- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to go about HSA excess contribution for the past 2 years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

Hello, I'm in a bit of tangle on excess HSA contribution and will like to hear more from the community how to go about this from tax purposes:

I'm currently enrolled in a High Deductible Family plan (me and my wife) and qualified for HSA contributions. My employer contributes $2,000 to the plan and I add on the rest to reach the family limit.

In February 2021, my wife applied for Health Insurance but it is a not High Deductible medical plan.

In 2021, I've contributed the family max of $7,200.

In 2022, I've contributed the family max of $7,300.

When filing for turbo tax recently for the year of 2022, I found that the IRS rule limits me to only INDIVIDUAL max instead of FAMILY max due to my wife's Health Insurance being a non-HDP plan for the years of 2021 and 2022. I'm in a bit of a tangle to sort this out now. Based on what i've read online and in various forums, I'm thinking of making the following actions to resolve this and see how others will go about this:

1) For the tax year of 2022:

Since I still have time before the tax deadline (April 18th), I'll make an excess contribution withdrawal request to my custodian for the year of 2022 of the amount of ($7,250) . That will leave me with a contribution of 2022 of $50 dollars since I've contributed the max of $7,300. This should be okay because in 2021, my contribution was over by $3,600 so automatically rolling over the 2022 the ($3,600+ $50 (after withdrawal)) should reach the INDIVIDUAL limit. Thereby removing the 6% excise tax on the year of 2022. Please correct me here if that's not the right step.

2) For the tax year of 2021:

For the excess contribution year of 2021, since I didn't know about the limit I will need to do an amend for that year by filing a Form 5329 of the extra contribution and pay taxes of 6% excise tax for that year. Is this a correct solution move going forward?

Turbo tax:

If the 2 actions above for year 2022 and 2021 are correct, I'm a bit stuck in terms of how to fill the HSA portion in TurboTax. I've contributed $7,300 and I cannot change that. I also not sure how to report the automatic rollover from 2021 to 2022 in turbo

Thank you for your time and appreciate your guidance here, community! I hope i can get the 2022 and 2021 fix before the tax filing!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

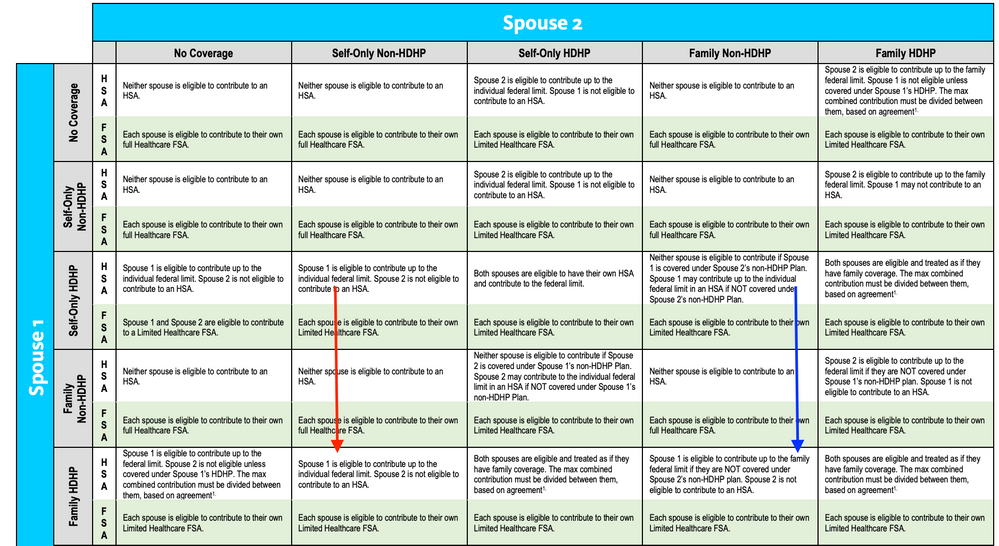

Sorry, I didn't notice the chart was wrong where the red arrow is. The chart is in fact wrong at that point, if taxpayer 1 is covered by a family plan, then taxpayer 1's limit is always the family limit (unless taxpayer 1 has supplemental coverage from taxpayer 2 in which case taxpayer 1 is ineligible).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

"I found that the IRS rule limits me to only INDIVIDUAL max instead of FAMILY max due to my wife's Health Insurance being a non-HDP plan for the years of 2021 and 2022."

Where do you see this? The IRS says, "Family HDHP coverage is HDHP coverage for an eligible individual and at least one other individual (whether or not that individual is an eligible individual)." See the bottom of page 4 of Pub 969. The fact that your spouse is disqualified from making contributions to an HSA does not mean that you are disqualified from having coverage under a Family HDHP.

And since you are eligible for Family HDHP coverage, you haven't made any excess HSA contributions, so please don't do any withdrawals without coming back to us first.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

Your contribution limit is determined by the plan you are enrolled in. If you are enrolled in a family plan that covers your spouse, you are eligible to contribute up to the family limit. It is not necessary for your spouse to be enrolled in an HDHP.

However, it is important that you can’t have any other non-HDHP coverage. If your spouse’s insurance also covers you, then you are disqualified from making HSA contributions. (It’s OK for your spouse to have overlapping coverage from your plan and her own plan, but you must not have overlapping coverage from her plan on top of your own plan.)

Also, if your spouse participates in a flexible spending account (FSA) with her medical insurance, that also disqualifies you from contributing to an HSA. An FSA can be used to pay the medical expenses of the account holder, their spouse, or their dependents, so even if your spouse‘s medical coverage only includes herself, if she has an FSA, that covers you, and that counts as other coverage, which disqualifies you from contributing any amount to an HSA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

I've been getting my resources on the internet and this chart may have mislead me thinking I am not eligible for family plan. I think IRS Publication 969 should be my first go-to.

Here's the structure for me and my spouse's medical plan for better context:

2021:

Me (spouse 1): I'm enroll through my employer for family HDHP which includes me and my spouse. I've contributed the FAMILY max ($7,250).

My wife (spouse 2): My wife enrolled in a PPO plan (non-HDHP) plan. I'm not in her plan since I have a HDHP plan.

2022:

Me (spouse 1): same as 2021 but contributed to the new family max ($7,300)

My wife (spouse 2): same and I am not on her plan.

Does this mean I still qualify for the FAMILY max (not INDIVIDUAL max)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

@Nmotion wrote:

I've been getting my resources on the internet and this chart may have mislead me thinking I am not eligible for family plan. I think IRS Publication 969 should be my first go-to.

Here's the structure for me and my spouse's medical plan for better context:

2021:

Me (spouse 1): I'm enroll through my employer for family HDHP which includes me and my spouse. I've contributed the FAMILY max ($7,250).

My wife (spouse 2): My wife enrolled in a PPO plan (non-HDHP) plan. I'm not in her plan since I have a HDHP plan.

2022:

Me (spouse 1): same as 2021 but contributed to the new family max ($7,300)

My wife (spouse 2): same and I am not on her plan.

Does this mean I still qualify for the FAMILY max (not INDIVIDUAL max)?

Yes, your situation is included in that chart under spouse 1 family HDHP, spouse 2 self-only non-HDHP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

Thank you for the fast follow up! I think one thing is still a bit unclear and will love to have your help here is that the chart says "individual federal limit" instead of "family federal limit" (See the red and blue arrows of the different adjective) which I'm not sure now what is the HSA contribution limit I can make here.

Is my contribution limit up to $7,300 (family limit) or $3,650 (individual limit)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

Sorry, I didn't notice the chart was wrong where the red arrow is. The chart is in fact wrong at that point, if taxpayer 1 is covered by a family plan, then taxpayer 1's limit is always the family limit (unless taxpayer 1 has supplemental coverage from taxpayer 2 in which case taxpayer 1 is ineligible).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to go about HSA excess contribution for the past 2 years

That's correct that I do not have coverage from my spouse 2 so that means I can still contribute to the family amount. Words can't express how much you've saved me and thank you so much! You've really saved me from a lot of stress that have occurred the past a few days and appreciate the TT community

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

glesieutre

New Member

msv1

New Member

lcai69

New Member

TheGuttes

Level 1

Boomhauser

Level 2