- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign tax credit and form 1116

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

- I have $583 foreign tax credit carry over to this year.

- I have $353 foreign tax paid in 2023.

I answered the step by step questions regarding foreign tax paid, and the amount $936 appears in schedule 3. So I thought everything regarding the foreign tax was done correctly. However, TT gave me an error at the end, pointing to form 1116

I thought I won't need form 1116 since we are filing as married, joint and our foreign tax paid is less than $600. The error occurred at the screen where it asks the following question:

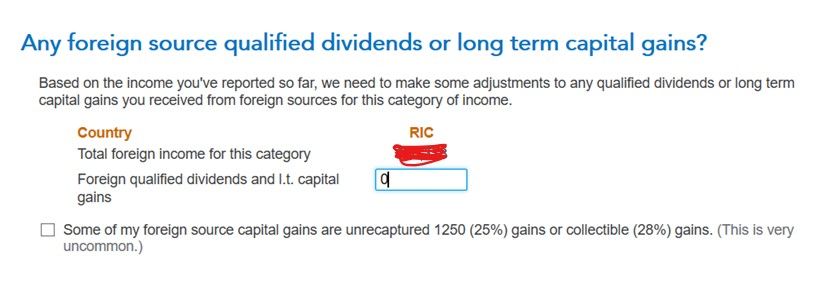

"Any foreign source qualified dividends or long term capital gains?"

How will we know how much of the qualified dividend is from the foreign country "RIC"? Any amount I entered here will increase the tax I owe by decreasing the foreign tax credit. So I'm totally confused.

I reviewed 2021 tax return where I have claimed foreign tax credit of $519. The step by step process was easy and didn't ask me about the income from these foreign sources.

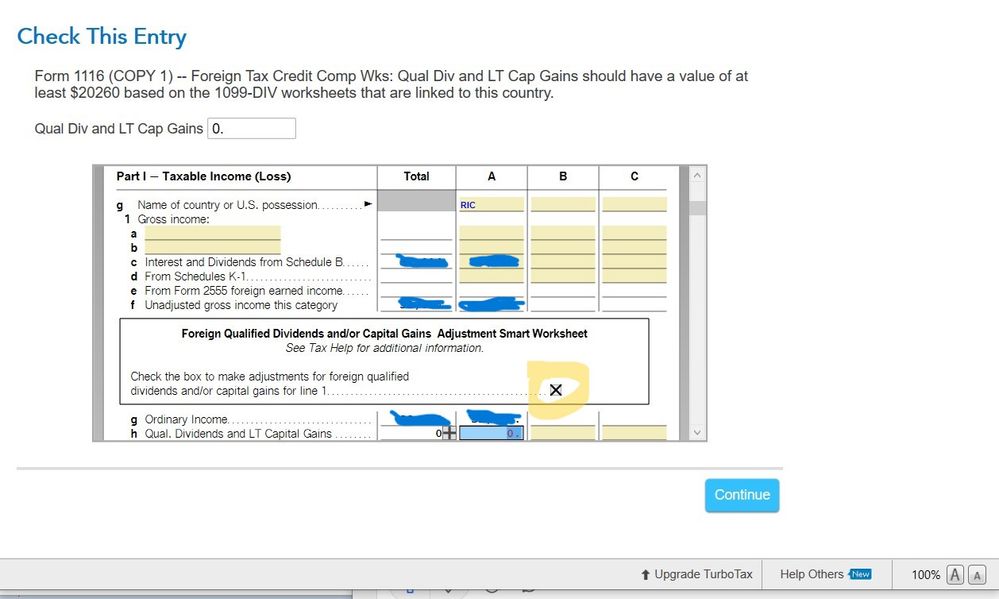

The Foreign Tax Credit Computation worksheet is mostly blank in 2021 and the box to make adjustments for foreign qualified dividends and/or capital gains for line 1 is not checked in 2021, but it is checked in 2023 as shown in the photo. How can I uncheck the checkbox in 2023 tax return?

The attached photos may not be inserted into the right place, one is in Form 1116 copy 1; the other is step by step question.

I appreciate any pointer in advance.

Cindy

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

if form 1116 is not used and carryover from the previous year can not be used and is permanently lost. also since you have a carryover your FTC is more than $600 unless you want to lose any unused amount from 2022

either the amount on the foreign dividend income/qualified amount is on the 1099 or it's not. I had to call my broker because it was not. I would suggest you call yours or the fund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

Thank you. I took some time to re-do this foreign tax section and understand better now. The error was eliminated, and only part of the carryover from last year can be used this year which is ok.

But I do have one question on the amount on line 3e of form 1116 "gross income from all sources". The amount is much higher than my Total Income on line nine of form 1040. What did I miss here?

I do have capital loss from the selling some securities to offset the capital gain distribution. Is that not accounted? I tried that, but the amount doesn't match. :(

Thank you for pointing me to the right direction.

Cindy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

To clarify, what type of income is your foreign gross income? If it is capital gains income, it may have been negated by the capital gains losses. That may account for the difference between the amount on the 1040 versus the amount of the Gross Foreign Income.

.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

It is dividend, some of them qualified dividend.

Thanks,

Cindy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

Some of that income on line 9 may have been reduced by the adjustments to the income. Look on the 1040 on Line 8 and see if the adjustments reduced the amount of Gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

Thank you. I finally read the detail instruction of form 1116 from IRS and the amount here in line 3e doesn't include investment loss.

Thank you for all your pointers. I have filed my tax return for 2023.

Cindy

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

skal

Level 2

Lakie7

Level 1

monikagoel

Returning Member

mdsaronson

Returning Member

skal

Level 2