- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TP should not be greater than the tax imposed by another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TP should not be greater than the tax imposed by another state?

I am living in NY and working in NJ and keep getting this error on my NY resident credit and do not know how to fix it

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TP should not be greater than the tax imposed by another state?

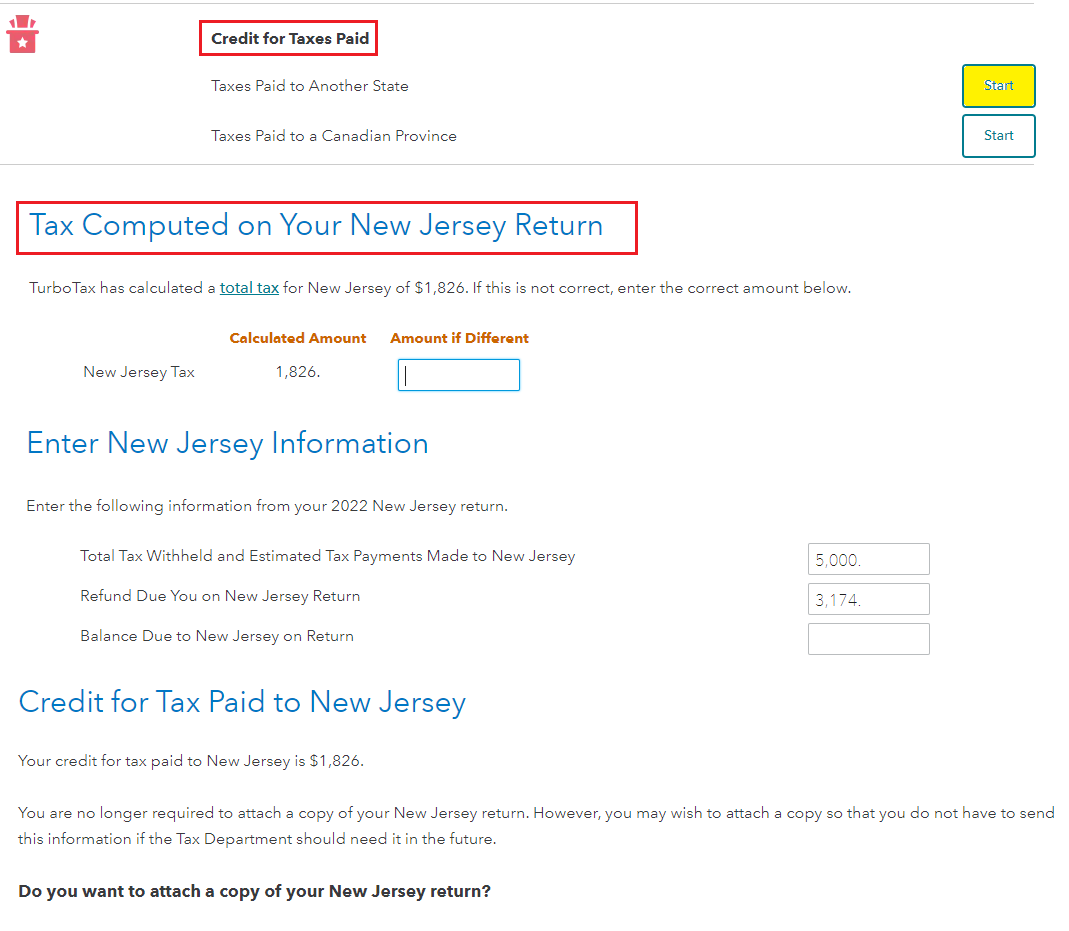

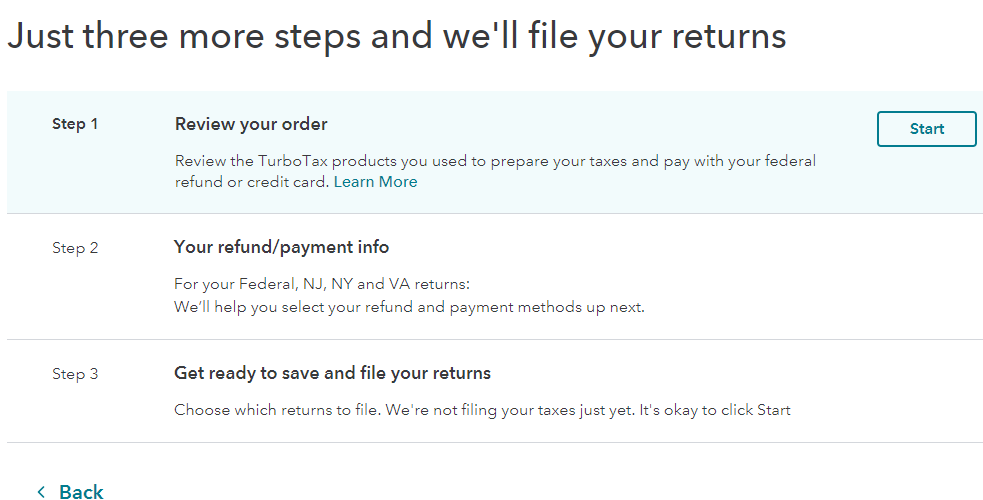

As I go through the New Jersey (NJ) nonresident return and then complete a New York (NY) resident return I was able to complete both returns without errors on either state return. See the images below.

- The only NJ income was wages from a W-2.

Your nonresident return must be completed first, then the resident return so that it picks up the credit when you select 'Credit for Taxes Paid', then 'Taxes Paid to Another State'.

If you have done the returns in the correct order, review your entries and be sure to go through each screen until you are finished with all and returned to the summary of your state taxes. If you have not done them in the correct order, you should delete them to start over.

BEFORE you start over and even if you don't need to start over you should clear your cache and cookies. It handles many issues that seem nonsensical on a regular basis.

- Close your TurboTax return first.

Watch to be sure you are selecting 'all time' as example. Do not use selections like 'last hour' for those browsers that give you options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

StPaulResident

Returning Member

Waylon182

New Member

UnderpaidinIndiana

New Member

dmcrory

Returning Member

davidash805

New Member