- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Yes, you can get these taxes back. Since Indiana and Ken...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in indiana and work in Kentucky and have paid taxes to both states for 2 years. Is there any way to get any of the more than 3k I've paid kentucky back?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in indiana and work in Kentucky and have paid taxes to both states for 2 years. Is there any way to get any of the more than 3k I've paid kentucky back?

Yes, you can get these taxes back. Since Indiana and Kentucky are reciprocal states, you are not required to file a Kentucky return unless KY withheld taxes. Your question suggests that they did not, but by filing a return, it appeared that you owed KY taxes, when that was not the case. To fix this, file a KY amended return with a zero income, but stating the amount you paid towards your tax "due" from the last two years. Then, you will put in the explanation that you are an Indiana resident and should not have paid KY state tax. To back this up, provide a copy of the Indiana returns for each year. Kentucky will return the taxes you paid in mistakenly.

Next year, when you use TurboTax, you will want to say no to the question if you worked in another state besides Indiana. This is because KY does not tax you, so this will prevent the program from generating a return you don't need.

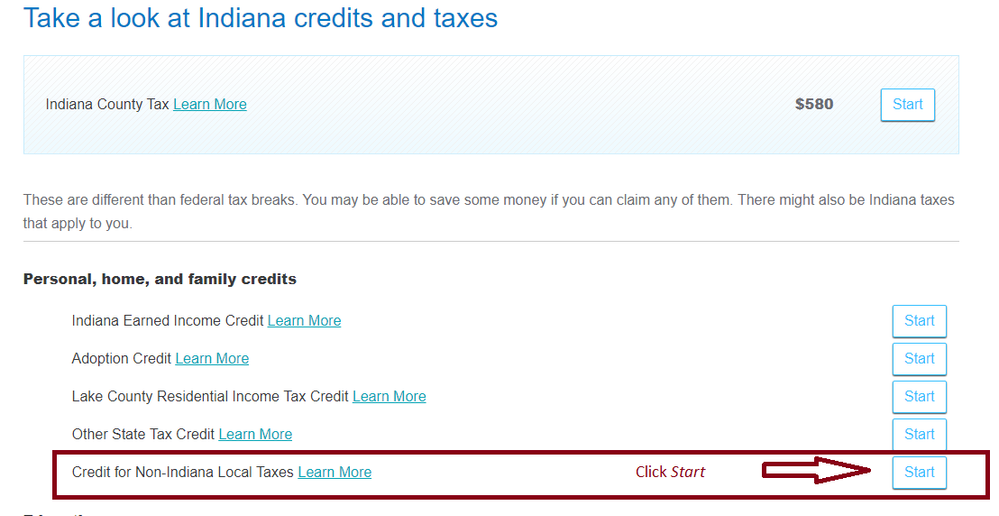

Finally, there is a possibility that you could be entitled to extra refund on your Indiana return as well. While the reciprocal agreement covers state taxes, it does not cover local taxes, which you may have paid in KY where you worked. However, IN does provide a credit for local taxes you paid in another state. If you did not take advantage of this credit, and you paid local taxes in KY (box 19 on your W-2), then, you can open up the Indiana State Return, click on the Other Deductions and Credits tab, and look for the selection "Local Taxes Paid to another State". See the screenshot below: (Trouble seeing screenshot? Click on the following link: https://ttlc.intuit.com/community/state-taxes/discussion/i-live-in-indiana-and-work-in-kentucky-and-...)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in indiana and work in Kentucky and have paid taxes to both states for 2 years. Is there any way to get any of the more than 3k I've paid kentucky back?

Yes, you can get these taxes back. Since Indiana and Kentucky are reciprocal states, you are not required to file a Kentucky return unless KY withheld taxes. Your question suggests that they did not, but by filing a return, it appeared that you owed KY taxes, when that was not the case. To fix this, file a KY amended return with a zero income, but stating the amount you paid towards your tax "due" from the last two years. Then, you will put in the explanation that you are an Indiana resident and should not have paid KY state tax. To back this up, provide a copy of the Indiana returns for each year. Kentucky will return the taxes you paid in mistakenly.

Next year, when you use TurboTax, you will want to say no to the question if you worked in another state besides Indiana. This is because KY does not tax you, so this will prevent the program from generating a return you don't need.

Finally, there is a possibility that you could be entitled to extra refund on your Indiana return as well. While the reciprocal agreement covers state taxes, it does not cover local taxes, which you may have paid in KY where you worked. However, IN does provide a credit for local taxes you paid in another state. If you did not take advantage of this credit, and you paid local taxes in KY (box 19 on your W-2), then, you can open up the Indiana State Return, click on the Other Deductions and Credits tab, and look for the selection "Local Taxes Paid to another State". See the screenshot below: (Trouble seeing screenshot? Click on the following link: https://ttlc.intuit.com/community/state-taxes/discussion/i-live-in-indiana-and-work-in-kentucky-and-...)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

steuer-jesse

New Member

pmpo857685

New Member

MyKnew

New Member

ead307d72a5f

New Member

berbellsc

New Member