- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1095-a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

I have an adult child that made less than $7000 in 2019. I have marketplace insurance and we are both on it. She is filing separately. How do I allocate the percentages on the 1095-a page? I could put 50% but what happens to her 50%?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

If you allocate 50% to your daughter, your daughter's 50% allocation of the 1095-A gets reported on her tax return.

Your daughter will need to enter your 1095-A when she prepares her tax return. Just like you, she will check the box indicating that the policy was "shared by somebody who is not on her tax return" and answer the allocation questions.

You and your daughter can choose the allocation, or you can claim 100% of the 1095-A. See the details at this section of the IRS Instructions for Form 8962 for detailed instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

Thanks, the policy is under my name only. She would still need to report her 50% on her return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

That's correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

Thank you. When filling out the page on TT, I left the SLCSP box blank on both returns and entered 50% on the other two boxes. Is this correct? Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

You must enter the 1095-A exactly as it appears including the SLCSP. However, if there is a zero in any box, you can leave that blank in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

I meant on the allocation page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

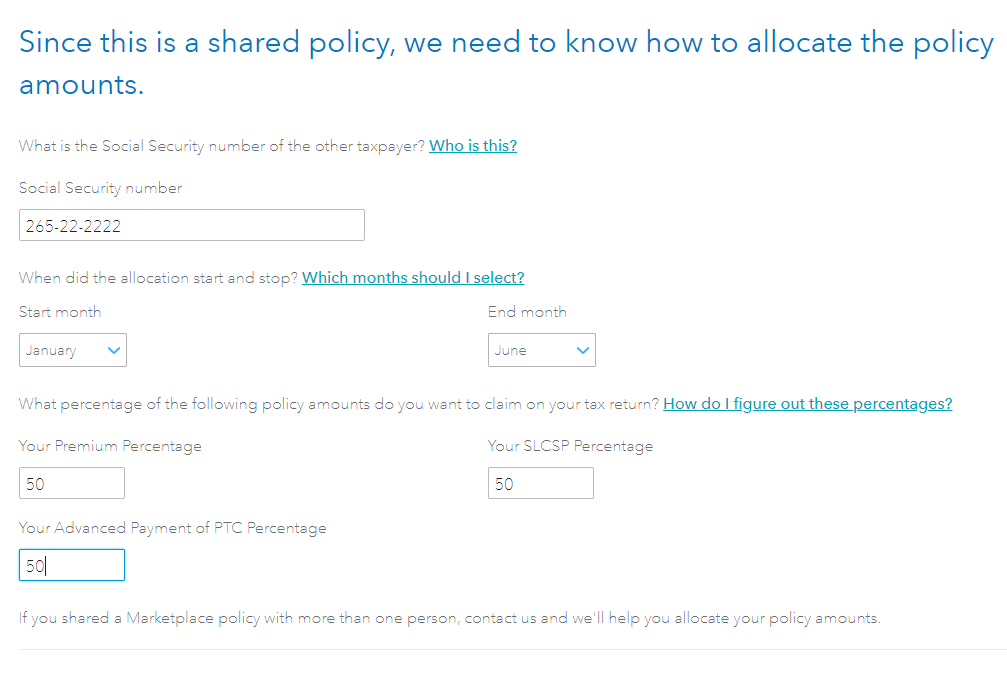

Is this the page you are referring to? Enter the percentage for every box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

When I do that, I have to pay and my daughter doesn’t. It doesn’t make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

If you paid all the premiums and got the benefit of the Premium Tax Credit, then you can allocate 100% to yourself and 0% to your daughter. The IRS says the family can allocate this any way they like.

This 100% - 0% is typical in situations like yours where there is an adult child still on the policy, but the parent was actually paying everything.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

what is the problem that TurboTax have with Form 1095-A? or with dependents? I sent a Income tax it was pendent for 4 days and now is reject

I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

@Berrygyrl59 wrote:I have an adult child that made less than $7000 in 2019. She is filing separately.

"Filing separately" doesn't mean anything. Does she qualify as your dependent? If you are not sure, what is her age and was she a full-time student for any part of 2019? Is her income over $4200?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

Please review this Turbo Tax link to determine how to share allocations between you and your adult child. Your adult child will need a copy of the 1095A so they can report your share of the premium information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

Can the allocation be reversed? I take 0% and she takes 100%? Her income was lower than mine. It is my understanding that as long as she and I agree on this, we can do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-a

Yes, if you both agree, this can be an effective way to maximum tax benefits.

@Berrygyrl59

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

franceswaller488

New Member

chelseanoland1987

New Member

AFarkas103

New Member

cardendavid8899

New Member

tjsbsq1

New Member