- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Help with Formm 8862

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Formm 8862

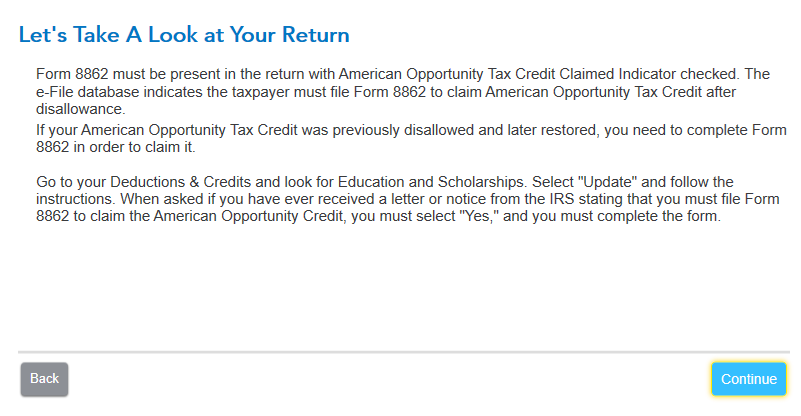

Federal tax file rejected 5 times. Each time the stated reason is Form 8862 in relation to the American Opportunity Tax Credit:

Attempts to complete form 8862 ALWAYS fail at the point where we attempt to complete Section IV for our remaining full-time student/dependent, who is a Junior in his 3rd year of eligibility for AOTC.

The result is always the same:

We tried removing AOTC, switching to Lifelong Learning Credit, and any other variation we could think of until we ran out of time and had to file for an extension. I'm out of ideas -- can anyone help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Formm 8862

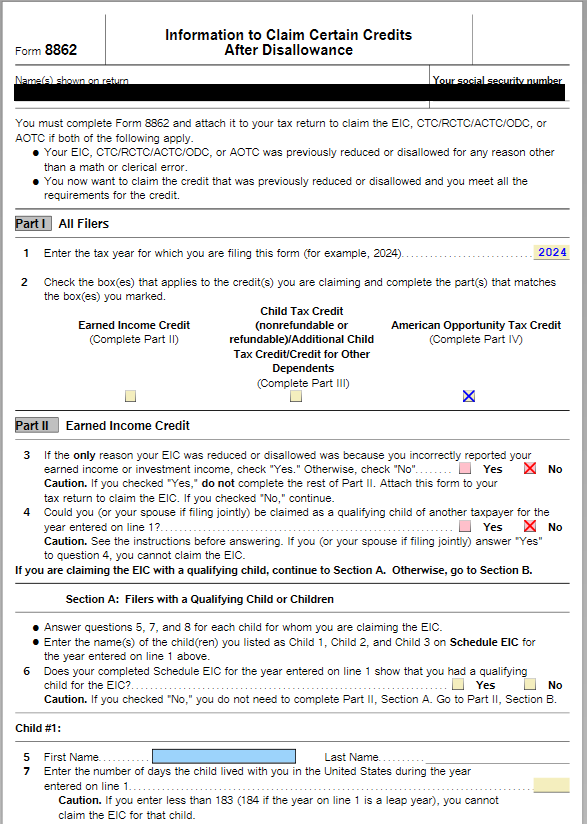

The questions in Part ll pertain only to the Earned Income Credit, so remove all of the X's from Part ll and scroll down and enter the child's info in Part lV. Form 8862 is 3 pages and you need to be on page 3.

Scroll down until you get to Part lV and fill it out as follows:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Formm 8862

The questions in Part ll pertain only to the Earned Income Credit, so remove all of the X's from Part ll and scroll down and enter the child's info in Part lV. Form 8862 is 3 pages and you need to be on page 3.

Scroll down until you get to Part lV and fill it out as follows:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

phatmanz1

New Member

phatmanz1

New Member

adrienne_finch

New Member

razarimoxey14

New Member

littletaff20

New Member