- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

Hi :(. I moved from NJ to PA in July of 2023. I worked entirely remotely for a NY-based company for all of 2023. I need help determining how to file my state tax returns for all 3 states, especially my double-taxed income. I was double-taxed by NY and PA from October 5th 2023-December 31st 2023. I'm so unsure of how to fill out the Double-Taxed Income page. How do I determine how much of my income is being taxed by NY versus PA? I don't know what to enter in ANY of the boxes. I think I've done the NY return properly, but I haven't even started NJ!! I'm so lost. If anyone can provide advice or guidance of any kind I will give you my firstborn. That's an exaggeration. But I'm a published poet and I'll write you an ode of gratitude. I'm completely serious. I generally consider myself quick to learn new things, but taxes are exempt from that.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

To start NY has a Convenience of the Employer Rule. Basically, this rule says if you are working remotely for your convenience then you are considered to be working in NY. If you are working remotely for your employers convenience, then you would not be considered to have income from NY sources.

If you DO meet the criteria to not be considered to have income from NY sources, then you would file a NY return to claim a refund of your withholdings. You would enter your NY income as $0 and your withholdings as however much was withheld for NY.

If you do NOT meet the criteria to be considered working remotely for the convenience of the employer, then ALL of your income would be taxable to NY. In this situation, you will file your NY return FIRST and include ALL the income earned in NY. This will all be taxed by NY. But you will then receive a credit on your NJ and PA returns.

For the time you were a PA resident, all of the income you received will be taxable to PA. PA tax rate is a flat 3.07%. If you did have to pay taxes to NY, then you will walk through the steps to take the credit for the taxes paid to NY. Be aware NY tax rates are generally higher than PA flat tax rate, so your credit will be limited to the amount of tax PA would charge on the income. You will not get a credit that results in a refund of the taxes you paid to NY from PA.

You will do the same thing for NJ as you do for PA. You will also need to enter the dates in which you lived in both states. This will help with the allocation of income to the proper states.

PA Taxes paid to Another State

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

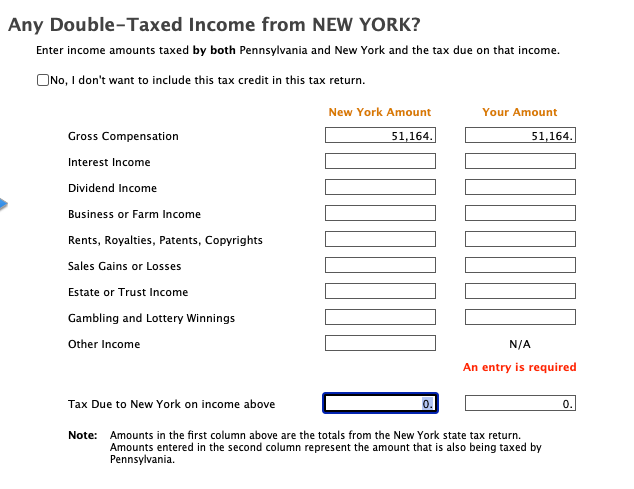

Hi Vanessa--to start, thank you so much!! That helped me fill out the NY return! Now I am stuck on the PA return. I am meant to input "Any Double-Taxed Income from New York." I was taxed by NY and PA for part of 2023. I entered my gross compensation (I have no other income sources), but then the form asks for "Tax Due to NY on income above." Does this mean the amount of tax I paid to New York during 2023? Is this information found in box 17 or 19 on the W2, or somewhere else? If you have any guidance as to how I should approach this portion of the return, I am extremely appreciative of any help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

Does this mean the amount of tax I paid to New York during 2023? No, It is asking for your total NY state taxes that you are liable for to NY on form IT-203 line 50. What you paid during the year is not relevant. This is the reason you have to do the Non Resident return first so you know your actual liability.

If anywhere it asks your NY taxable income, then you will enter all of your income as double taxed since you earned it all while working in NY. This is different than the amount of tax you paid, so pay close attention to the questions and how they are worded.

Is this information found in box 17 or 19 on the W2, or somewhere else? This will be found on line 50 of your NY IT-203.

The photo you uploaded did not load so I cannot see what it is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

Thanks, Vanessa. Unfortunately I am still confused--trying to upload the image again. I'm unsure what to input in the righthand column. Should I be doing my NJ return before my PA return? Where would I find the information to input in the righthand "Tax due to NY on income above" box? Do I input my full gross compensation in both Gross Compensation boxes, or only the NY column as the money was made working for a NY company? I greatly appreciate all of the time and energy you have inputted into helping me. I have tried going to three family members (longtime tax payers haha) for help, and we are all totally lost. Thank you so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Remote worker in PA, moved from NJ to PA mid-year, employer is based in NY State.

It doesn't matter if you do your NJ or PA first since you won't have income double taxed by the two of them. But, you will need to know for both PA and NJ, how much of the income you earned while living in each state.

The New York amount is the amount is the amount that NY taxed.

So, if you earned that $1,164 while living in NJ, then your amount would be $0.

If you earned that $1,164 while living in PA, then your amount would be $1,164

If you earned half while living in NJ and half while living in PA, then your amount on the PA return would be $582

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kiMurphy

Level 2

kcoub1

New Member

mpdoodle

New Member

Allthethings

Returning Member

marstorry77

Level 1