- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The problem I see is that I don't get that screen that says "Tell us about your foreign tax".

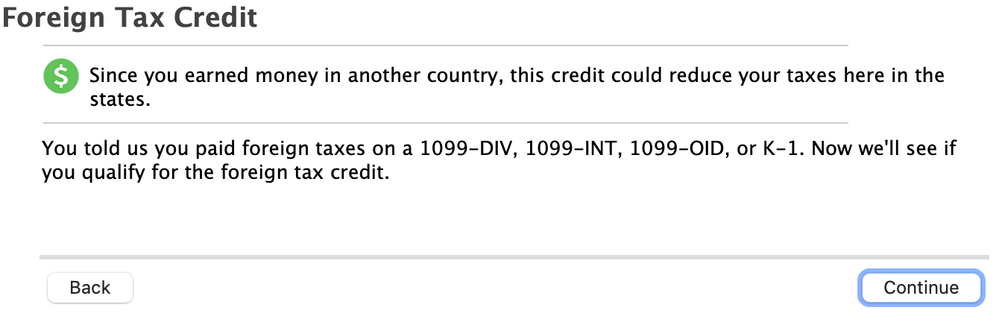

So my first screen is this when I go under the section for Estimated Taxes:

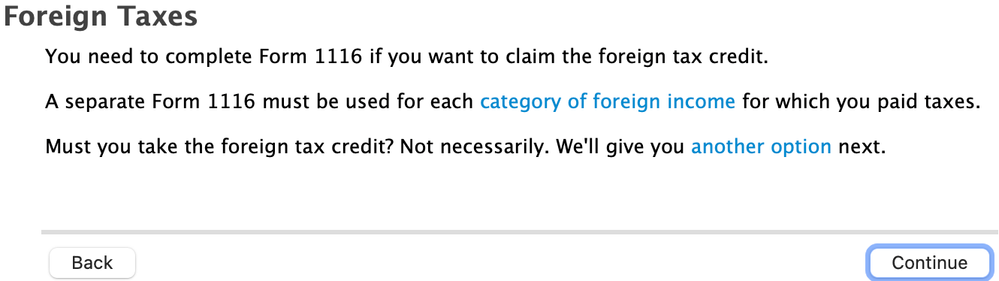

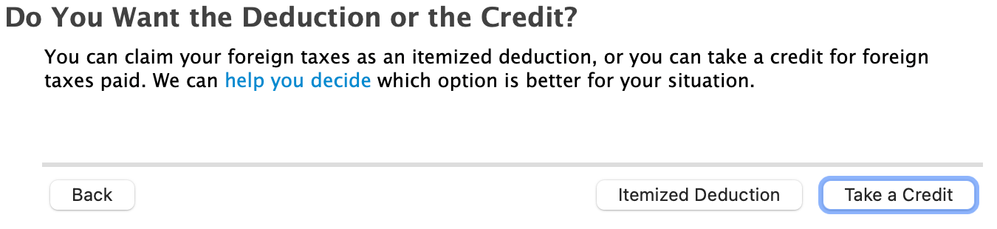

I choose Continue from above and receive this screen to which I choose "Take a credit"

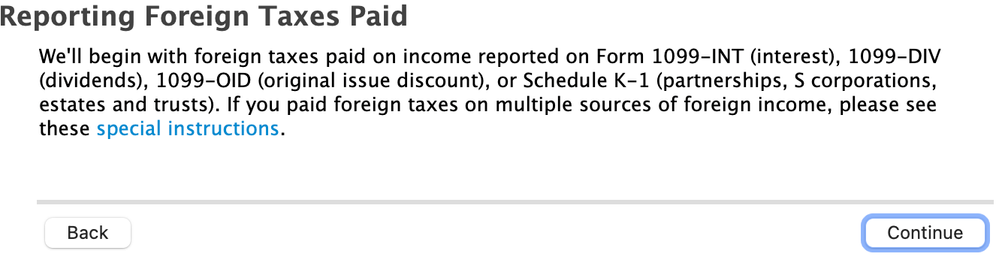

No choice but to choose Continue:

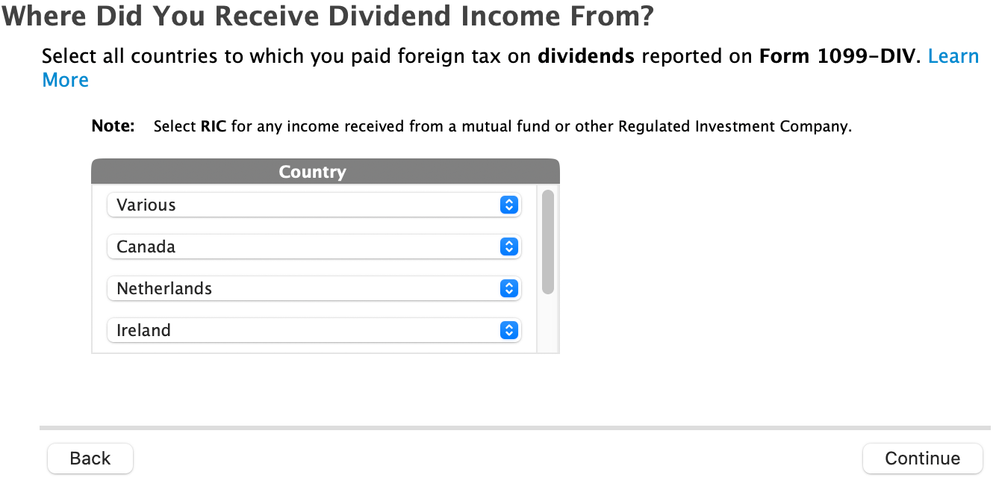

This is where the fun starts. SO, I have "Various" and 4 other countries which I paid $860 of foreign taxes. Each time I enter in a country in the screen below and then choose Continue:

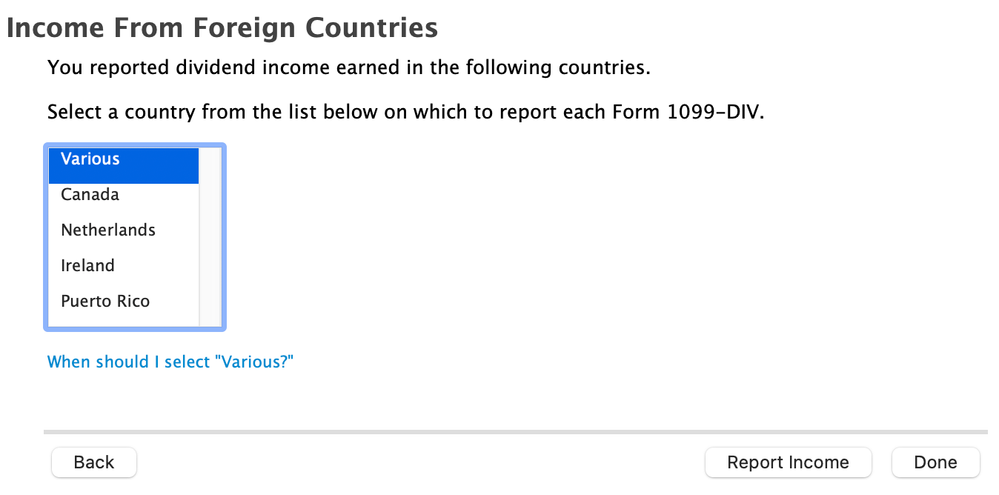

This now shows me each of the countries that I entered above and my thought would have been to simply choose each country and add the applicable foreign taxes paid but since "Various" is highlighted, I then choose "Report Income"

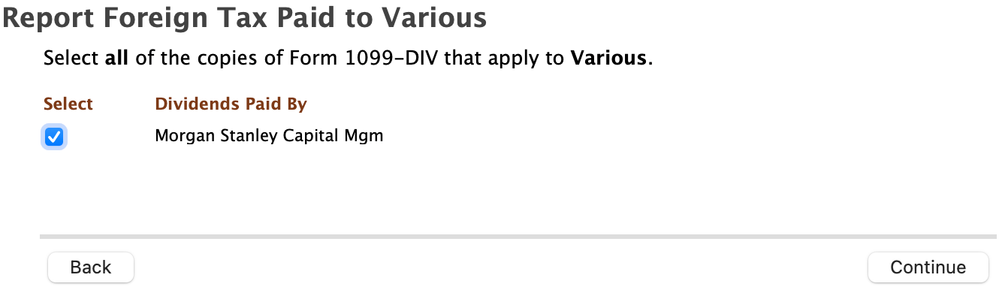

Its on my Morgan Stanley statement so I assume this should be checked and move forward

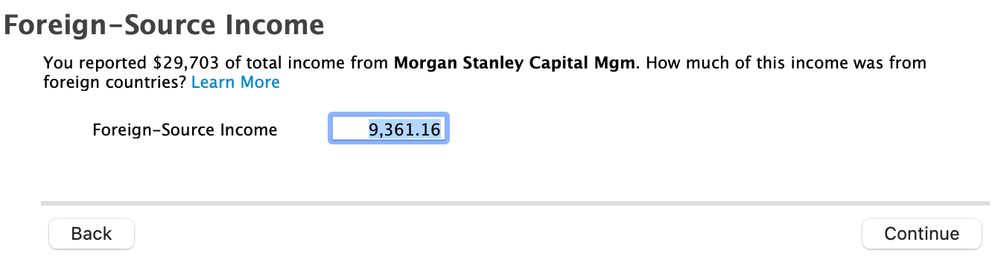

My assumption here is of all 1099-DIV, how much was received in dividends from foreign countries (not the portion related to taxes). Then choose continue:

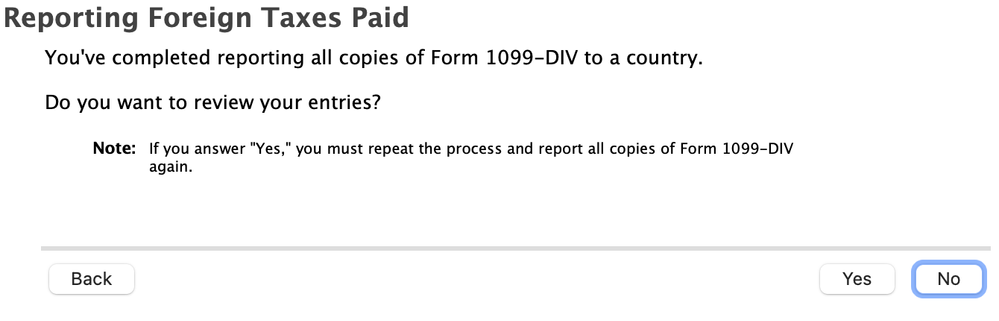

At this point, if I choose "Yes", it brings me back to the screen with the countries and the only country listed is "Various" and I have to start over again. It does not allow me to enter in the country and its applicable foreign taxes paid.

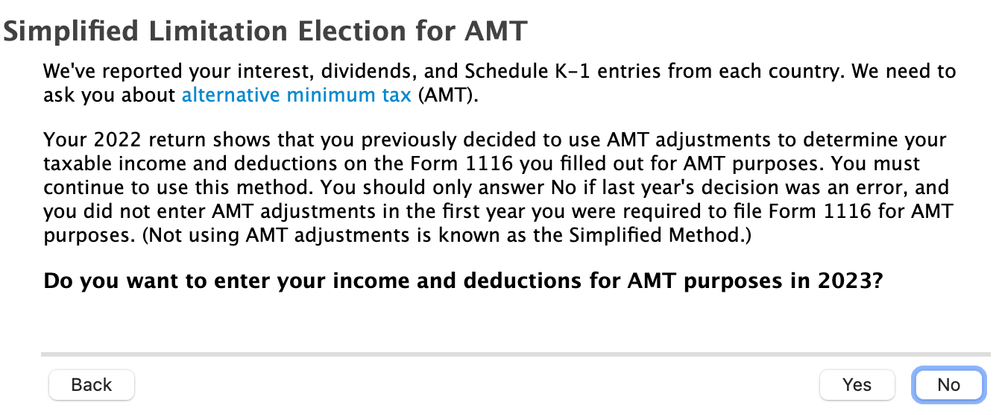

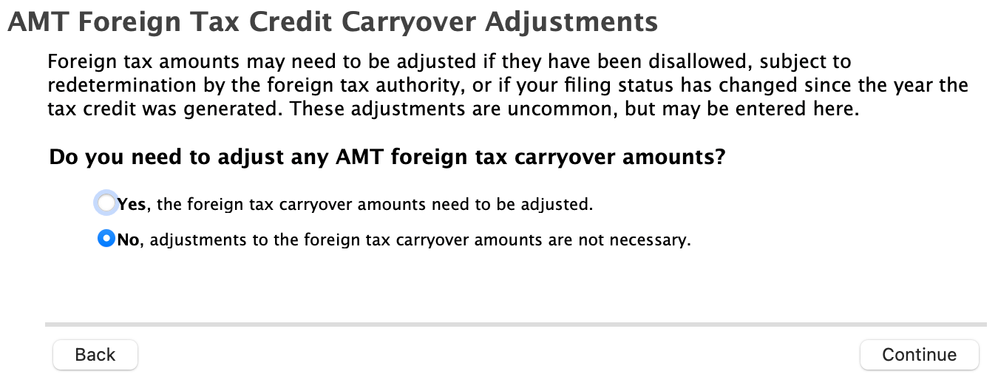

So, I will hit no now to which it begins talking about AMT which I know nothing about so I will say No

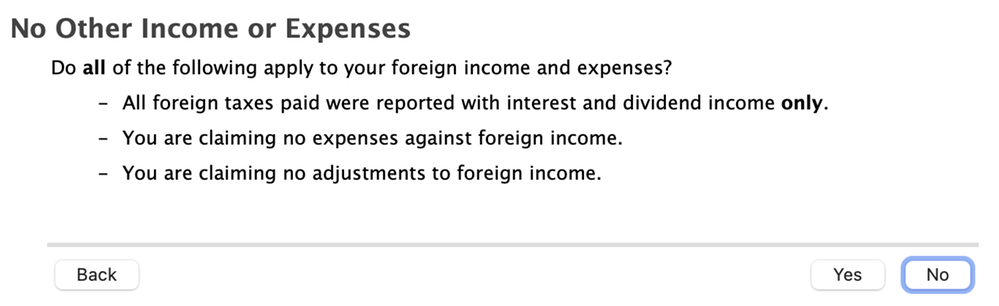

My assumption here is YES but not entirely sure

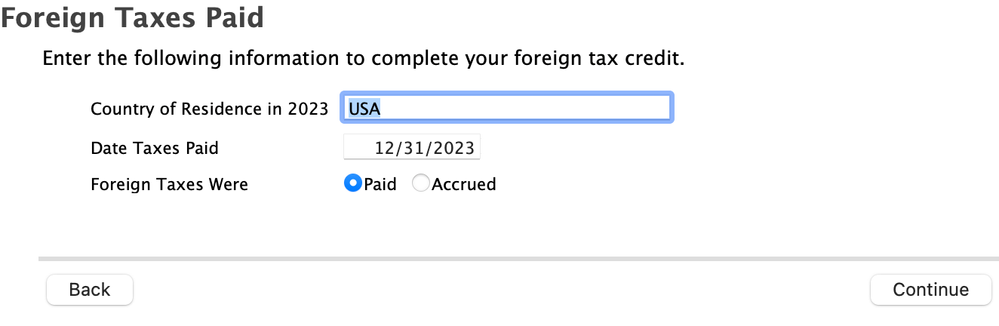

This seems correct:

I have no idea where this is coming from:

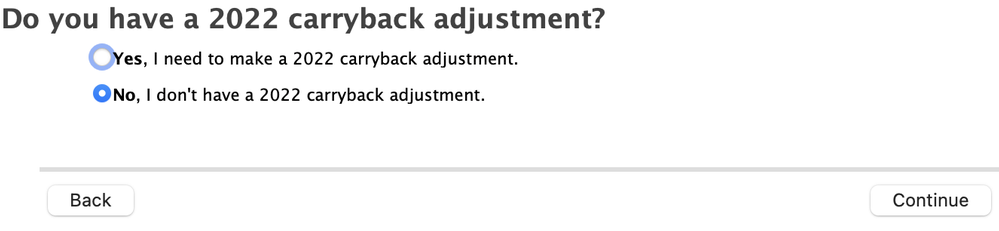

I assume that the answer is no:

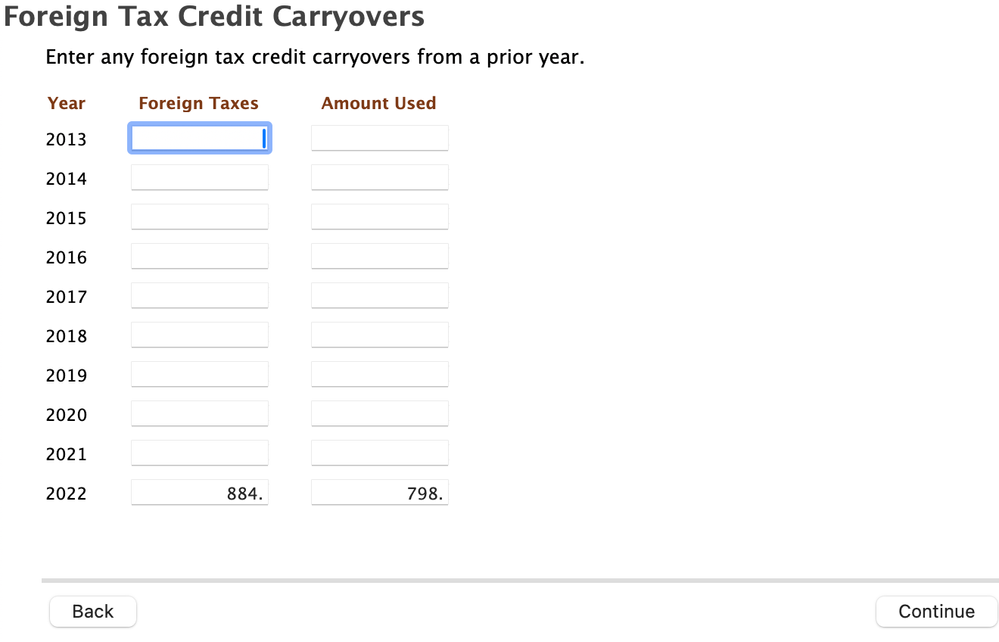

I leave this blank as is because I am unsure:

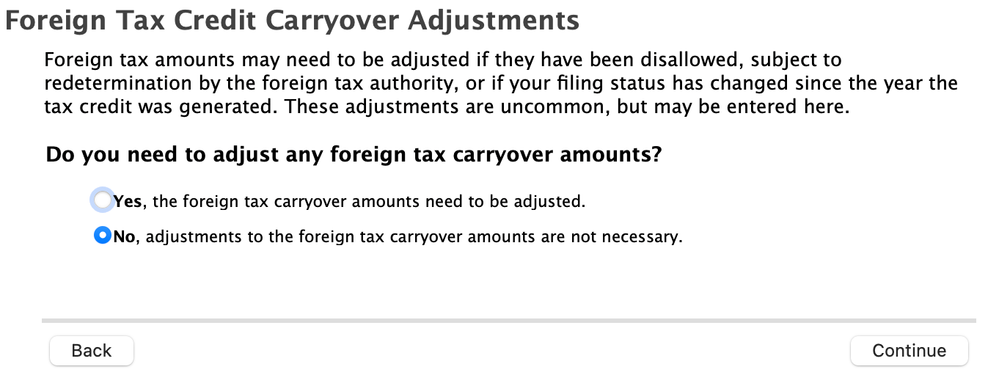

Similar screen to which I say no:

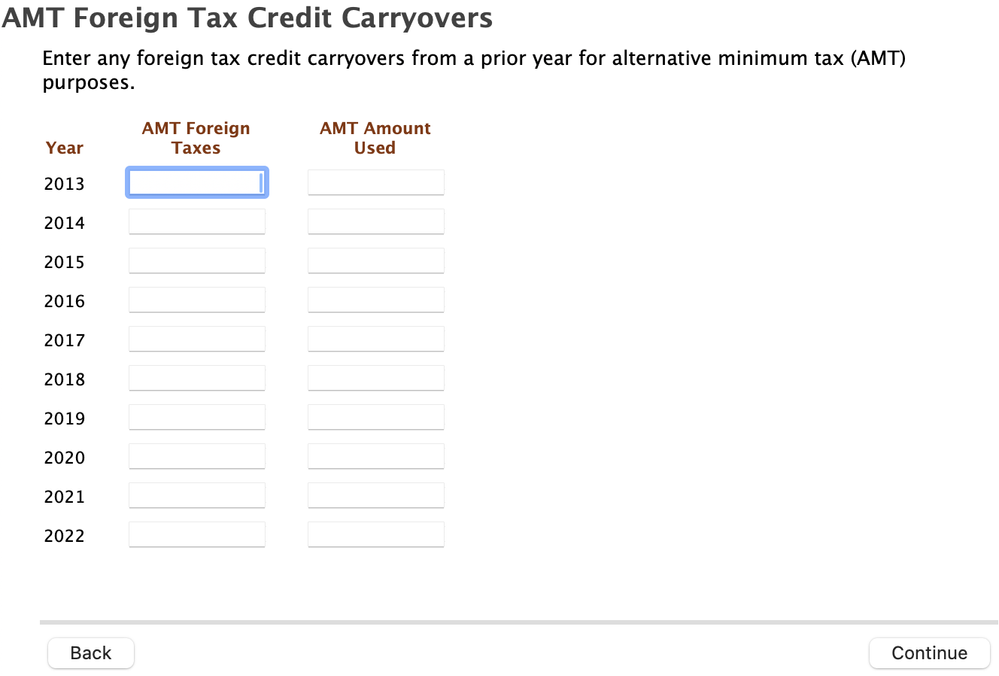

I think the answer is no but I truly don't know:

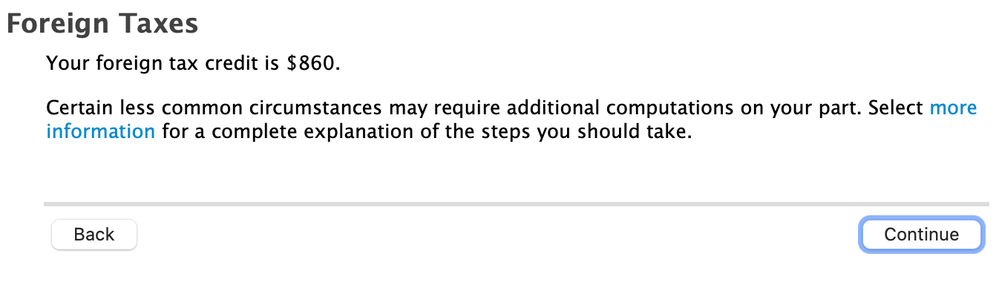

I finally get to this section which matches box 7 of my 1099-DIV

The process in which I got here I am not sure is accurate but not sure of another way. Also, I may have an issue when I run a check at the end of the process but if anything here looks odd to you or if I did something wrong, I would really appreciate your input. Thank you!