- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Has anyone noticed that for doing state tax in SC, step M. (credit for US obligations) is not accounted for. Looks like one must do this calculation on your own.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has anyone noticed that for doing state tax in SC, step M. (credit for US obligations) is not accounted for. Looks like one must do this calculation on your own.

Has anyone noticed that for doing state tax in SC, step M. (credit for US obligations) is not accounted for. Looks like one must do this calculation on your own.

Additionally, Code Section 12-2-50, entitled “Governmental bonds, notes, and certificates of

indebtedness tax exempt” provides:

(A)Both the principal and interest of all bonds, notes, and

certificates of indebtedness, by or on behalf of the United States

government, the State, or an authority, agency, department, or

institution of the State, and all counties, school districts,

municipalities, and other political subdivisions of the State, and all

agencies thereof, are exempt from all state, county, municipa

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has anyone noticed that for doing state tax in SC, step M. (credit for US obligations) is not accounted for. Looks like one must do this calculation on your own.

No. You should not be having to calculate anything. You will need to review your federal entries. Once you enter the form, go through all of the questions afterward to get the deduction on line m.

Every state exempts US obligations because federal law prohibits states from taxing Interest and dividend income from obligations of the United States. In reverse, the federal does not tax state obligations so they must be added back to SC online 1D of SC 1040. States will exempt obligations within their state to encourage local investment.

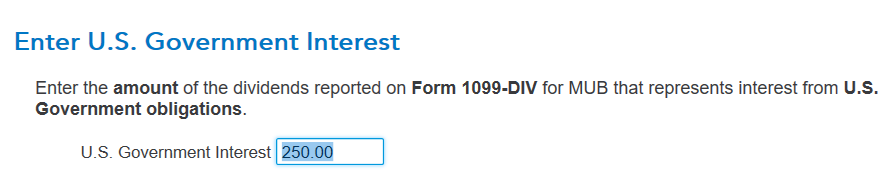

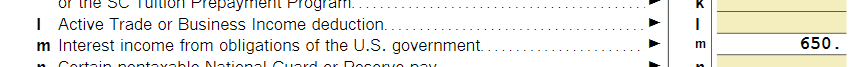

For the subtraction, line m is calculated by the program and comes from: Amount from federal Schedule B, Interest and Dividends, Interest Income Smart Worksheet, Box 3 US Savings Bond/Treasury Obligations plus amounts from federal 1099- DIV Worksheet, U.S. Government Interest reported on the Schedule K-1 for Partnerships, S Corporations, Estates and Trusts. This total amount is reduced by related adjustment amounts on the 1099-INT and 1099-DIV Worksheets which have an adjustment type associated with them.

In the federal, you may have been asked if there were any state adjustments, exemptions, etc. - depending on 1099-int or 1099-div

and you select the state and enter the amount.

I had $400 that was carrying to line m without my having to do anything. Then I added a 1099-DIV to make a partial exemption. Line m automatically changed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has anyone noticed that for doing state tax in SC, step M. (credit for US obligations) is not accounted for. Looks like one must do this calculation on your own.

It would have been helpful to know that with downloaded info from a brokerage that interest/dividends from US government obligations is not computed. Fortunately in the past I was aware that this interest is not taxable by the states and figured it out with a calculator. It is a little tricky to get the data flow thru with the federal tax called by TT (An uncommon tax situation) which I would call quite common. One has to click through 4 or 5 different boxes just to get to this area. I would have never found it on my own.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shanenancy

New Member

mtang

Returning Member

May507

Level 2

rjkturbo2017

New Member

ladydineedham

Level 2