- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- PA resident with K-1 reported in NC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PA resident with K-1 reported in NC

I am a PA resident. In 2023, I received taxable income from an estate in NC. The estate accountant prepared a federal K-1 and an NC K-1. No PA K-1 was created.

After doing my federal taxes with turbotax (including the K-1 income), I had turbotax prepare a non-resident return for NC, with the K-1 reported income. Tax rates are higher in NC than in PA, but I imagined that I would get some kind of credit for these NC taxes (on the K-1 income only) on my PA taxes.

I then used turbotax to prepare my PA state taxes. Turbotax "saw" the K-1 filing and entered it in my PA taxes. It also offered me a screen that said, in effect, "you will see yourself paying taxes twice, in both NC and PA, but don't worry -- later we will get you a credit in PA for the taxes paid in NC."

Then the trouble started. First, although I was taken through something that was looking for tax credits, and the taxes paid to NC were noted, I was shown no credit in PA for taxes paid in NC. In effect, I would (will?) be paying both 4.5% on this income in NC and 3.07% in PA. Is this correct?

Second, in trying to hunt down an answer to this question, I went to the PA turbotax screen for Schedule J (income from estates) and saw a box saying something like, "this income is not subject to PA taxes." I think that this is not true, but for the heck of it, I clicked it, to see what would happen. What happened was that the PA tax on these monies went away. But no credit -- I am simply failing to report income to PA that I should be reporting to PA. Worse yet, turbotax is not allowing me to add this income back in. It keeps telling me that I have no estate income to report, without offering me the capacity to edit. Is there anything I can do to fix this other than "destroying" the PA state income tax and doing it over again?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PA resident with K-1 reported in NC

There is no tax credit issued to the State of PA. You would need to exclude the estate income from your PA return.

As you prepare your PA tax return, there will be an Estates and Trust Summary. You will select edit in the line that lists the name of the estate. Please refer to screenshot 1.

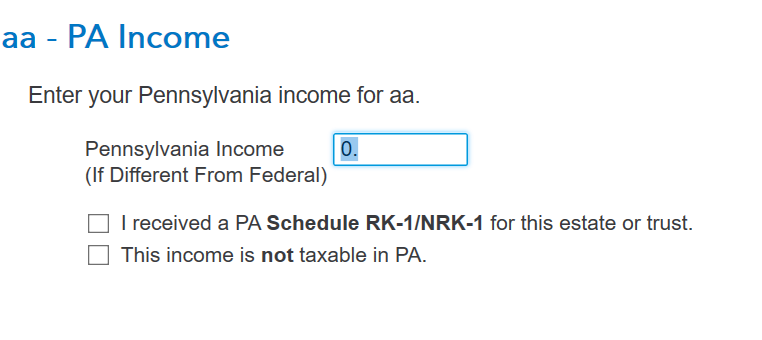

The next screen will ask, what the PA income is, you would place a zero in the box. This will then exclude the Estate income from your pa return. This is illustrated in the second screenshot. As I said, you won't get a tax credit in PA since the income is being excluded but you won't be taxed twice on the income.

Be sure you enter your k-1 under federal taxes first so the information will flow to both your NC nonresident and PA resident return.

The income tax rate for North Carolina in 2023 is 4.75%. For PA it's 3.07%.

[Edited 03/13/24|1:45 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

flyingcapybara

New Member

sunshineInTheRain

Level 3

datproto

New Member

jmpeacock-sbcglo

New Member

nshakur

New Member