- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

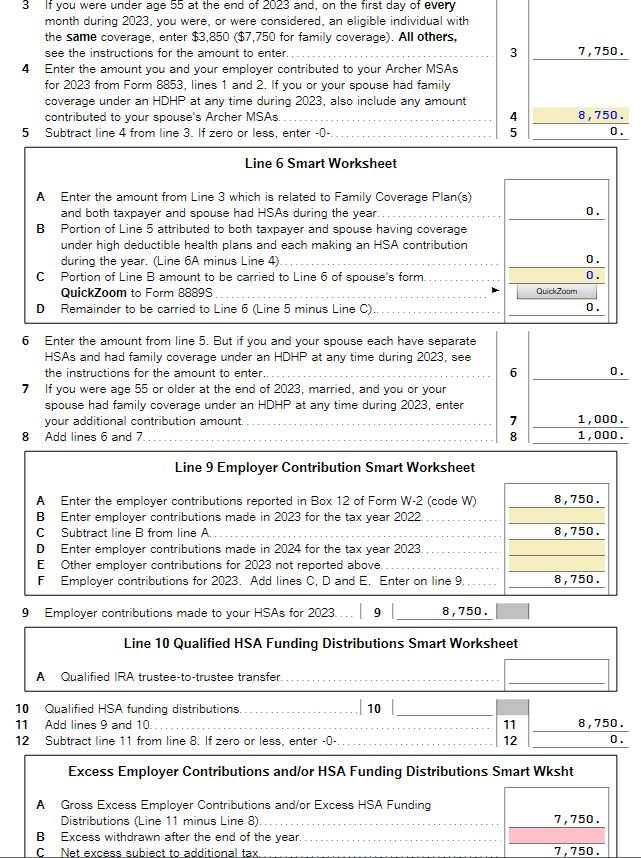

I finished the "Wages & Income" section where I included the amount of 8,750 in my W2 box 12. I also went through all the Deductions steps including the Medical section for HSA where I entered Form 1099-SA ($2,417.13) and then I checked on "Yes, I only used it for medical expenses", then I checked "did not inherit this HSA", then next screen showed $8,750 for my "2023 employer and payroll contributions", I had $0 for "Any contributions you personally made", then selected Yes for "I was covered by an HDHP" and selected "I was covered by a Family plan every month on the year", then selected No for "Did you overfund your HSA in 2022" (since year 2023 was my first year having an HSA account). Then, Turbo Tax displayed "It looks like you have an excess contribution of $7,750" and it is asking me to choose from three different options of withdrawing or not withdrawing full/some of the amount by April 15,2024. Did not know where I should go from there.

See below for Summary:

Deduction $0

Total distributions $2,417

Taxable distributions $0

Taxable earnings on excess contributions $0

Taxable employer contributions $7,750

Tax-free employer contributions $1,000

Excess employer contributions $0

I clicked on "Forms" and I see under the "Forms in My Return" section that Form 8889 is Not Done. I did not come across Form 8889 and don't know where is that in the process. Please help.

See attached below for more information.

[PII image removed]

Thanks for your time!