- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I got a w2 for my paid family leave for CA from a 3rd party. Do I paid CA state taxes on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a w2 for my paid family leave for CA from a 3rd party. Do I paid CA state taxes on this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a w2 for my paid family leave for CA from a 3rd party. Do I paid CA state taxes on this?

No, for California state taxes, PFL benefit payments are not reportable pursuant to Revenue and Taxation Code Section 17083. In TurboTax, you will be able to indicate that it was Paid Family Leave after you enter the W2 information. (If you did not see it, go back through the section again.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a w2 for my paid family leave for CA from a 3rd party. Do I paid CA state taxes on this?

When i enter the w2 information and on the 3rd page I fill out it was for PFL, the amount goes down in my State for what I owe, but then when I go to the next page to continue, my State Tax owed goes back up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got a w2 for my paid family leave for CA from a 3rd party. Do I paid CA state taxes on this?

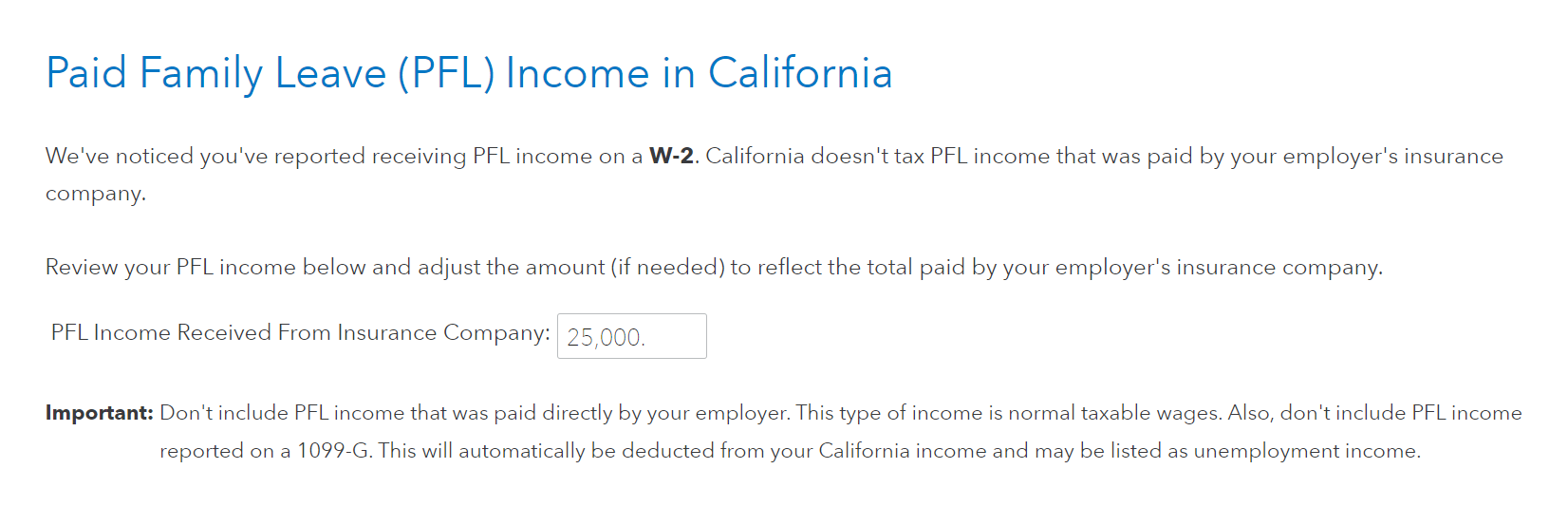

Remember that the refund meters are live calculations and will go up and down as you make your entries. When you get to the California state section, you will have to verify the Paid Family Leave.

See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

4md

New Member

2022 Deluxe

Level 1

user17561777520

New Member

michael_s_peterson

Level 2

dominibopula

New Member