- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Georgia part-year and nonresidents has the wrong information but it will not let me change it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

I have the same issue. Turbo Tax indicates that I have a #109,265 Cap Gain Loss carried over from the my Federal return. But this is not correct. It will not allow me to correct it on the GA return. What can I do other than stop using TurboTax and hire a pro?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

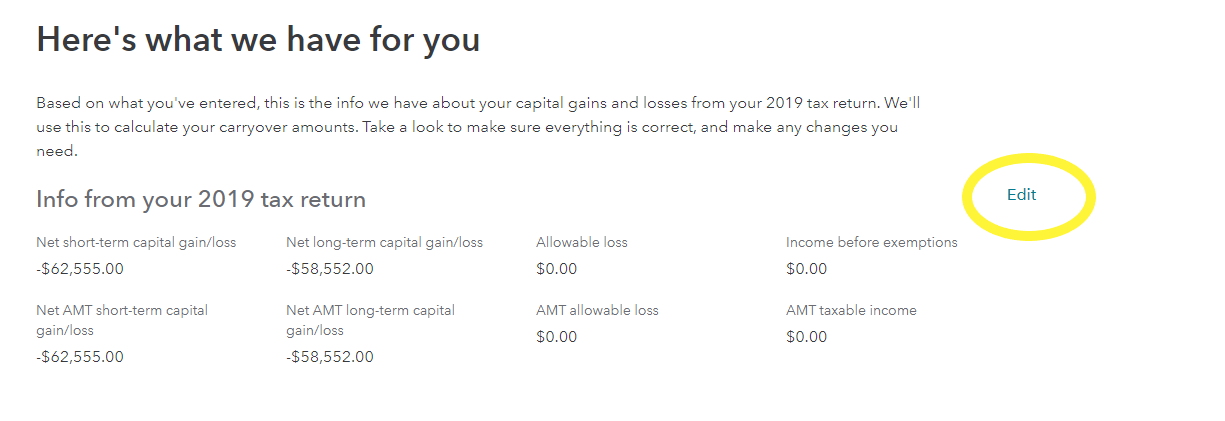

If your capital loss carryover is incorrect, then you need to manually adjust it on the federal side in TurboTax.

- Open your return.

- Search for capital loss carryover.

- Select the Jump to link in the search results.

- Click Edit and enter your correct carryover.

I have attached a screenshot for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

I am having similar problem entering Interest Income and Dividend Income. Situation is part year NJ (first part) and part year GA (2nd part). First did Federal, then NJ, then purchased and downloaded additional state of GA and started GA. Shows Georgia column for the Interest and Dividend Income entries as static with incorrect values (Interest is neither total federal or balance from NJ and Dividend is Federal total of which part was already allocated to NJ) and am able to make entries in Other State column but Georgia column doesn't adjust and can't be corrected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Wouldn't the previous reply about going into the Federal side and making a correction result in the Federal and any other state come out wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Here is a screen shot of what I am experiencing. As stated, can't make an adjustment on this screen to the GA amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

It looks like if I enter the 'Other State' amount and then continue and then come back, the Georgia coumn updates albeit the amounts on the Interest side of things don't seem to balance out and end up being zero which is fine with me if that means there is some cap on interest income or something. Dividends seem to equal the whole al right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Same issue occurs with each of the succeeding windows after Interest/Dividends but once you continue and then come back, the Georgia column adjusts albeit with some sort of apparent cap on certain amounts attributed to GA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Yes, this is a poorly worded interview screen. The screen shows the total on the federal return, then asks you for the amount of interest and dividends for the other state. The column that is headed with "Georgia" should actually read "Federal".

As such the left hand column should not be editable because it came from the federal return.

As you note, after you enter the Other State's amount, then on Schedule C on the Georgia return, the amount you allocated to the Other State is allocated to the Other State, and the remainder is allocated to Georgia. Then the Schedule calculates the ratio of incomes before applying the Georgia Standard or Itemized Deduction and the personal exemptions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

Thanks. This is helpful but am not sure it is actually working correctly. For example, with the Dividends, when I enter the amount allocated to Other State, continue and then go back, the total of Georgia and Other State is what the total of all dividends. But with Interest, when I enter the amount for Other State, continue and then go back, Georgia becomes 0 and the total of Georgia and Other State do not reflect the total interest income. I was thinking maybe GA has some sort of limit on simple interest income or something but I can't seem to find anything. Does anyone know if TurboTax is aware of this and will be issuing any updates?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Georgia part-year and nonresidents has the wrong information but it will not let me change it.

OK, this might be helpful to others. I contacted Turbo tax technical support and we worked through a few things in trying to understand the screens. As it turns out, GA handles interest, dividends and other income in a manner that depends on whether earned by yourself, spouse or jointly. NJ takes each source and splits between states irrespective of ownership. The subtle clue in the GA panels was the name of each person is within the intro paragraph. So for example, you jointly have $1200 of total interest income comprised of $800 that is yours and $400 that is your spouses and say 75% was paid by each to the Other State. Under the screen for your self, you'd enter $600 and when you hit Continue and come back, GA should show $200. Then when you go to your spouse's screen, you'd enter $300 as paid to Other State and when you hit Continue and come back, her GA should show $100. The key to this working correctly is way back in the Federal entries where you designate ownership of the interest, dividend and other income as being yourself, your spouse or jointly. Some things like Other Income appear to be allocated to only one spouse or the other and not joint. One of the brick walls I kept hitting was that for myself, the total of GA and Other State never added up to being the actual total interest because TT was only allowing allocation of about half the amount to me and the other was to my spouse, whose screen I kept blowing past thinking it was the navigation circling back to the first screen again. Once I verified source ownership and then properly allocated each owners share between states, everything seems to total out correctly.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lsw7266506

Level 3

lsw7266506

Level 3

mileseavila

New Member