- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi DaveF1006,

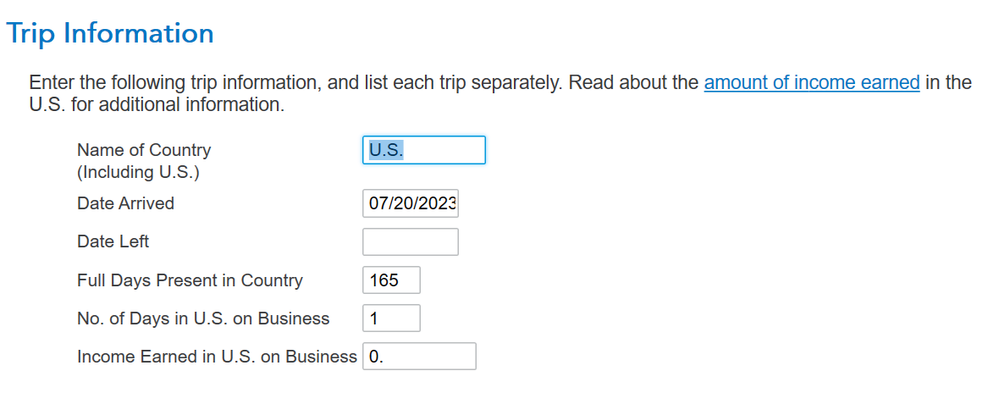

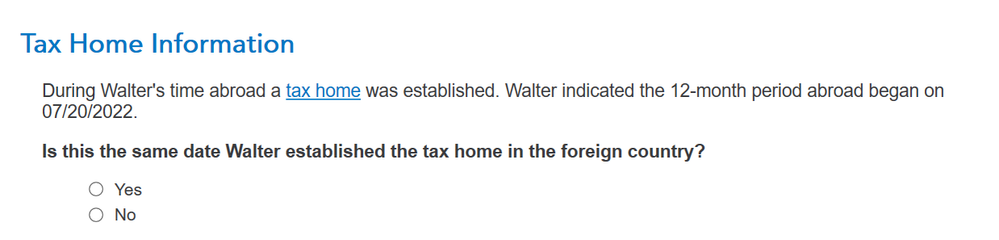

Regarding my Form 2555 Foreign Income Exclusion. I have another question and also want to circle back to the end date. We moved overseas at the end of 2021. For all of 2022, I was overseas and did not return during the calendar year. Do I use 1 Jan 2022 for the year I started my tax home in a foreign country or my 20 July 2022 -19 July 2023? See the screen shot below.

Thanks,