- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Wisconsin Edvest filing information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Edvest filing information

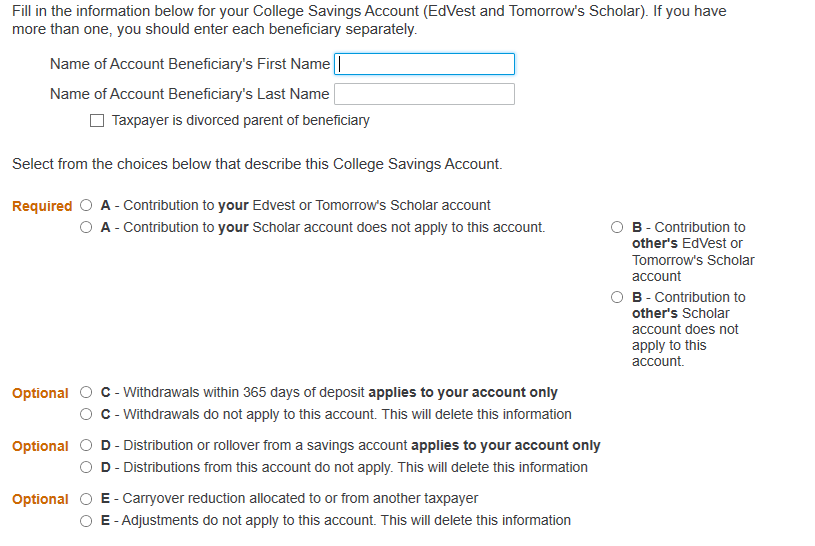

The wording while filling out the Wisconsin Edvest is confusing and I don't quite know what to put in.

First, is my dependent's name is what I put the Beneficiary blanks?

Second, in the required section "A," do I select 'contribution to YOUR Edvest ... acount?' This is technically in my dependent's name so it is not "my" account or is it?

Third, do I need to make a selection for "B" which is OTHER'S account?

Fourth, if I do select the first option for "A" there are extra spots at the bottom. The first spot is what YOU contributed to the account. Do I put in our amount here because I did contribute to this account?

I guess the bigger question is: is this Edvest account "Mine" even though it is in my dependent's name?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wisconsin Edvest filing information

If you are the person who started the account, then the account is 'yours'. The beneficiary is the person who will presumably use the funds in the account to attend college. So, if the account was set up with your dependent as the beneficiary, then enter their name in the beneficiary field.

As long as you are the one who started the account, then you will enter your contributions made to 'your' account. Most 529 plans allow you to contribute (but not necessarily deduct) to an account that was set up by someone else -- that is what is meant by contributing to an 'other' account.

If you are still not sure whether the account is set up in your name, but with your dependent as the beneficiary, then you should contact the 529 plan administrator or check your statement for the account.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mary7820

Returning Member

rhinostat

New Member

JaylaMG97

New Member

rclawson001

New Member

IFoxHoleI

Level 2