted Form 8853 (Archer MSA) and then went back to the HSA interview, but still had the same message that I am having an excess contribution of $7,750 (I checked and found that the form 8853 was re-created with an X as stated earlier). I am not sure where this amount on line 4 is coming from.

Thanks for your response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

OK, let's do an "HSA Reset". This will remove all HSA data, even data you can't see, and if we do it right, the MSA data, too.

***Reset***

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen)

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form (1099-SA (if one), 8889-T, 8889-S (if one), and 8853). Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, 8889-S (if one), and 8853.

5. go back and re-add your W-2(s), preferably adding them manually

6. go back and redo the entire HSA interview....

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

I followed the steps you mentioned by deleting my W2 (have a paper copy), clicking on Forms to delete those you mentioned. I was not able to delete Form 5329-T and Form 8889-T; both were labeled as (Not Done) with a red exclamation mark - every time I choose to delete them, they disappear for a second and then come back. I got surprised when I switched back to the step by step to re-enter my W2 and when I saw my W2 is back (and not deleted). I even closed my Turbo Tax and restarted my computer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

The 5329-T reappears because it exists to do penalties for many different situations, but the 8889-T reappears only when you have HSA triggers. The most common HSA trigger is the code W in box 12 on your W-2, which is why you deleted it.

There is one other very rare case which I don't usually mention - did you do a Qualified HSA Funding Distribution? Transfer money directly trustee to trustee from an IRA to an HSA?

Rats. There must be something on your W-2 that is resurrecting it.

OK, this time, to delete the W-2, do it through Forms mode and not through the interview.

And how many W-2s do you have? More than one?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

Thanks for your reply. Yes I had qualified HSA funding distributions appearing on my 1099-SA tax form. No, I did not transfer from an IRA to HSA. I only have one W-2.

I decided to start a new tax return (start fresh). The only difference is that a new screen titled "Report Archer MSA Contributions", that I did not get the first time, asking me to "Enter all contributions made for 2023 to regular MSAs or Archer MSAs owned by you or your spouse. Include any employer contributions". This is where I just entered 0 (zero). See this time HSA Summary (different than what I reported earlier).

Deduction $0

Total distributions $2,417

Taxable distributions $0

Taxable earning on excess contributions $0

Tax-free employer contributions $8,750

Excess employer contributions withdrawn $0

Line 4 now has a zero amount in Form 8889. Here is my question, why the MSA screen did not appear the first time? Can this be a bug in the software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA excess contribution

"Here is my question, why the MSA screen did not appear the first time? Can this be a bug in the software?" - Very unlikely to be a bug, because tens of thousands of users go though this software each month...including me, and I don't recall the last time I saw this screen.

I don't know what happened, but I am glad it has gone away.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

megan0956

Returning Member

riteden

Returning Member

Nick2024

New Member

SoCalRetiree

Level 1

ayubruin7777

Level 1