- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Live in RI, Work in MA: Domicile Question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in RI, Work in MA: Domicile Question.

I am a citizen of MA. In October 2020, due to my work being 100% remote, I moved to RI to save on rent. I have no intention of permanently residing in RI; I plan on moving back to MA upon lease-end. For this reason, I would not consider my domicile as RI, and I never converted my MA license to RI (if that matters).

In such circumstances, do I have to file an MA and RI tax return? Can I just file an MA tax return?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in RI, Work in MA: Domicile Question.

It depends.

If your intent is to return to MA, you will need to be able to show Rhode Island that you have no intention of staying. The terms of your lease may be indicative of your intentions.

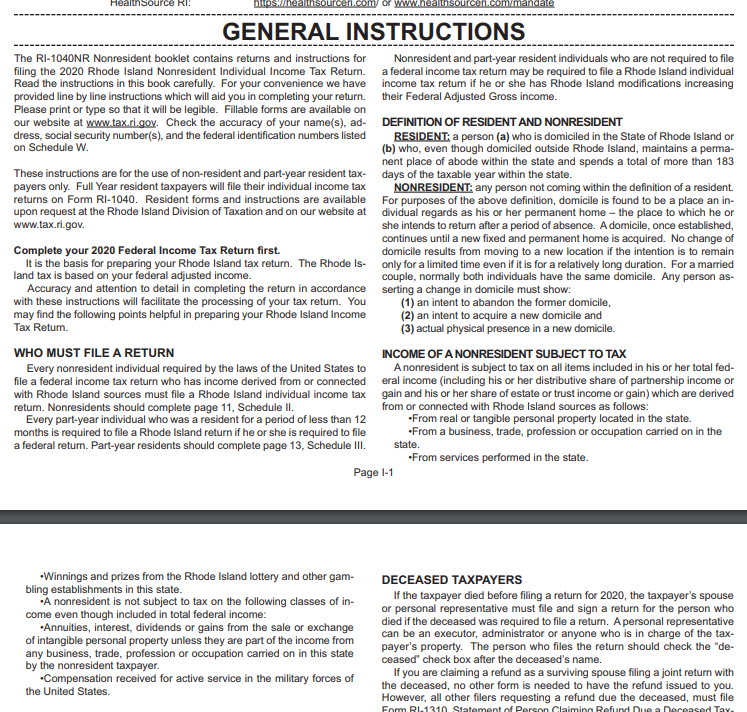

Rhode Island includes having a clause which says "no change of domicile results from moving to a new location" indicating that your stay in Rhode Island could be considered temporary for tax purposes. However, if you reside within the state for over 183 days, you would be considered a resident of Rhode Island and would need to file a tax return there. This may become a factor in 2021 depending upon how long your lease is.

However, any income earned while you are within Rhode Island could be subject to state income taxes as a nonresident if the income is from Rhode Island sources. Please see the attached excerpt for more information.

For 2020, you may be okay filing just your MA state tax return, but only if you did not earn any income within Rhode Island and meet the residency requirements as outlined above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

Once a year Accountant

Level 3

VAer

Level 4

afletchertfc

New Member

rajasekhar-madugula

New Member