- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1098 refi & payoff of HELOC and refi loan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

I refinanced my home in 2020. I paid off my loan,(which was refi from 4 years ago),HELOC and also other debt and used some on house. I have 3 1098's. I enter my first 1098 for existing loan and answer that it is not my original from when I bought my house, and this is the one that was paid off. Do I answer that I took $ out for other than my house on this question for this loan or the new refi loan? My HELOC was all for house and paid off with the new refi, 3rd 1098. On the 3rd 1098, do I say it is a refi and I took $ out? Which is the correct 1098 to say I took $ out. I need to show that the first and the 2nd 1098, home loan and HELOC are paid off. I am not getting a place to state it was paid off.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

It depends. I would suggest entering each 1098 individually so that the calculations regarding your interest deduction are accurate. Here is my best suggestion.

- Enter the 1098 from your original loan exactly the way that is listed on the 1098, including the mortgage balance. Be sure to indicate that this loan was paid off or refinanced with a different lender in 2020.

- Enter the 1098 for the Heloc. This time enter the 1098 but enter 0 as the mortgage balance.

- Make sure you indicate that this loan was also paid off or refinanced with a different lender in 2020.

- Also there are questions you will answer regarding that this is a Heloc.

- Here you won't mentioned you didn't pull money out. We will handle that in third 1098T

- Once your 2nd 1098 is complete, let's enter the third 1098 regarding your new loan

- Enter the information exactly the way this is listed on the 1098, including the loan balance.

- When you complete entering the 1098, there will be a question that asked if Is this loan a home equity line of credit or a loan you've ever refinanced? Here you will say yes.

- Next screen asks Great. So which type of loan is it? indicate it is A mortgage loan that I've refinanced.

- Then below that line Have you ever pulled cash out from this loan when refinancing it? Here you will say yes

- The next screen asks Have you used the money from this loan exclusively on this home? Here you will say no

- Next screen asks, Let's see how much interest you can deduct this year.

- Indicate that you wish Turbo Tax to help you figure it out.

- Finish through the section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

You are getting a place to say they were paid off when you enter the outstanding balances of $ 0 as of 1/1/21. You have multiple 1098s so follow these instructions

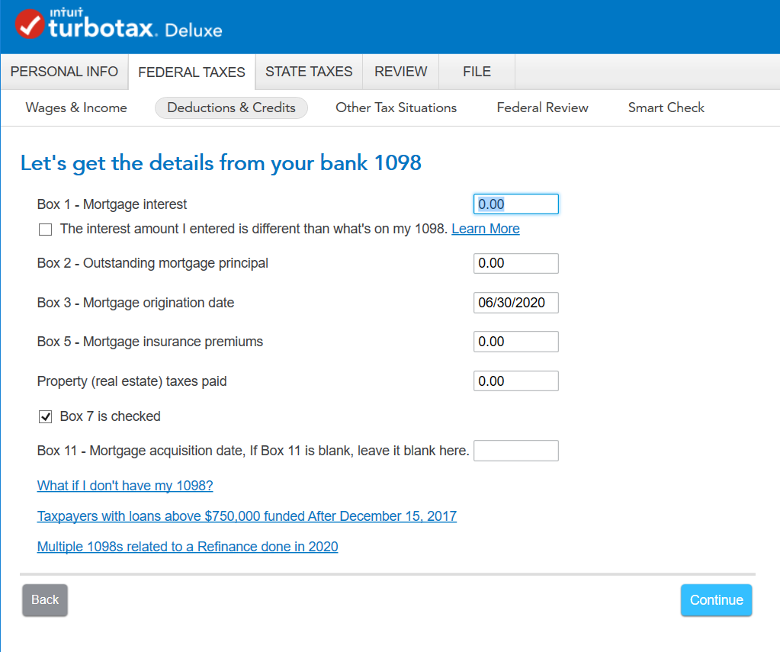

steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

WHERE TO ENTER THE LOOK BACK CREDIT

If you're referring to the IRS Taxpayer Certainty and Disaster Tax Relief Act of 2020 EIC special look back provision, see the steps below.

- Type EIC in the search and select the Jump to.

- Continue with the onscreen interview until you get to the Do you want to use last year's earned income? screen.

- Continue with the onscreen interview until complete.

Per IRS: If your earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

Note: If you earned income was higher in 2020 versus 2019, you won't be able to use the EIC special look back.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

Home Debt Over $375,000

Under tax law, you are limited on the amount of home interest you can deduct. The limit is based on the loan amount and date of the origination of debt. We want to make sure we calculate this correctly for you.

If you refinanced last year, you’ll have a Form 1098 from your previous lender and one from the lender you refinanced with. You’ll need both forms.

Follow these.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

Each 1098 is for a different lender. The first is my loan I just refinanced, but was not my original loan when I purchased the house. no $ were taken from this loan. 2nd 1098 is my HELOC. Bothe of these were paid off with the last 1098 and $ were taken out for other debt.

If I am supposed to add these together, which institution name would I use? Do I mark the first one as being my original loan or a refi, since it had been refi 4 years ago?

I still don't see a place to enter date of payoff.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

Yes, mark the first loan as the original loan. You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately. Use the original loan.

Follow these steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender(s))

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

@DMC62

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

My first loan #1 1098 and my HELOC #2 1098 are from 2 different lenders, under $300,000.00. I have a 1098 for both. The first one was paid off, and the HELOC was paid off by a new loan #3 1098, 11/23/2020.

If i add 1098 together, which ones would be added together? Also, what Lender name would I use.

I only get a loan paid off question if I mark it as refinanced.

It is confusing that I should add them together. If I add #1 and #2 together, do I mark as original loan or refinanced? And what Lender name would I enter.

I also, did take extra $ out when the HELOC and #1 loan were paid off.

Please clarify.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

It depends. I would suggest entering each 1098 individually so that the calculations regarding your interest deduction are accurate. Here is my best suggestion.

- Enter the 1098 from your original loan exactly the way that is listed on the 1098, including the mortgage balance. Be sure to indicate that this loan was paid off or refinanced with a different lender in 2020.

- Enter the 1098 for the Heloc. This time enter the 1098 but enter 0 as the mortgage balance.

- Make sure you indicate that this loan was also paid off or refinanced with a different lender in 2020.

- Also there are questions you will answer regarding that this is a Heloc.

- Here you won't mentioned you didn't pull money out. We will handle that in third 1098T

- Once your 2nd 1098 is complete, let's enter the third 1098 regarding your new loan

- Enter the information exactly the way this is listed on the 1098, including the loan balance.

- When you complete entering the 1098, there will be a question that asked if Is this loan a home equity line of credit or a loan you've ever refinanced? Here you will say yes.

- Next screen asks Great. So which type of loan is it? indicate it is A mortgage loan that I've refinanced.

- Then below that line Have you ever pulled cash out from this loan when refinancing it? Here you will say yes

- The next screen asks Have you used the money from this loan exclusively on this home? Here you will say no

- Next screen asks, Let's see how much interest you can deduct this year.

- Indicate that you wish Turbo Tax to help you figure it out.

- Finish through the section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

Why would I enter $0 for HELOC? It was paid off in 11/2020. The only way I can show these are paid off is to go to the actual form and ck it. I don't get that option unless I say it was a refi/HELOC on 1st loan or HELOC. Sorry, am I missing. something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 refi & payoff of HELOC and refi loan

Also, you cannot enter $0 for outstanding mortgage principal. It will give you an error.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Opus 17

Level 15

devries92

Level 1

Trojan99

Returning Member

csmail13

New Member

JWC2622

New Member