- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

There is no tax credit issued to the State of PA. You would need to exclude the estate income from your PA return.

As you prepare your PA tax return, there will be an Estates and Trust Summary. You will select edit in the line that lists the name of the estate. Please refer to screenshot 1.

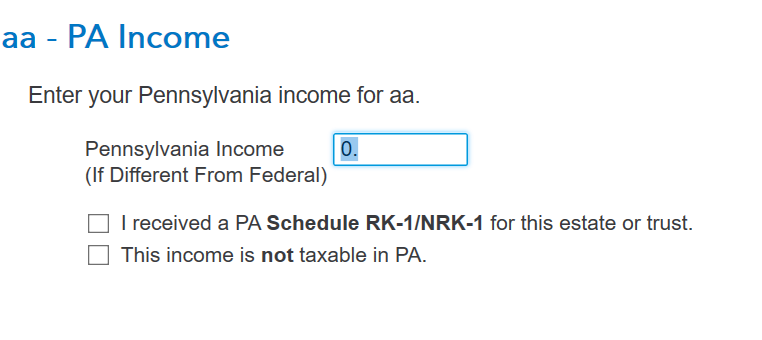

The next screen will ask, what the PA income is, you would place a zero in the box. This will then exclude the Estate income from your pa return. This is illustrated in the second screenshot. As I said, you won't get a tax credit in PA since the income is being excluded but you won't be taxed twice on the income.

Be sure you enter your k-1 under federal taxes first so the information will flow to both your NC nonresident and PA resident return.

The income tax rate for North Carolina in 2023 is 4.75%. For PA it's 3.07%.

[Edited 03/13/24|1:45 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"