- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Income Exclusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion

Hi,

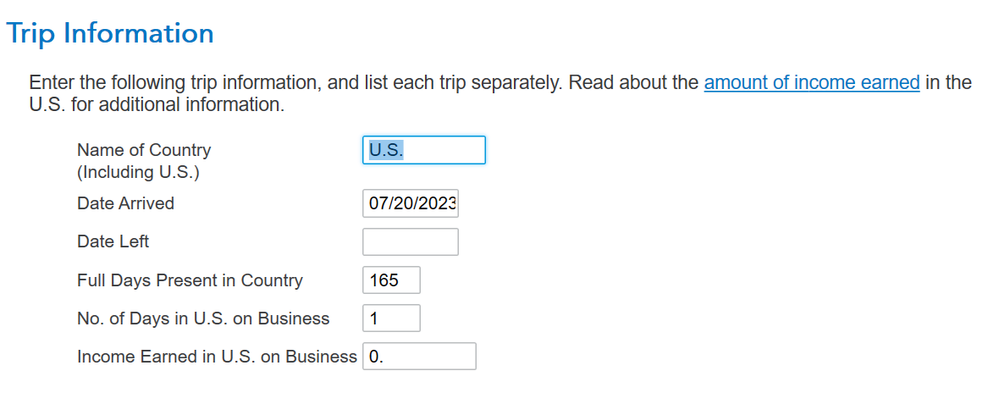

I am working on my taxes and I am not sure how to proceed with completing the 2555 for foreign income exclusion for 2023. I was out of the country for all of 2022 and part of 2023. Based on the guidance for the physical presence test I have a 12-month period in which I was out of the country which started in 2022 and ended in 2023. I used the dates 19 July 2022 to 18 July 2023 (or vis versa whichever worked in TT). We were in the country from 20 July to the present. So in 2023, we were in the country for 165 days, from 20 July until the end of the year but we did not leave the US. I entered the July date in TT but what about the end date? The field calls for the date we left the country but we did not leave at the end of December. How to enter this in TT.

Additionally, the field that asked the number of days I was in the country on business but when I entered 0 the TT informe me the number had to be greater than zero. I was not in the country for business, we returned home after my overseas contract expired. How to handle this?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion

It depends. if i am understanding you correctly, you ask what end date to enter for your foreign residency. In this case, it is July 18, 2023. See the second screen shot below. Before you select this, make sure you check the box that you are using the Physical Presence Test to exclude your foreign income and not the bona fide residence test.

Sometimes Turbo Tax gets strange and may ask you how many days you were out of the country. Normally you can leave this field blank but if the program will not allow you to move on, put a "1" in that field just to see if you can move ahead without errors.

Also be sure to correctly fill out your information in the MY INFO section of your return if you hadn't already. Please refer to the first screenshot that illustrates this instruction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion

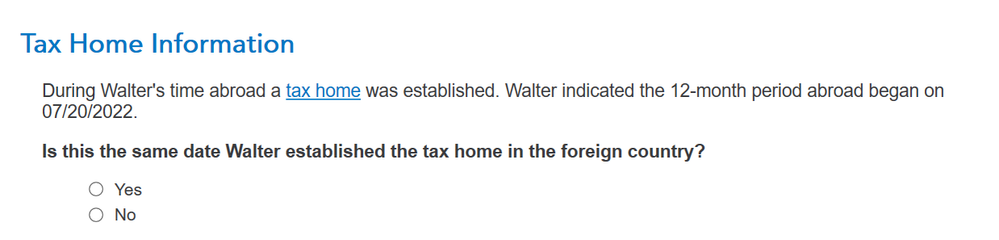

Hi DaveF1006,

Regarding my Form 2555 Foreign Income Exclusion. I have another question and also want to circle back to the end date. We moved overseas at the end of 2021. For all of 2022, I was overseas and did not return during the calendar year. Do I use 1 Jan 2022 for the year I started my tax home in a foreign country or my 20 July 2022 -19 July 2023? See the screen shot below.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion

Yes, you would use Jan 1,2022 as the date you began living in the foreign country. Also, the trip information screen appears because you must have answered yes to the question preceding this screen. This question asked you if you made any trips abroad during the time period between 07/20/2022-07/19/2023. Here you will say no and that screen you list above should disappear in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion

Got it. Thanks for the clarification. I did not read the question closely enough and think it through.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

RShaunSmith

New Member

king2434

Level 1

tanyamedukha

Level 2

GrPoten00_18

New Member

gscippio44

New Member