- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Turbo Tax is showing retirement plans as income Pa.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing retirement plans as income Pa.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing retirement plans as income Pa.

The retirement distribution code you have entered for each Form 1099-R is correct. The distribution code for a normal distribution is 7, in Box 7.

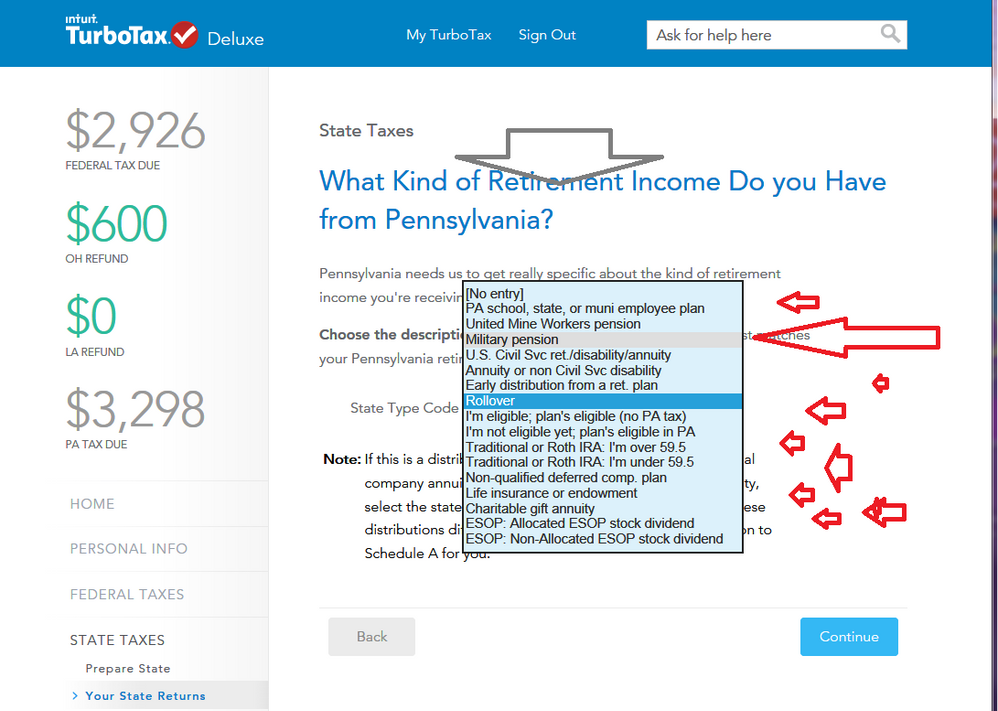

Once you get to your PA return you do have to answer the question as noted in the screen image from @StreamTrain. However, the selection should be: "I'm eligible, plan's eligible (No PA tax)".

This will eliminate taxing the retirement on the PA return. See image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing retirement plans as income Pa.

It will likely show as income for PA until you fully complete every scrap of information in the Federal section.

Then....When you start in on the PA section, you'll be presented with selecting the source of those retirement $$....that's where you need to select where it came from...and after that.....if it's qualified to not be taxed, the PA taxable income will be reduced.

________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing retirement plans as income Pa.

I am trying to find out what distribution code to use for 3 of my retirement accounts. 2 are from Allianz . 1 is a simple IRA, the other is not checked The other is an annuity from Met Life. All 3 on the 1099r box 7 have the number 7 for normal distribution.When I get to the state tax section of ttax none of the choices from the drop down box zre normal distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is showing retirement plans as income Pa.

The retirement distribution code you have entered for each Form 1099-R is correct. The distribution code for a normal distribution is 7, in Box 7.

Once you get to your PA return you do have to answer the question as noted in the screen image from @StreamTrain. However, the selection should be: "I'm eligible, plan's eligible (No PA tax)".

This will eliminate taxing the retirement on the PA return. See image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sheehyboston

New Member

topmiller

Level 3

RogerButer

New Member

Sedutra

Level 2

kaconley37

Level 1