- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error with the Home Interest Worksheet (Premier PC Desktop Version); mortgage interest deduction could be misapplied

On the Step-By-Step portion of the software's Deductions & Credits workflow for mortgage insurance, you'll eventually get to a screen that reads "Let's get some details about the loan"

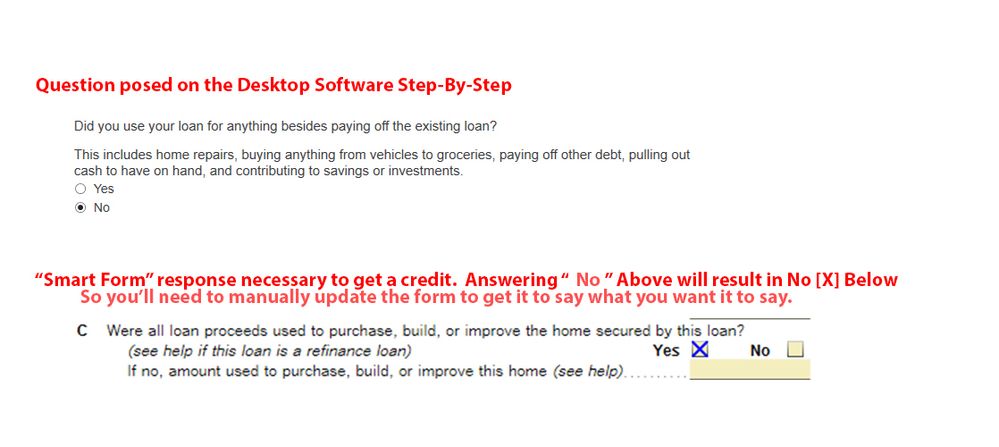

And most important if you choose "yes" to refinance is a question that says "Did you use your loan for anything besides paying off the existing loan" . The language here is important, it says "besides paying off the existing loan." So if you only used the refinance to pay the existing loan, your instinct will be to check the (*) No radio option.

However, this screws up on the Smart Worksheet" item C. Because if you go to the Forms and look at the worksheet, the all-important checkbox reads "Were all loan proceeds used to purchase, build, or improve the home secured by this loan" Yes [ ] No [ ]

The problem is the way Yes/No flips. The guided question on the step-by-step interface asks for a confirmation of a negative. While the smart worksheet is the inverse and you must put the [X] next to yes to get any credit. Since Turbotax is storing the radio response from the step-by-step, you could accidently be disqualifying yourself the mortgage interest from a qualifying mortgage interest deduction.