- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2023 excess IRA contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

My wife and I are married, filing jointly for 2023. She inadvertently contributed more than the 2023 limit to IRAs. When we realized this last month (January 2024), we filled out a form with the bank to have the excess $500 removed, and moved into her brokerage account. With gains accounted, the website shows a 2024 IRA distribution of $526, in addition to 2023 IRA contributions of $4,400 (traditional) and $2,600 (Roth). In other words, the website still shows $500 over-contribution, but also shows the distribution of $526, which is meant to correct that over-contribution.

We're now trying to do our taxes using TurboTax Deluxe. Here's what we've done, and we're wondering if we did it correctly and what to anticipate in the future:

1. I contributed to a Roth of my own, wife contributed to her own Roth and traditional.

2. Wife contributed $4,400 to a traditional, before 01/01/2024. It was not recharacterized, and she is not covered by a retirement plan at work. No excess IRA contributions before 2023, no nondeductible contributions to her IRA. Not a repayment of a retirement distribution.

3. Wife contributed $2,600 to a Roth, before 01/01/2024. (This made the TurboTax federal refund tracker go down by $30, which makes sense - 6% penalty on $500 excess). It was not recharacterized. No withdrawals before 2023, no prior conversions, no past excess contributions. We then entered a Contribution Withdrawn Before the Due Date of $500. (This made the refund tracker go up by $30, suggesting removal of the 6% excess contribution penalty.) But should this be $526 including gains instead?

3. I contributed $6,500 to a Roth. It was not recharacterized, no prior conversions, no past excess contributions. Not a repayment of a retirement distribution. I am covered by a retirement plan at work.

4. This all results in a screen saying we qualify for an IRA deduction of $4,400. As far as we understand it, this is correct for married filing jointly given our MAGI and her not being covered by a retirement plan at work - it's the full amount of her traditional IRA contribution. The Roth contributions have already been taxed, meaning nothing to deduct? A little fuzzy on understanding this part.

5. Should we be expecting a 1099-R next year, to account for taxes to be paid on that $526? And what will we do with that on our 2024 taxes? Or is there a way to address that now, to avoid future complications?

Thanks in advance for any insight or clarity!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

You will get a Form 1099-R in the following year. The best thing to do is to report the excess contribution distribution in 2023 before you file your tax return. Otherwise, you would have to amend your 2023 return when you get the Form 1099-R in 2024.

To enter a refund of excess IRA contributions in the current year follow these steps:

- Go to the personal income section of TurboTax

- Find the Retirement Plans and Social Security menu option

- Start or Update IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Choose Add Another 1099-R

- Choose I'll type it in myself

- On the screen that says Tell Us Which 1099-R You Have choose I need to prepare a Substitute 1099-R

- Enter the distribution amount in box 1 of the substitute 1099-R

- Enter the earnings in box 2(a)

- Enter code "P" and "J" in box 7

- When asked about the year on the form 1099-R, say it is for the year following the year you are working on

Follow these additional steps to see if you qualify for removal of the 10% penalty:

- Click "Continue" after all 1099-R are entered and answer all the questions.

- Continue until the "Did you use your IRA to pay for any of these expenses?" screen and enter the amount of earnings under "Corrective distributions made before the due date of the return".

[Edited 3/6/24 at 1:28 PM PST] @settlersbanjo

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

You will get a Form 1099-R in the following year. The best thing to do is to report the excess contribution distribution in 2023 before you file your tax return. Otherwise, you would have to amend your 2023 return when you get the Form 1099-R in 2024.

To enter a refund of excess IRA contributions in the current year follow these steps:

- Go to the personal income section of TurboTax

- Find the Retirement Plans and Social Security menu option

- Start or Update IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Choose Add Another 1099-R

- Choose I'll type it in myself

- On the screen that says Tell Us Which 1099-R You Have choose I need to prepare a Substitute 1099-R

- Enter the distribution amount in box 1 of the substitute 1099-R

- Enter the earnings in box 2(a)

- Enter code "P" and "J" in box 7

- When asked about the year on the form 1099-R, say it is for the year following the year you are working on

Follow these additional steps to see if you qualify for removal of the 10% penalty:

- Click "Continue" after all 1099-R are entered and answer all the questions.

- Continue until the "Did you use your IRA to pay for any of these expenses?" screen and enter the amount of earnings under "Corrective distributions made before the due date of the return".

[Edited 3/6/24 at 1:28 PM PST] @settlersbanjo

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

Hi there,

Thank you for the detailed explanation. That was very easy to follow, but I just wanted to double check on the years since that looks a little funky.

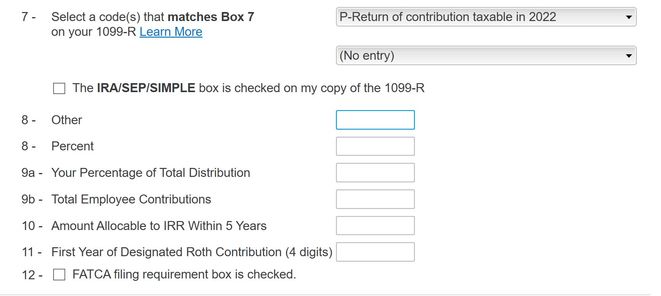

For step 9, it says P-Return of contribution taxable in 2022. Is this just a nuance of us entering the 1099-R ahead of time, since the contribution was actually made in 2023 and the form is expected to come at the end of tax year 2024?

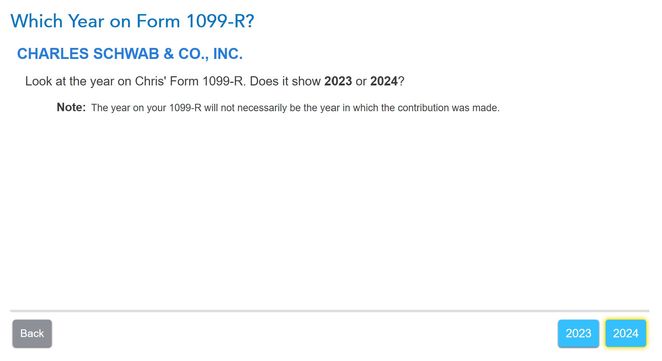

And for step 10, selected 2024 per your guidance:

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

Yes, you are correct. In 2024 the code P on the Form 1099-R will reference 2023 so that is why you enter it now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

@ThomasM125 I also made a 2021 & 2022 excess Roth IRA contribution. I've amended my federal tax returns (to pay the 6% penalty) but do you know if state tax returns need to be amended? (I'm in CA) I can't find any resources that say state tax returns need to be amended for Excess Roth IRA Contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 excess IRA contribution

Hey there, quick goback. I just came across this mention of code 8 for excess contributions during the current year, instead of code P for the prior year. Do you have any thoughts on that?

https://www.taxact.com/support/1210/2023/form-1099-r-excess-401k-contributions?hideLayout=False

From the 2023 1099-R form instructions:

8—Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2023.

Use Code 8 for an IRA distribution under section 408(d)(4), unless Code P applies. Also, use this code for corrective distributions of excess deferrals, excess contributions, and excess aggregate contributions, unless Code P applies. See Corrective Distributions, earlier, and IRA Revocation or Account Closure, earlier, for more information.

P—Excess contributions plus earnings/excess deferrals taxable in 2022.

See the explanation for Code 8. The IRS suggests that anyone using Code P for the refund of an IRA contribution under section 408(d)(4), including excess Roth IRA contributions, advise payees, at the time the distribution is made, that the earnings are taxable in the year in which the contributions were made.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jl_brooks

Level 2

tocguy

Level 3

Flanda

Returning Member

megan0956

Returning Member

AdamBATL

Level 2