- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Pennsylvania state tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

Why is the information not carrying correctly from the rentals on my federal return to the PA state return. They carried correctly to CA, but not to PA.

Is anyone else having this issue?????????????????????????????????????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

Are you wanting to report income on a Pennsylvania nonresident income tax return? I reported my state of residence (not Pennsylvania) and selected that I did not live in any other state.

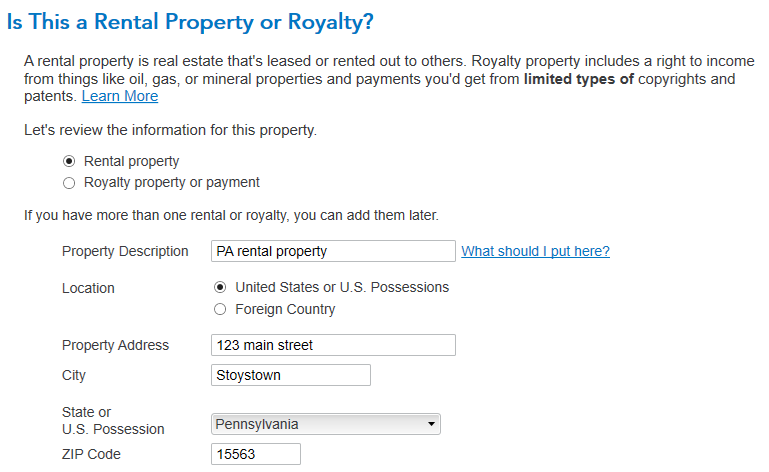

Did you report that the property is located in Pennsylvania?

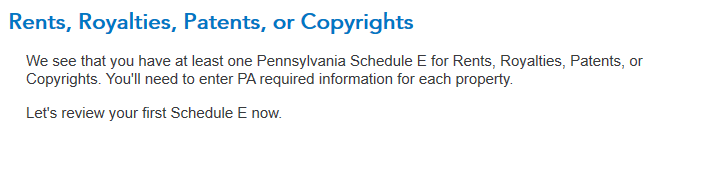

The Pennsylvania state income tax return will prompt you with this screen.

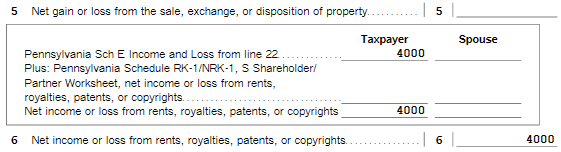

Pennsylvania form PA-40 reports

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

Pennsylvania resident. There are three Schedule E on the federal return. The program shows three Schedules E on the PA return but there are two copies of one schedule and another schedule is missing. The CA state program carried the three over correctly, however the PA state did not. I think it is a program flaw that Intuit may have to address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

Through Forms mode I corrected the errors that were made. I am not sure your looking at it now will show the issue unless I revert it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pennsylvania state tax return

There are 9 rentals filling three Schedules E. The program did not carry the Schedule E , Part I, Line 1a, A, B, C information correctly. Lines 3-22 did carry in order. The result was data being incorrectly matched with rentals. Had I not noticed it those rentals named as being in PA would have carried the earnings of rentals in different states.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PAP

New Member

cg_PAnonresident

New Member

melpaw57

Level 3

Martinmayer

Level 2

jannstr

New Member