- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends.

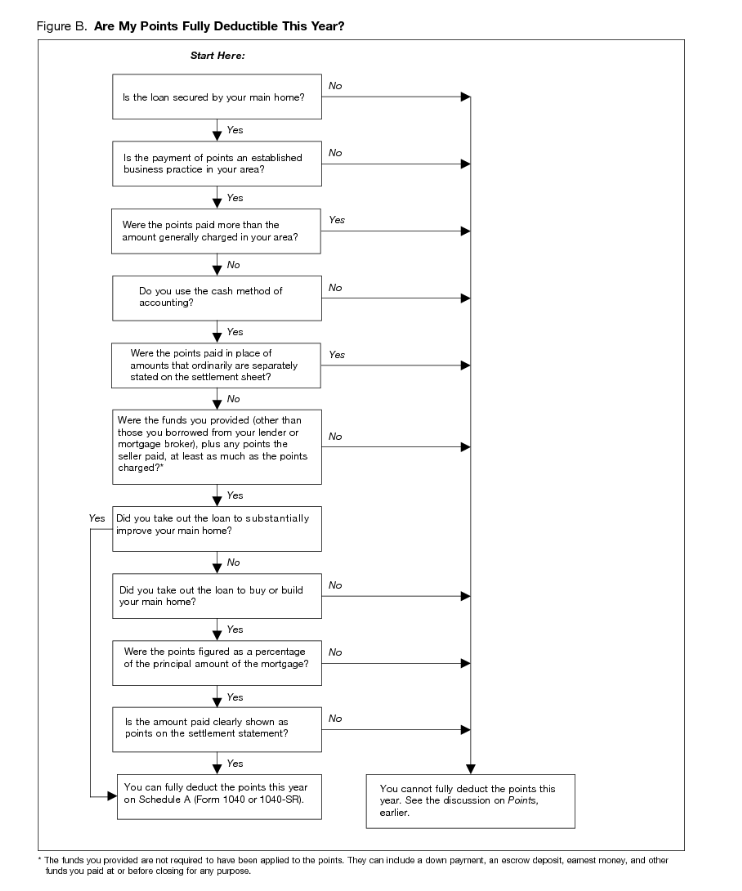

Typically you would amortize the points over the length of the loan. Attached is a flowchart from the IRS that you can use to determine if you can expense the points this year or if you will need to amortize them based upon your specific set of circumstances.

As far as your rental property, you are correct. Since it did not get rented out in 2019, you do not have any filing requirements for the property.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 15, 2020

6:58 PM