- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign tax credit and form 1116

- I have $583 foreign tax credit carry over to this year.

- I have $353 foreign tax paid in 2023.

I answered the step by step questions regarding foreign tax paid, and the amount $936 appears in schedule 3. So I thought everything regarding the foreign tax was done correctly. However, TT gave me an error at the end, pointing to form 1116

I thought I won't need form 1116 since we are filing as married, joint and our foreign tax paid is less than $600. The error occurred at the screen where it asks the following question:

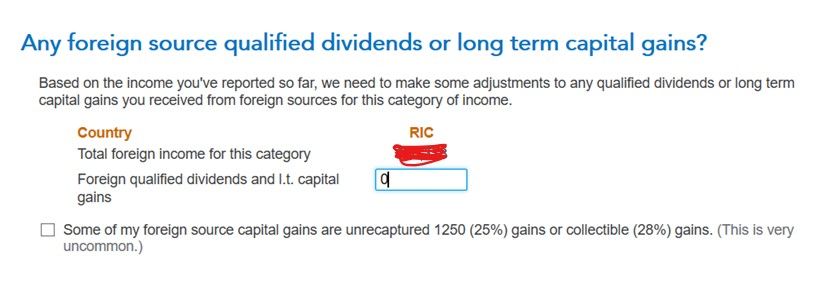

"Any foreign source qualified dividends or long term capital gains?"

How will we know how much of the qualified dividend is from the foreign country "RIC"? Any amount I entered here will increase the tax I owe by decreasing the foreign tax credit. So I'm totally confused.

I reviewed 2021 tax return where I have claimed foreign tax credit of $519. The step by step process was easy and didn't ask me about the income from these foreign sources.

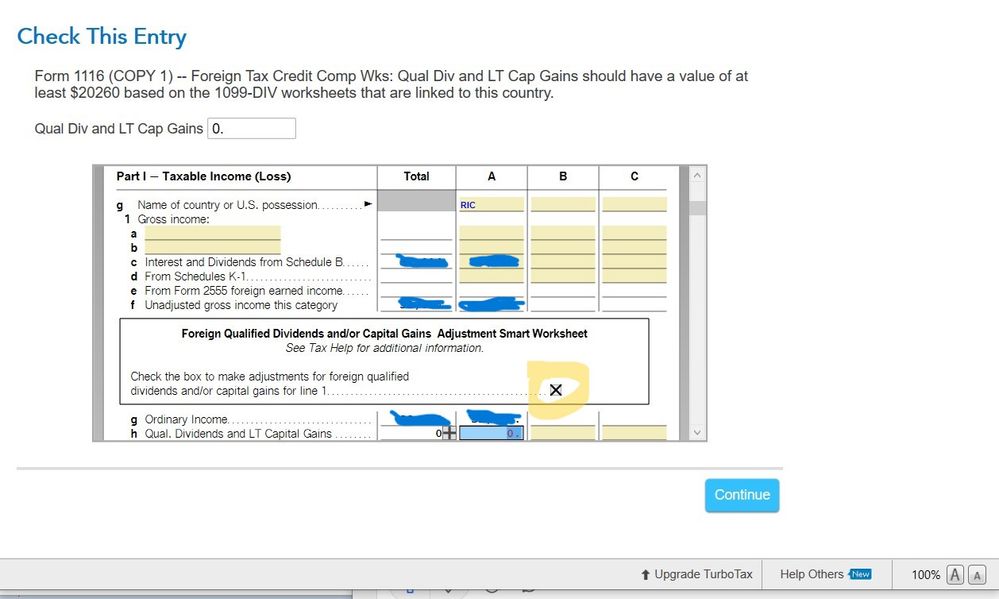

The Foreign Tax Credit Computation worksheet is mostly blank in 2021 and the box to make adjustments for foreign qualified dividends and/or capital gains for line 1 is not checked in 2021, but it is checked in 2023 as shown in the photo. How can I uncheck the checkbox in 2023 tax return?

The attached photos may not be inserted into the right place, one is in Form 1116 copy 1; the other is step by step question.

I appreciate any pointer in advance.

Cindy