- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Glitch in TT 2021 Mortgage Interest Deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

Hi everyone,

I've researched quite a few posts on this site regarding our issue, but can't seem to find anything which fits the bill. Our situation is actually pretty straightforward, but the new questions in TT this year seem to erroneously disallow the mortgage interest deduction. I'm a CPA so I have a good understanding of the tax concepts involved, but your assistance would be much appreciated if I'm entering something incorrectly.

Our situation is actually pretty straightforward. We have one mortgage on our primary residence and one 1098. The original purchase was made in 2013 and was refinanced in 2015 of only the mortgage balance - no cash was taken out. In 2021, balance exceeds $1m, and TT seems to be calculating the limitation properly when certain (new for 2021) questions are answered. However, I think TT is glitching and disallowing the entire deduction erroneously in the following situation.

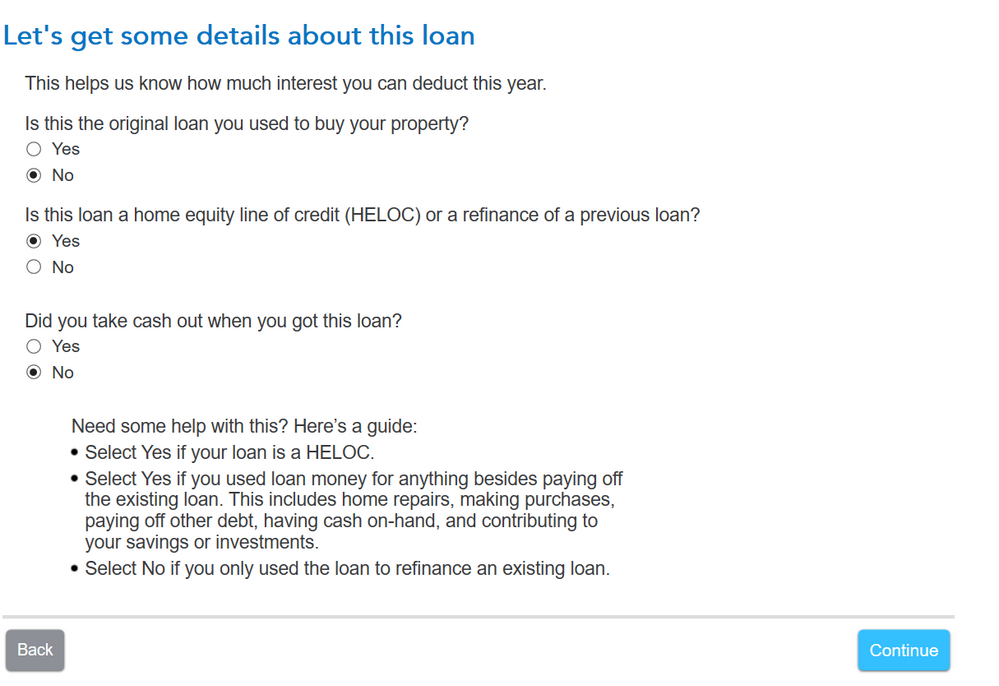

When indicating that this loan is a refi of a previous loan, which is what we did in 2015 as noted above, the mortgage interest is entirely disallowed. However, the refinanced loan should be treated as home acquisition debt on the secured primary residence and the related interest deductible, within IRS limitations. What am I entering wrong?

Again, I have no issues with the limitation calculations - it's when the questions are answered, the deduction is incorrectly disallowed. I have tried looking at the Forms page and the the Home Mortgage Interest Smart Limitation Worksheet as well and the right assumptions lead to the incorrect disallowance of the entire deduction.

Thank you,

Matt808

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

The second question should be answered NO. The loan was "only used to refinance an existing loan."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

Thanks John. That response in TT does generate the correct deduction. However, the question & answer are not correct - this was a refinance of another loan and indicating it as such results in an incorrect deduction amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

I had the same issue and had to answer "No, this isn't a refinance" even though that's not the correct answer. Is this going to be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

The worksheets are not a part of the return. You can make one correct entry instead. Your goal is to file an accurate return at this point.

See About Publication 936, Home Mortgage Interest Deduction part II on page 9. Use page 12 to combine all loans. Only one table 1 is used for all of your loans in one place. The instructions to go through line by line are after the table. There are examples throughout to help you.

Page 13 has mixed-use mortgages.

@hungkienluu

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

Or, alternatively, TT could fix the error in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

Oh my goodness YES, YES, YES! TurboTax was created by Intuit - the people that have always made things simple and "intutitive." The fact that you can't just answer the questions and get the correct calculation. In my opinion, the questions should never have been written in an "or" format. It should have been written as TWO separate questions as the two results are not necessarily calculated in the same manner. Not sure you decided this would be a good decision. I can tell a lot of user are having issues with this - which is just causing frustration to have to research what it occurred. Not a good move, TurboTax!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

The whole concept of TurboTax is that the user should not have to jump around trying to decide what the "best" answer should be to a question. The question should not have been asked in an "OR" format, but rather set up as 2 questions with each result calculating the result correctly. This is very unlike your Intuit products are supposed to work - intuitively. Very disappointed in the programming.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

We had the same situation; i.e. refinanced our original loan without taking out extra money. We answered the question, "yes," as it was a refinance, however TT DID NOT calculated the taxes correctly. Very disappointed in the TT format on this question. Needs to be fixed so users don't have to "figure it out."

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

user17558084446

New Member

dalibella

Level 3

scatkins

Level 2

djpmarconi

Level 1