- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State Tax Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

After filing my 2023 Ca. State taxes I noticed that my federal earned income was the same as the states. The issue with this is that I had $20K in Social Security benefit payments which are not supposed to be taxed. How do I get this corrected?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

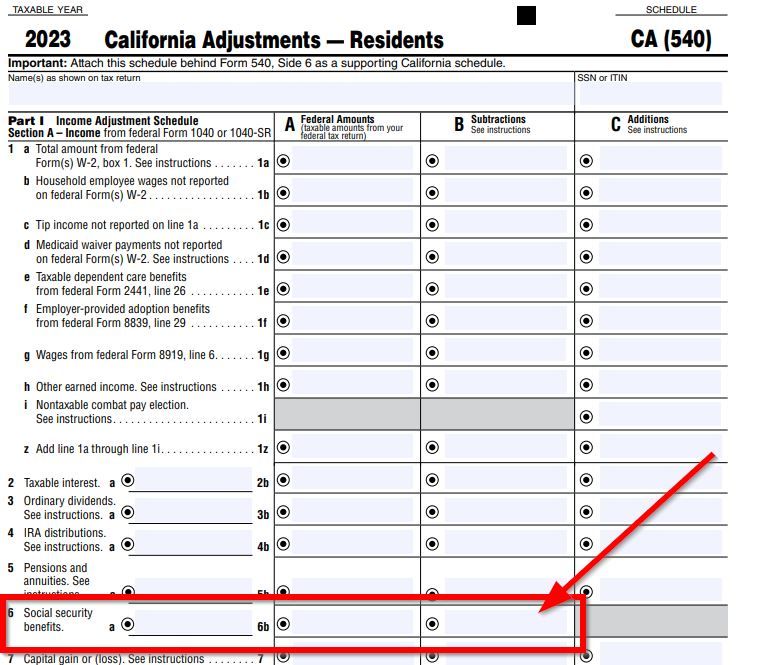

I'm in California. The taxable part of Social Security on 1040 line 6b is automatically subtracted from the CA return. Should be on the adjustments page Schedule CA(540). Where are you seeing it taxed on Calif?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

The state actually taxed 15% of my Social Security, not the entire amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

Calif should not tax any of it. And federal only taxes up to 85%.

Up to 85% of Social Security becomes taxable when all your other income plus 1/2 your social security reaches:

Married Filing Jointly: $32,000

Single or head of household: $25,000

Married Filing Separately: 0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

Did you enter SS in the wrong place? Does the 20,000 show up on federal 1040 line 6a? How much is taxable on line 6b?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

6a 20,154 6b 17,131. This is the number that was used in the state forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax Error

Ok I looked at my return. 6a & 6b are on your federal return. $17,131 is 85% of SS that is taxable. So where are you seeing 17,131 on your California return? It should be on your California Adjustments line 6

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

marcus_rumley

New Member

RB0071

New Member

diaspora1010

New Member

cwc005

New Member

lueylu33-

New Member