- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

On the Step-By-Step portion of the software's Deductions & Credits workflow for mortgage insurance, you'll eventually get to a screen that reads "Let's get some details about the loan"

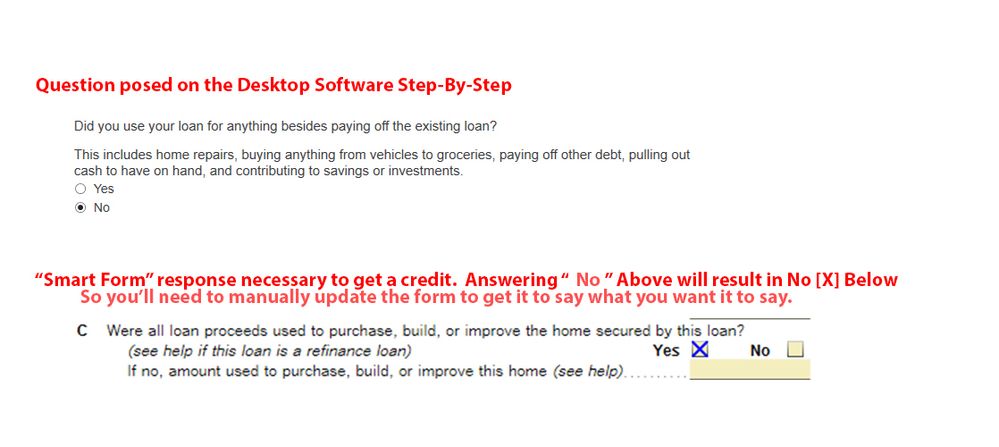

And most important if you choose "yes" to refinance is a question that says "Did you use your loan for anything besides paying off the existing loan" . The language here is important, it says "besides paying off the existing loan." So if you only used the refinance to pay the existing loan, your instinct will be to check the (*) No radio option.

However, this screws up on the Smart Worksheet" item C. Because if you go to the Forms and look at the worksheet, the all-important checkbox reads "Were all loan proceeds used to purchase, build, or improve the home secured by this loan" Yes [ ] No [ ]

The problem is the way Yes/No flips. The guided question on the step-by-step interface asks for a confirmation of a negative. While the smart worksheet is the inverse and you must put the [X] next to yes to get any credit. Since Turbotax is storing the radio response from the step-by-step, you could accidently be disqualifying yourself the mortgage interest from a qualifying mortgage interest deduction.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

Thanks for your post.

I have a similar issue that I have yet to solve. Mortgage interest limited is marked yes in the mortgage interest part of the Sch-A Tax and Interest Deduction Worksheet, even though line 22 of the Deductible Home Mortgage Interest shows the correct amount. That amount should transfer to Sch-A line 8a, but it does not. Even with your tip, I cannot figure out what is triggering the limitation. The loan amount is under 200k and it all went to the house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

By any chance did you enter multiple 1099s for the refinance or transfer of your mortgage? The system doesn't know that it's the same loan when you do that, it thinks you have multiple loans. If this is the case, remove the loan balance from all but the most recent 1098s. That way you won't trigger the limitation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

There is only one 1098.

I deleted the 1098 entry on the Step-by-Step screen and then checked the Forms. All of the corresponding form entries had been cleared EXCEPT that there was still a "0." entered on the line A2, "Limited amount to report on line 5a below" on the Tax and Interest Worksheet. I manually deleted that entry and saved the file. Then I switched back to Step-by-Step and reentered the 1098 info (box1 - $4010.11, box2 - $190,409.66, box3 - 07/21/2021). When I hit continue on the following screen (secured by a property of mine - Yes), the Fed and State tax numbers both changed (deduction included for both). I have no points. Most recent 1098 - Yes. Refinance - check. Used for anything beside paying off the existing loan - No. After [Continue] the numbers stayed the same, and I got the Congrats message. It appears that something had previously set the Limited flag, and that was not being cleared, even after the 1098 info had been deleted in the Step-by-Step screen. SEEMS LIKE A BUG. However, the manual clearing of that one "0." appears to have fixed my problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

mortgage interest can be posted and considered in tax calculations if you post the interest amount in the line that shows no 1098 was received on schedule A.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

CTinHI

Level 1

dgjensen

New Member

mc510

Level 2