- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: CO 104AD line 4 asks for deceased SSN. How do I include it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

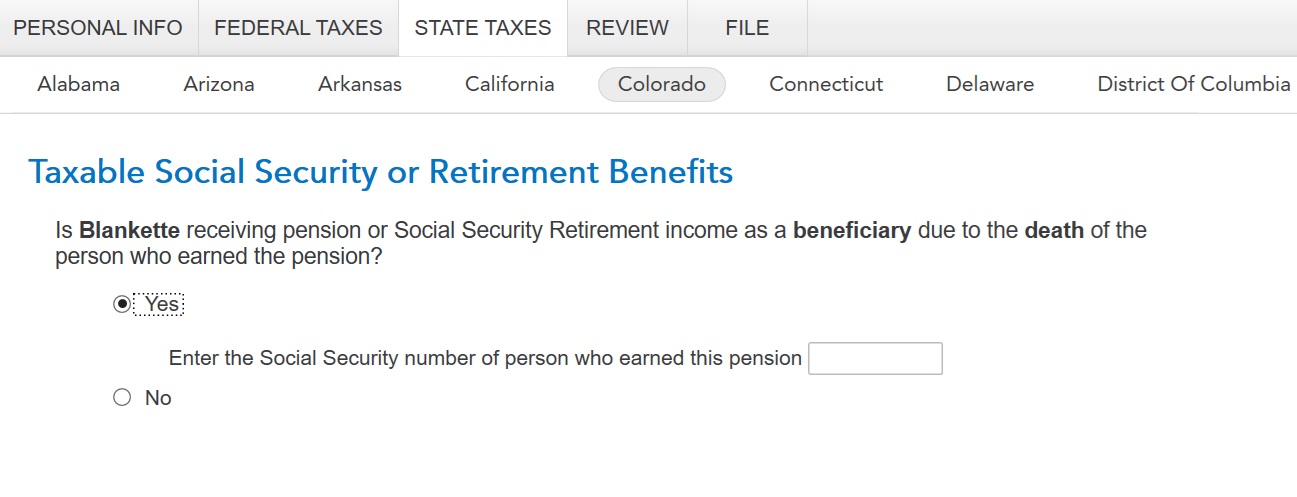

CO 104AD line 4 asks for deceased SSN. How do I include it?

CO 104AD line 4 asks for deceased SSN or ITIN.

How do I include it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

The SSN in question is that of the deceased person that you or your spouse inherited the pension from. Also, you need to be under 55 to see the trigger question. If you meet these requirements, you will see this question. And that's how the SSN gets on to the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

The person I inherited from is in fact deceased. I am over 55. I don't understand why my age has anything to do with whether the SSN is required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

These are the Colorado instructions for line 4 (and by extension, line 6) on form 104AD:

- Age 65 or older, then you may subtract $24,000 minus any amount entered on line 3, or the total amou...

- At least 55 years old, but not yet 65, then you may subtract $20,000 minus any amount entered on lin...

- Younger than 55 years old and you received pension/annuity income as a secondary beneficiary (widow,...

Colorado form 104AD, line 4 and 6, only cares about the SSN or ITIN if the pension is inherited from someone else. This is not the case for taxpayers over 65 or between 55 and 65 (in the instructions), hence only taxpayers under the age of 55 are asked the question about the SSN or ITIN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

Will Colorado deny my subtraction from income if I cannot enter the "deceased SSN" on line 4, form 104AD?

I am 53 year old Colorado taxpayer, who received a 1099-R pension distribution with box 7 distribution code 4 (meaning a death benefit). Neither the insurance company nor the estate executor will give me the deceased person's SSN.

The CO instructions are unclear on what is required vs optional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

I have looked through all the state documentation as well as the TurboTax support data base, and I don't see what happens if you can't supply the SSN. I suggest that you try to file with the field blank, and hopefully the State will accept it.

Note: if there is an e-file reject by Colorado, you have the option of printing and mailing - the e-file checks sometimes have no sense of humor. But I would try to e-file with the field blank; if the State does not like it, they will send you a letter, and you can explain to them why you would need a court order at least to get such confidential information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 104AD line 4 asks for deceased SSN. How do I include it?

I was able to e-file, and CO accepted my return without the SSN.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cher52

Level 2

ron6612

Level 5

user17573452940

Level 1

JoO5

Level 1

megaritzmom

New Member