- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No. You should not be having to calculate anything. You will need to review your federal entries. Once you enter the form, go through all of the questions afterward to get the deduction on line m.

Every state exempts US obligations because federal law prohibits states from taxing Interest and dividend income from obligations of the United States. In reverse, the federal does not tax state obligations so they must be added back to SC online 1D of SC 1040. States will exempt obligations within their state to encourage local investment.

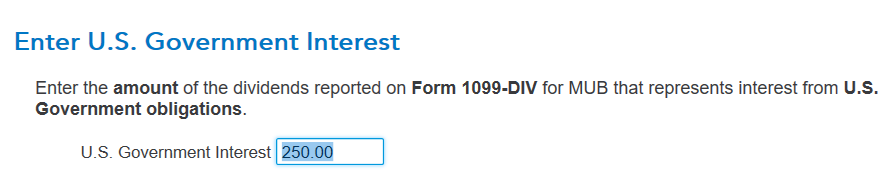

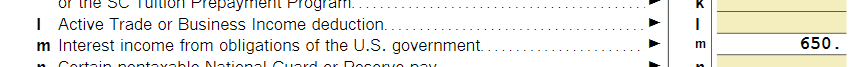

For the subtraction, line m is calculated by the program and comes from: Amount from federal Schedule B, Interest and Dividends, Interest Income Smart Worksheet, Box 3 US Savings Bond/Treasury Obligations plus amounts from federal 1099- DIV Worksheet, U.S. Government Interest reported on the Schedule K-1 for Partnerships, S Corporations, Estates and Trusts. This total amount is reduced by related adjustment amounts on the 1099-INT and 1099-DIV Worksheets which have an adjustment type associated with them.

In the federal, you may have been asked if there were any state adjustments, exemptions, etc. - depending on 1099-int or 1099-div

and you select the state and enter the amount.

I had $400 that was carrying to line m without my having to do anything. Then I added a 1099-DIV to make a partial exemption. Line m automatically changed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"