- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Input Backdoor Roth Conversion at State (NJ) Level

Hello TurboTax Community,

I did a backdoor roth IRA conversion for 2023.

I originally placed $6,500 on my traditional IRA, then converted it to Roth the following week. It did earn a small amount of interest ($2).

I converted the entire balance of the Traditional IRA ($6,502) to Roth the following week.

When I file my NJ return, I would usually input:

- $6,502 on the Value of Account on the Date of the Distribution

- $6,500 on the Contributions Related to This Distribution Previously Taxed by New Jersey

This way, the taxable amount for this backdoor roth conversion would be $2 at the state level.

But I don't see the text box to enter these numbers this time. See screenshot below.

I have been able to do it using TurboTax since 2017. Not sure why it's not appearing in 2023.

Has anybody encountered this error before?

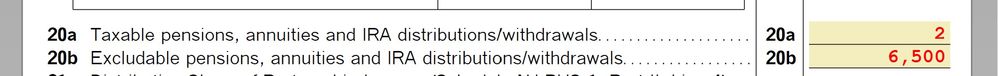

All I can do is go into Forms mode and do an override on lines 20a and 20b on NJ-1040 page 2. See the screenshot below.

Am I doing something wrong in the way I entered my backdoor conversion this year?

Appreciate any guidance you can share.

Thanks!