- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to Input Backdoor Roth Conversion at State (NJ) Level

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Input Backdoor Roth Conversion at State (NJ) Level

Hello TurboTax Community,

I did a backdoor roth IRA conversion for 2023.

I originally placed $6,500 on my traditional IRA, then converted it to Roth the following week. It did earn a small amount of interest ($2).

I converted the entire balance of the Traditional IRA ($6,502) to Roth the following week.

When I file my NJ return, I would usually input:

- $6,502 on the Value of Account on the Date of the Distribution

- $6,500 on the Contributions Related to This Distribution Previously Taxed by New Jersey

This way, the taxable amount for this backdoor roth conversion would be $2 at the state level.

But I don't see the text box to enter these numbers this time. See screenshot below.

I have been able to do it using TurboTax since 2017. Not sure why it's not appearing in 2023.

Has anybody encountered this error before?

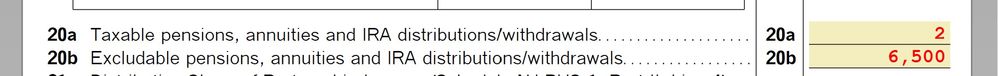

All I can do is go into Forms mode and do an override on lines 20a and 20b on NJ-1040 page 2. See the screenshot below.

Am I doing something wrong in the way I entered my backdoor conversion this year?

Appreciate any guidance you can share.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Input Backdoor Roth Conversion at State (NJ) Level

In the state interview click "Update" next to "Adjustments" and continue through the questions until you get to the "Roth Conversion" screen. Here you can enter the "Value of Account on the Date of the Distribution" and the "Contributions Related to This Distribution Previously Taxed by New Jersey".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Sunny-641

New Member

koonsup

Level 1

bhJogdt

Level 2

VAer

Level 4

frankiestylez

Level 2