- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Glitch in TT 2021 Mortgage Interest Deduction?

Hi everyone,

I've researched quite a few posts on this site regarding our issue, but can't seem to find anything which fits the bill. Our situation is actually pretty straightforward, but the new questions in TT this year seem to erroneously disallow the mortgage interest deduction. I'm a CPA so I have a good understanding of the tax concepts involved, but your assistance would be much appreciated if I'm entering something incorrectly.

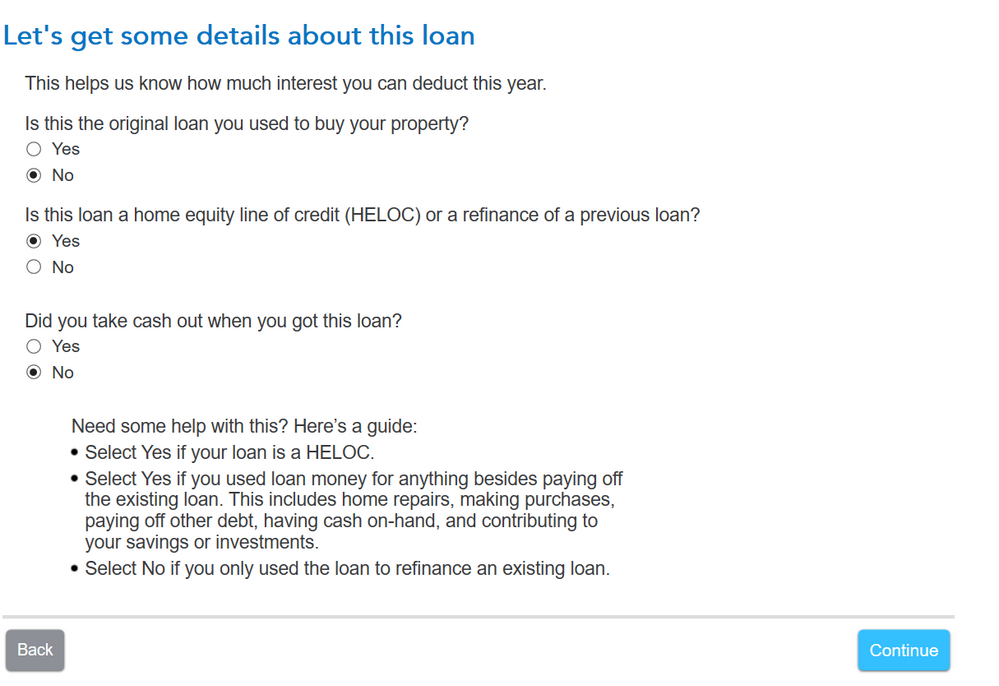

Our situation is actually pretty straightforward. We have one mortgage on our primary residence and one 1098. The original purchase was made in 2013 and was refinanced in 2015 of only the mortgage balance - no cash was taken out. In 2021, balance exceeds $1m, and TT seems to be calculating the limitation properly when certain (new for 2021) questions are answered. However, I think TT is glitching and disallowing the entire deduction erroneously in the following situation.

When indicating that this loan is a refi of a previous loan, which is what we did in 2015 as noted above, the mortgage interest is entirely disallowed. However, the refinanced loan should be treated as home acquisition debt on the secured primary residence and the related interest deductible, within IRS limitations. What am I entering wrong?

Again, I have no issues with the limitation calculations - it's when the questions are answered, the deduction is incorrectly disallowed. I have tried looking at the Forms page and the the Home Mortgage Interest Smart Limitation Worksheet as well and the right assumptions lead to the incorrect disallowance of the entire deduction.

Thank you,

Matt808