- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi there,

Thank you for the detailed explanation. That was very easy to follow, but I just wanted to double check on the years since that looks a little funky.

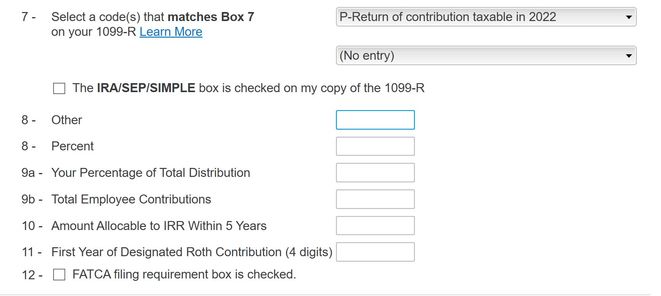

For step 9, it says P-Return of contribution taxable in 2022. Is this just a nuance of us entering the 1099-R ahead of time, since the contribution was actually made in 2023 and the form is expected to come at the end of tax year 2024?

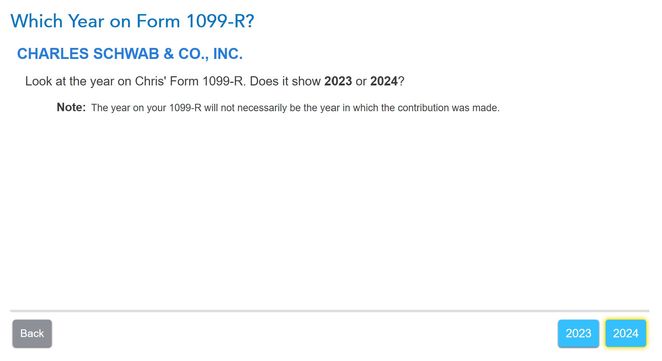

And for step 10, selected 2024 per your guidance:

Thank you so much!

February 12, 2024

6:38 PM