- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can I e-file with Form 1116 but no Form 2555?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

After spending over an hour with a specialist I figured out a way to work around the issue; if you don't/can't take the foreign earned income exclusion, just don't bother to do the FEI interview. Instead, enter the foreign income in the foreign tax credit part directly. That way Form 2555 is completely removed from the system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

Congrats! I'm glad you were able to solve it. Thanks for reporting back. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

Great to know that you finally got your problem resolved. I patiently read through the entire thread.

QUESTION : How did you report the foreign income by avoiding 2555?

I'm in a similar situation. Trying to claim FTC (foreign tax credit) by filing form 1116 instead of filling in form 2555.

However, in order to claim the FTC, the foreign income needs to be reported under Wages/Income section, and the only way to do that seems to be through the FEIE (Foreign earned income and exclusion) interview, which triggers the 2555 scenario. Now, if I go ahead and manually delete the form 2555 (using the desktop app) I run into an e-Filing error that instructs me to complete form 2555.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

You can choose not to exclude your foreign income, as you enter your foreign income there is is screen asking Whose Foreign Income Would You Like to Try and Exclude? (This is an example if you filing Married Filing jointly) Here you can say neither of us, or if it just you, indicate you do not want to exclude your foreign income.

After you make this entry, go to tax tools>tools>delete a form>delete 2555 and the form should disappear in your list of forms. If you are using the desktop version, go to forms>select 2555>delete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

I've tried this procedure, but the Form 2555 still shows up in the review as a problem. It's asking for dates, but there's no place to enter any dates.

I have even deleted the Form 2555 (one for me and my wife), they're not on the list, but it still shows up as a problem when I try to file.

One issue I noticed is that when I try to re-do the "foreign income" questions, the system automatically selects "Both of us" when asking whose income to exclude. I change it to "Neither of us", but when I finish the whole process again, those 2555 forms are still there and causing a problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

If this is persisting, I am going to recommend an alternate method of reporting your foreign income and this should work.

- Delete your foreign income from the Foreign Income and Exclusion section. Wipe it clean !!

- Go to tax tools>tools>delete a form>delete form 2555 and any worksheets that may be associated with it.

- After doing this, repeat step 2 just to make sure that Form 2555 doesn't appear.

- Now go to:

- Federal>wages and income

- less common income>show more

- Miscellaneous Income, 1099-A, 1099-C>start

- Other reportable income>start

- Answer yes to the first screen

- Next will be a dialog box asking for the description of the income. Type in Foreign income earned in XXX country and then the amount. At this point, you can make two individual entries or one combined entry.

- To claim a Foreign Tax Credit;

- Click on federal> Deductions and Credits at the top of the screen

- Select I will choose what I work on

- Scroll down to Estimates and Other Taxes Paid

- Select Foreign Taxes and then select start

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

That's very very helpful. I tried your way to file the foreign earned income. It perfectly resolved the issue. You saved tons of our efforts and time! Really appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

Thanks for sharing the elaborate steps. (I'm using the desktop version of TT)

I did exactly what you said starting with deleting the 1116 forms that had gotten added initially, and doing everything from scratch. I did verify that there was no 2555 or 1116 remnant in the forms.

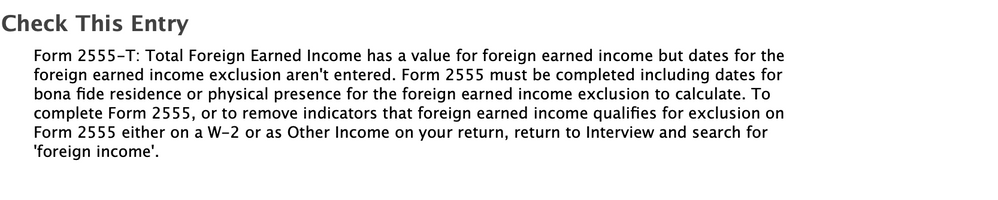

However, the return fails the Smart Check validation under federal taxes with the following error even though there's nothing really related to 2555 visible in the forms.

I think it's pure dumbness of the TT software which is probably safe to ignore and go ahead with the e-filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

@RabbitFamily , are you using the web portal or the desktop software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

I am using desktop software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

Go to the forms mode and look for Form 2555-S. Select it and then delete it by selecting delete form at the bottom of the page. See if that works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

My spouse has foreign income both on a W-2 and through a non-US employer we are trying to report via the foreign income section. Also don't want any FEIE, but facing the same issue...we selected 'Neither of us' when asked about whose income we wanted to exclude, but it created forms 2555-T & S anyways. I've tried deleting them, but I still can't E-File.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file with Form 1116 but no Form 2555?

If you are trying to report foreign income through the exclusion process, you are going to keep the 2555. Instead, delete the 2555 since you don't want it. Enter the income under regular income and note that it is foreign. Where you enter the income will vary based on the type. Since I believe your issue is w2 related, there are two good options.

1. A substitute w2:

- Start by selecting to enter a w2

- Continue past the EIN screen leaving it blank

- Select Type it in myself

- Complete the information

- Continue to the screen, Let's check for uncommon situations and select Didn't get a w2.

2. Other income follow these steps:

- go to the federal income section

- scroll to the bottom

- Miscellaneous Income, 1099-A, 1099-C, Start

- Scroll to the bottom

- Other reportable income, Start

- Other taxable income?

- Select YES

- Description foreign wages

- Amount, enter your amount

- continue

You will want to enter any foreign taxes paid, please follow these steps:

- Click on Federal Taxes > Deductions & Credits [

- Scroll down to the Estimates and Other Taxes Paid section.

- Click START on the box next to Foreign Taxes.

- Continue

- Did you pay taxes on income outside the U.S.? Click Yes, I did..

- Continue

- Continue

- Foreign Taxes, click Continue

- Deduction or Credit? Most people choose the credit since so few itemize deductions. You can try it both ways and determine what is best for you. Select an option.

- Continue to enter the information requested on the screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hijyoon

New Member

ahhlun

Level 2

MHSD36

Level 2

form8606

Level 2

akrawitz

New Member