- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Do I need to Amortize my Mortgage Points?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to Amortize my Mortgage Points?

In 2019 I bought a second property to use as my primary residence. I spent a few months renovating and moved into the property in December 2019. I paid points as part of my mortgage for this second property. My understanding is that I do not need to amortize those points, because I'm using this property as my primary residence (even though it's my second time purchasing a home). Is that correct?

Also, not sure if this is relevant, but I started listing my first property for rent in December, but it didn't get rented out in 2019, so I won't be filing a Schedule E as I had no rental income in 2019.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to Amortize my Mortgage Points?

It depends.

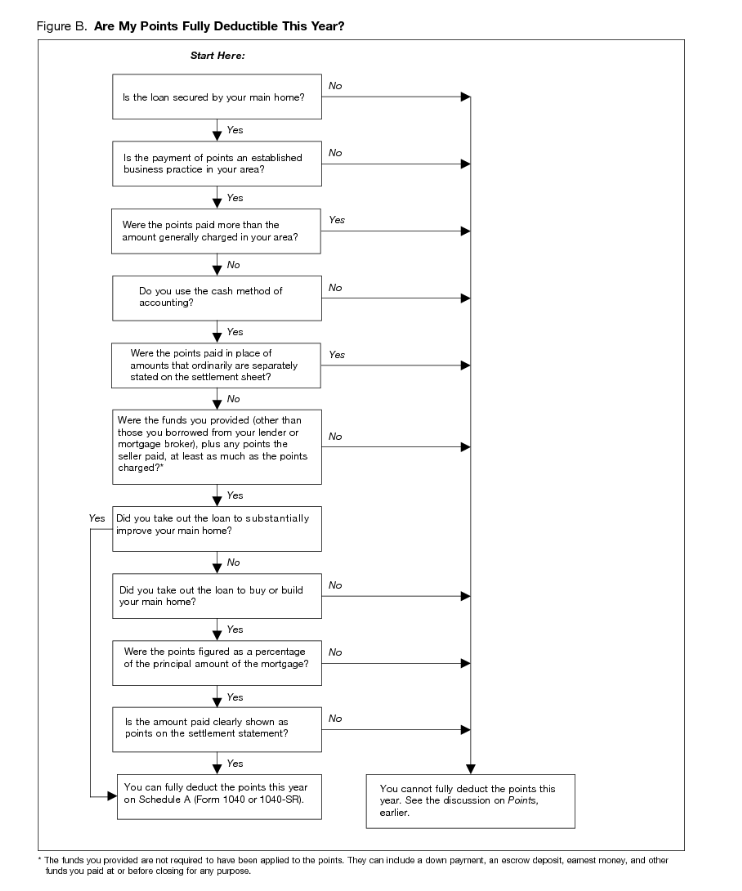

Typically you would amortize the points over the length of the loan. Attached is a flowchart from the IRS that you can use to determine if you can expense the points this year or if you will need to amortize them based upon your specific set of circumstances.

As far as your rental property, you are correct. Since it did not get rented out in 2019, you do not have any filing requirements for the property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wartiguejr

New Member

slogan96

New Member

javahounds

New Member

jordan-geonna

New Member

mhr1

Level 3