- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do you enter foreign tax credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

https://ttlc.intuit.com/turbotax-support/en-us/help-article/import-export-data-files/enter-foreign-t...

Any help would be appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

First, you enter the Form 1099-DIV that should report foreign taxes paid, in box 7. If you are single and your foreign taxes on dividends and interest is under $300 ($600 if married filing joint) this is all you need to do, as you will get the foreign tax credit automatically. If it is over that amount you need to go to the Estimates and Other Taxes paid section in the Deductions and Credits area of TurboTax to enter your foreign income.

Choose the Foreign Taxes option under Estimates and Other Taxes Paid:

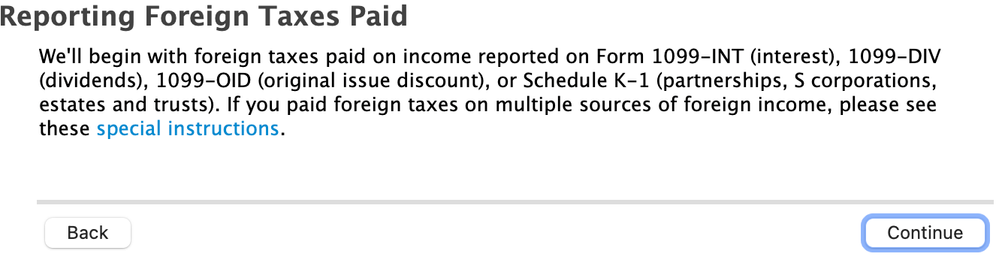

If your only foreign taxes were reported on your 1099-DIV or 1099-INT or similar statements, choose that option on the screen that says "Tell us About Your Foreign Taxes:

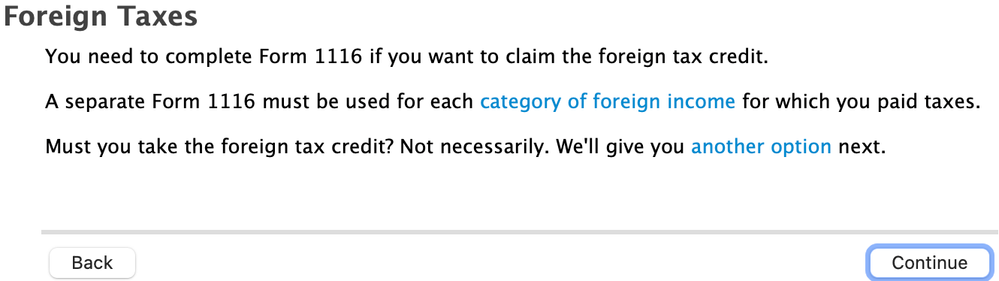

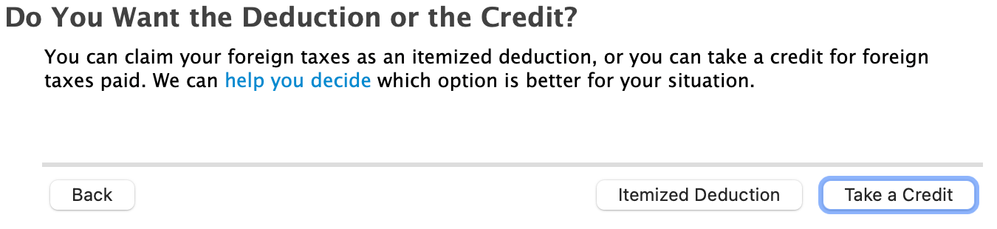

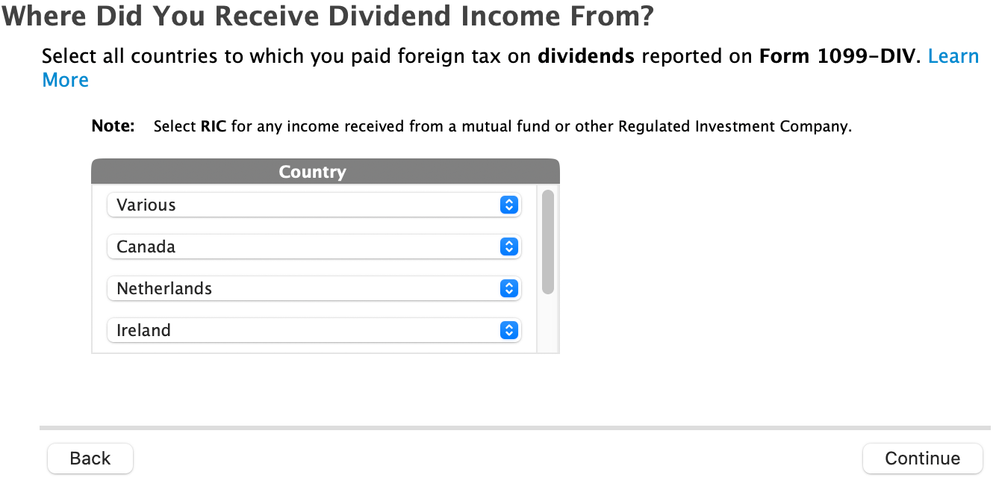

Indicate that you need to complete Form 1116 when asked. It's usually better to take the foreign "Credit" option over the "Deduction." Choose the countries you paid the taxes to:

Then report the income by country:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

Thank you @ThomasM125 but I wonder if the screenshots you had were from the online version. The desktop version that I have doesn't have those same options. Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

The screenshots were from the desktop version of TurboTax using the Deluxe product, what version of TurboTax are you using?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

The problem I see is that I don't get that screen that says "Tell us about your foreign tax".

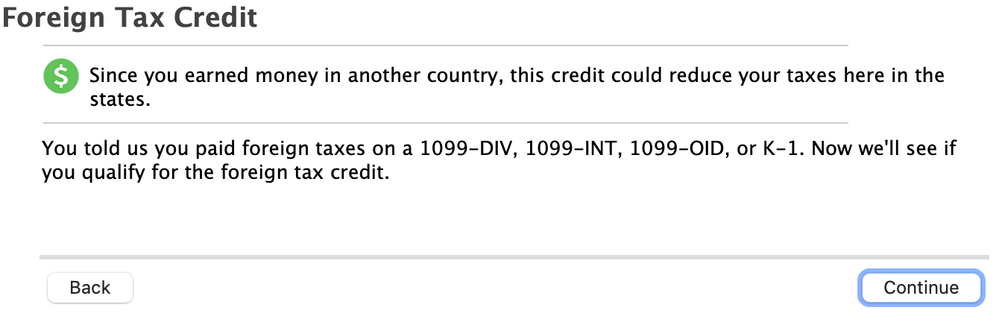

So my first screen is this when I go under the section for Estimated Taxes:

I choose Continue from above and receive this screen to which I choose "Take a credit"

No choice but to choose Continue:

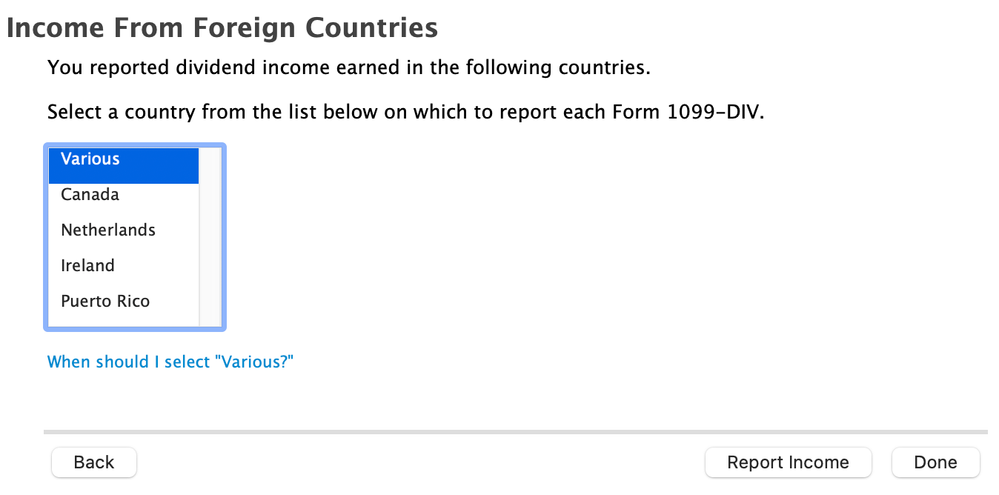

This is where the fun starts. SO, I have "Various" and 4 other countries which I paid $860 of foreign taxes. Each time I enter in a country in the screen below and then choose Continue:

This now shows me each of the countries that I entered above and my thought would have been to simply choose each country and add the applicable foreign taxes paid but since "Various" is highlighted, I then choose "Report Income"

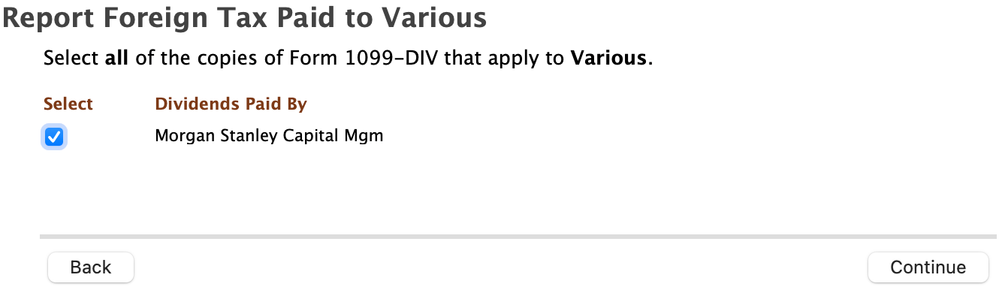

Its on my Morgan Stanley statement so I assume this should be checked and move forward

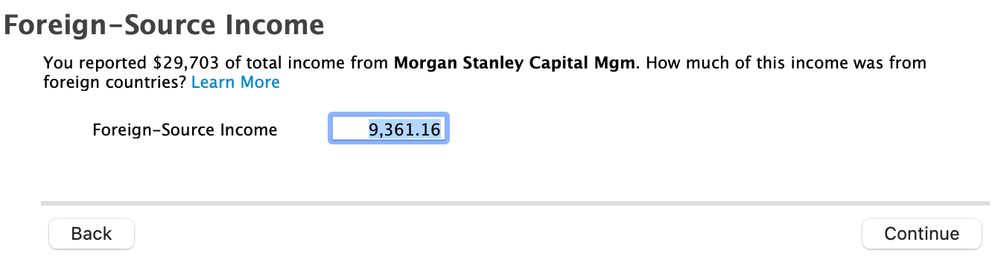

My assumption here is of all 1099-DIV, how much was received in dividends from foreign countries (not the portion related to taxes). Then choose continue:

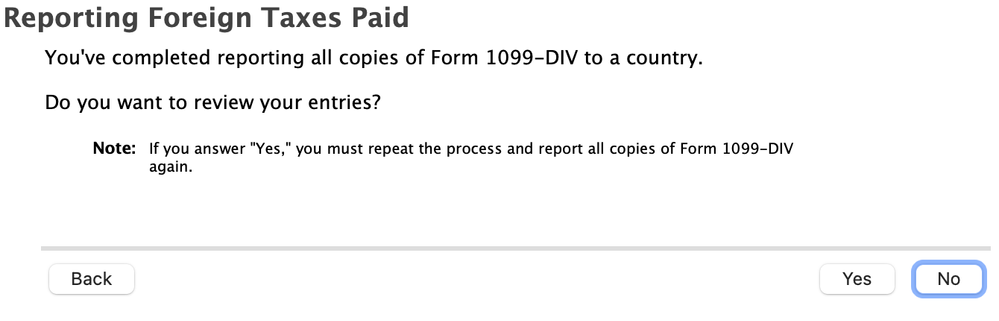

At this point, if I choose "Yes", it brings me back to the screen with the countries and the only country listed is "Various" and I have to start over again. It does not allow me to enter in the country and its applicable foreign taxes paid.

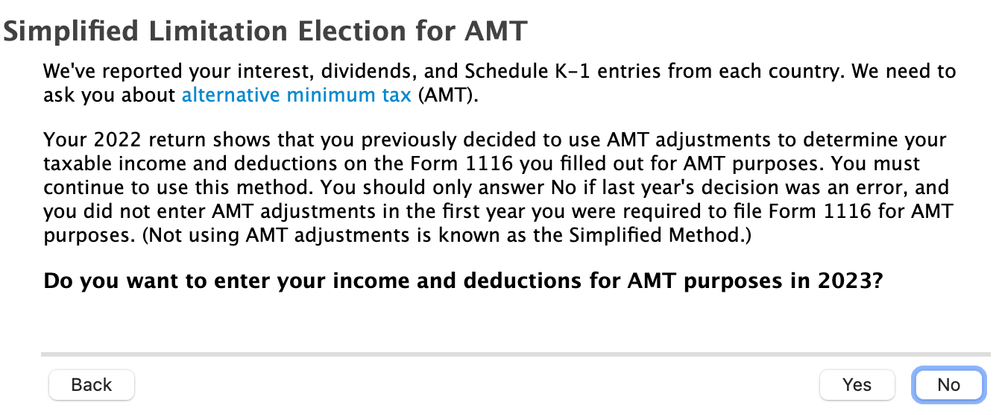

So, I will hit no now to which it begins talking about AMT which I know nothing about so I will say No

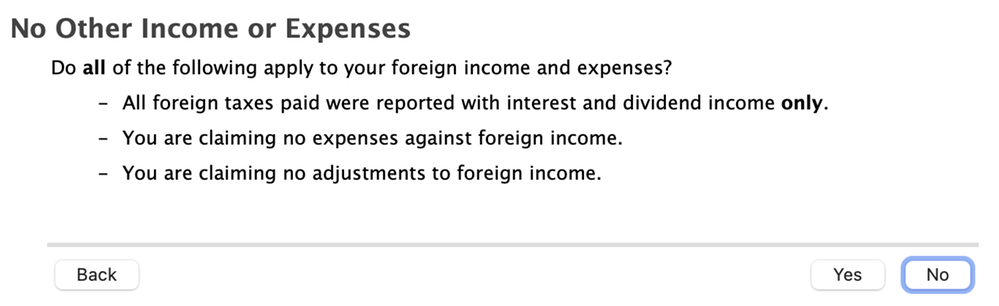

My assumption here is YES but not entirely sure

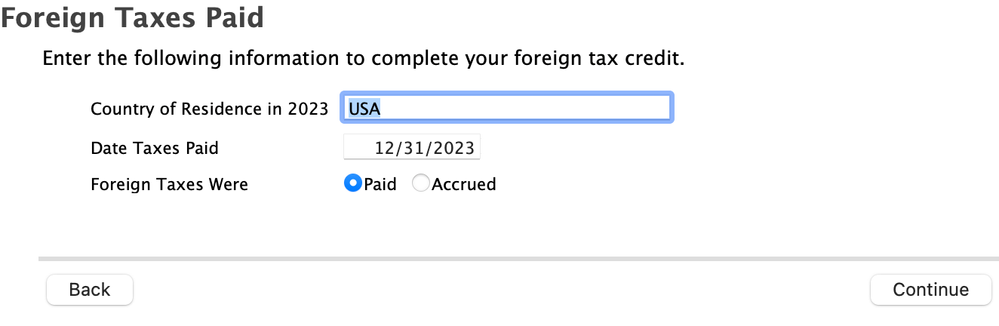

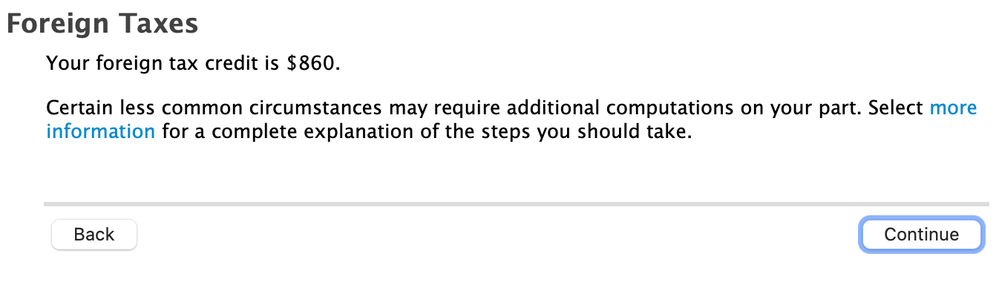

This seems correct:

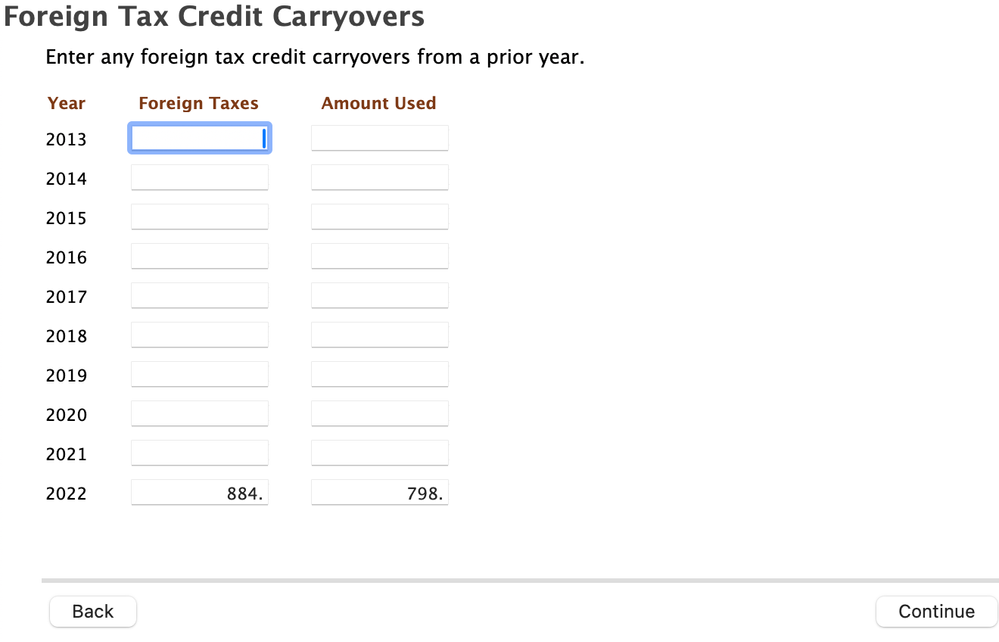

I have no idea where this is coming from:

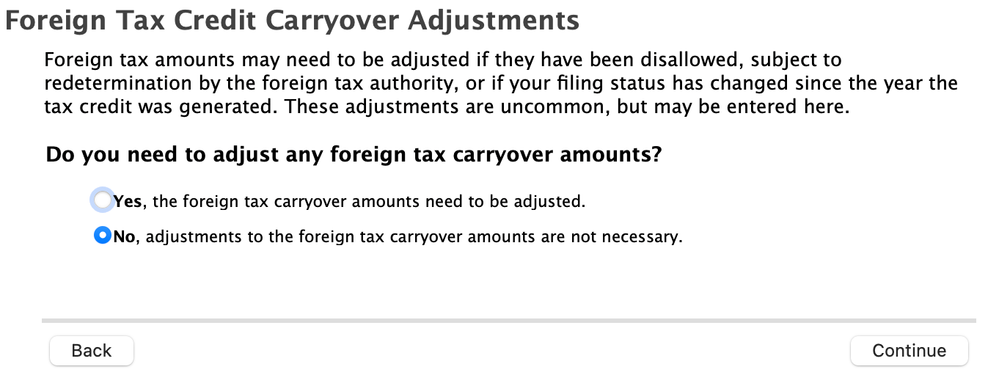

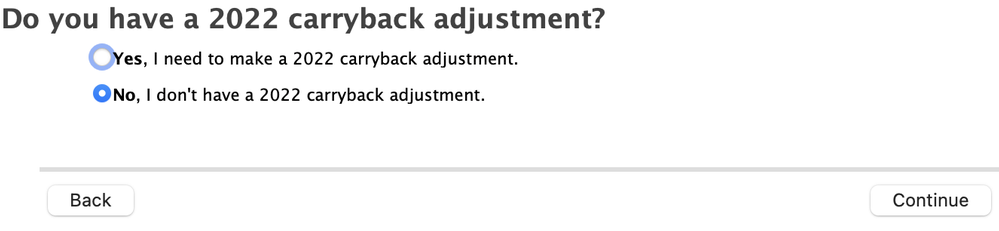

I assume that the answer is no:

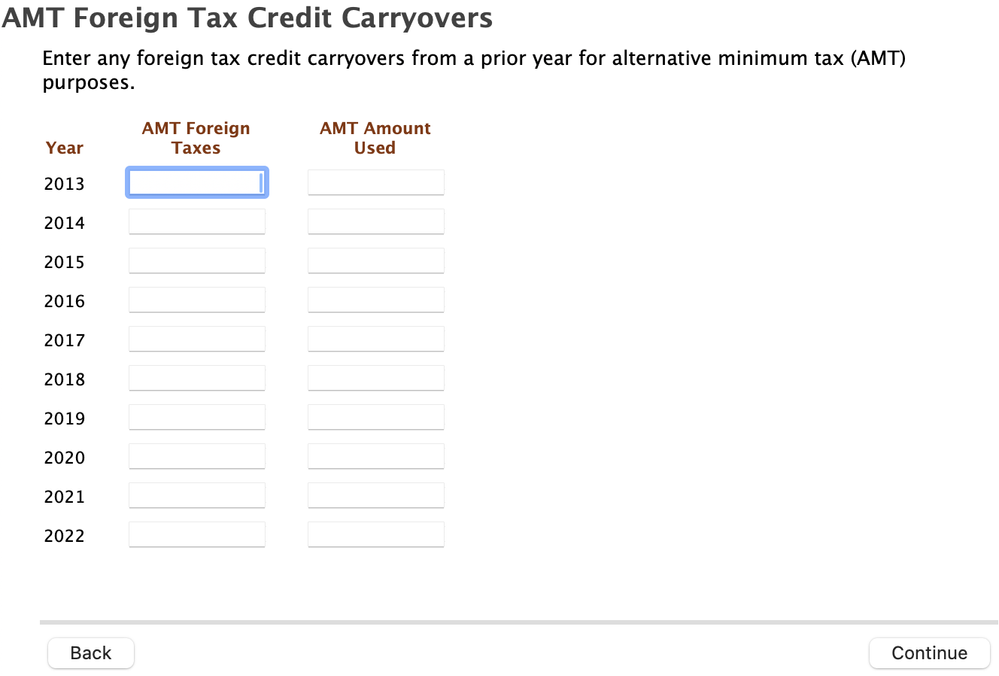

I leave this blank as is because I am unsure:

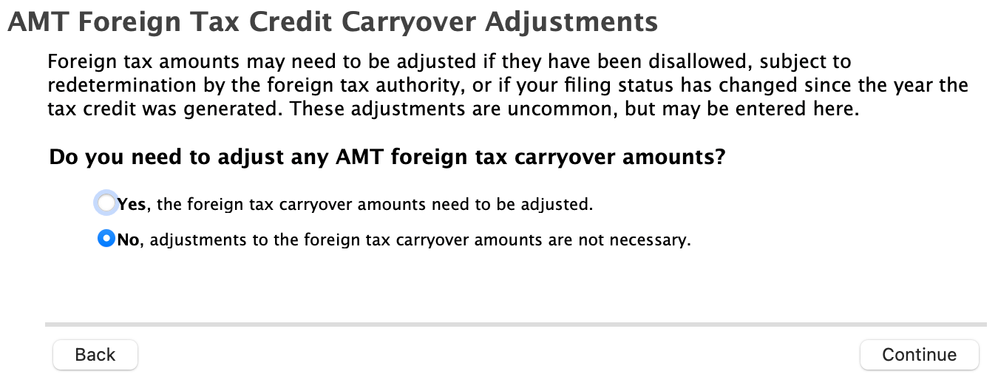

Similar screen to which I say no:

I think the answer is no but I truly don't know:

I finally get to this section which matches box 7 of my 1099-DIV

The process in which I got here I am not sure is accurate but not sure of another way. Also, I may have an issue when I run a check at the end of the process but if anything here looks odd to you or if I did something wrong, I would really appreciate your input. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

Yes, all the screens follows a logical pattern and base on what I see, it appears you have reported this correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

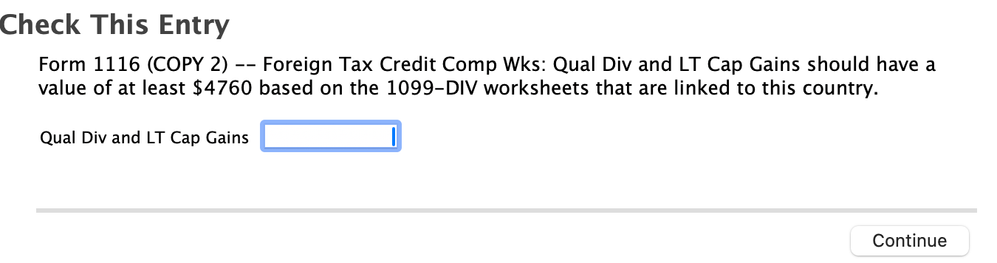

Thanks DaveF1006. However, now when I run the smart check, I receive the following error which I'm stumped on. Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

Yes, if it will allow you to make to entry, record the 4760 amount in this box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

Thanks DaveF but I don't even know what that number represents?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you enter foreign tax credit?

That is an amount taken from the 1099 DIV worksheets that are linked to the country you are working on in the Foreign Tax Credit section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

evan-scott1

New Member

NeUnhappy

New Member

Cat_Sushi

Level 2

teresadawn70

New Member

charles6years

New Member