- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Moving States as a Student

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving States as a Student

Hello, I am from CA but have lived outside of CA for the past decade (I went to undergrad in another state and then worked before going to graduate school). I lived in VA for one year before graduate school and am a student in VA. I was in VA for roughly 7.5 months in 2019.

I interned in TX over the summer of 2019, where I earned the entirety of my income for that year. I did not earn a cent in VA. I will have accepted an offer to return to TX to work full-time and will live in TX and do not have plans to return to VA after I graduate in May.

Do I need to pay state income tax in VA if I didn't earn any money while in VA and don't intend to return when I graduate from school here? If so, do I need to pay a full year's worth of tax even though I was not in VA for roughly 4.5 months and didn't earn any money in VA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving States as a Student

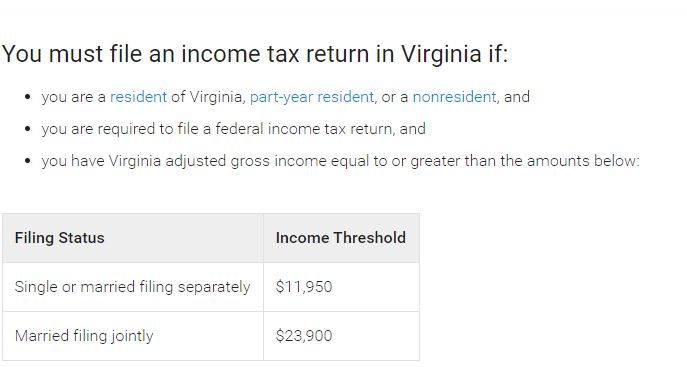

Yes, you will still need to file a VA return in 2019.

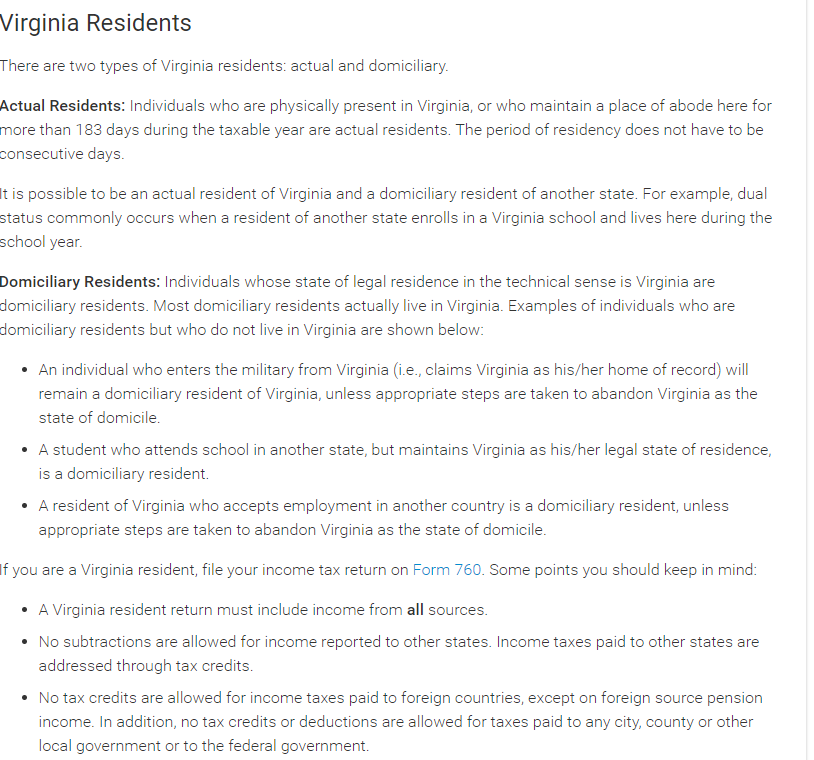

Since you were an actual resident of Virginia and were present there for more than 183 days, you have to include income from all sources, regardless of the state it was earned in.

See the following for additional information on your filing requirements and how Virginia classifies its residents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving States as a Student

Do I need to pay tax only in VA? Or can I split my taxation between VA and TX to take advantage of the fact that TX does not tax income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moving States as a Student

Yes, you would only pay tax in VA, unless you can prove that you left Virginia with no intention of returning. If you are able to do this, you may be able to file a nonresident or part-year Virginia resident return.

You are correct that TX does not have an income tax, therefore, allocating income is not an option. Being an intern is considered as having a temporary home in the other state, or in this case TX. As such, this income would still be considered taxable in your domiciled state of residence.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sharonburke6969

New Member

ambernickerson0420

New Member

alexachana

New Member

reforgedsteel

New Member

LightningBolt

New Member