- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

Appear like you had income from California, and these questions aim to establish your resident status. Depend on your residency status you will be taxed accordingly.

Please, follow the link for more information about Residency staus How California taxes residents, nonresidents, and part-year residents status and https://www.ftb.ca.gov/individuals/fileRtn/Nonresidents-Part-Year-Residents.shtml#residency_status

Hope its help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

Appear like you had income from California, and these questions aim to establish your resident status. Depend on your residency status you will be taxed accordingly.

Please, follow the link for more information about Residency staus How California taxes residents, nonresidents, and part-year residents status and https://www.ftb.ca.gov/individuals/fileRtn/Nonresidents-Part-Year-Residents.shtml#residency_status

Hope its help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

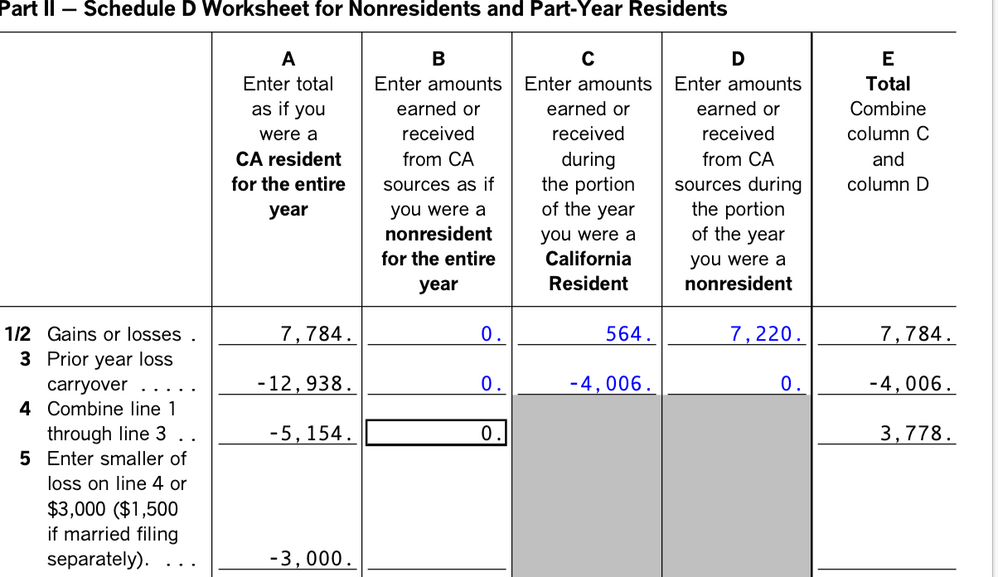

Those sound like questions on the Calif part-year/nonresident Schedule D Worksheet and are a little difficult to understand. I'll try to unravel them:

Gain/loss from Calif sources as if a nonresident for full year - this is as if you lived in, say Vermont, all year and you sold real estate located in Calif. Enter the gain or loss on dispositions like that (property is in Calif).

Gain/loss during the portion of the year you were a Calif resident - If you were a Calif resident during any of 2017 enter all gains/losses earned during that time - it doesn't matter where the property is. If never a Calif resident in 2017, skip it (if it wants an entry, enter 0).

Earned from CA source while a CA nonresident - this is the opposite of the one just above: Enter all gains/losses from Calif sources (i.e. real estate located there) during the time you didn't live in Calif. If you were a full-year nonresident then this is the same number as the first question above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

can someone explain this further using an example? Lets say i moved out of CA to VT in May 2021, and sold 2 stocks this year:

- Stock A: i sold a stock that i owned in Feb 2021 $80 gain

- Stock B: Sold a stock i owned in Nov 2021 while in VT for a $100 gain

For earned from CA source, is it:

- Stock A: $80 earned from CA source if non resident for entire year, $80 earned when CA resident, $0 earned from CA source if non resident

- Stock B: $0 earned from CA source if non resident for entire year, $0 earned when CA resident, $0 earned from CA source if non resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

Allocate your Capital Gains by the % of the year you lived in each state on your Part-Year Returns to both California and Vermont.

For example, if you had a total of $180 in Capital Gains reported on your Federal return, and you lived 6 months in California and 6 months in Vermont, you can allocate 50% of Capital Gains amount to each state.

Click this link for more info on Allocating Income as a Part-Year Resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

@TerryA , so if I stayed in the CA for say the period Jan-Apr(end) and in India for the rest of year (remaining part of Apr to end of year) in 2021,

for the column B, I should enter zero. Right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

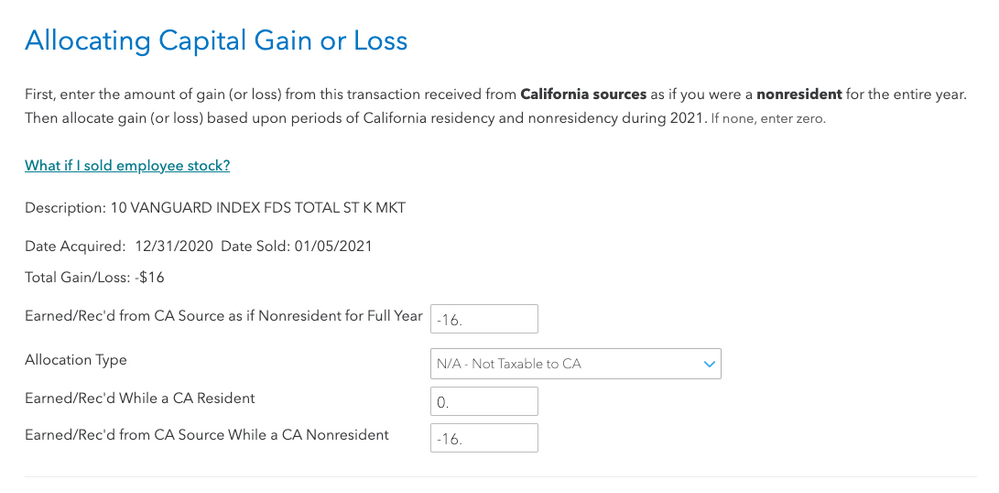

How does "California Source" apply to stocks?

In the real estate example, it's possible to earn money in California even though you're in another state. Therefore, you could consider that a Californian source of income.

However, stocks aren't tied to an area. Let's say that I suffered a -$16 loss on a sale outside CA. How would I answer "Earned/Rec'd from CA Source as if Nonresident for Full Year"? Shouldn't I put $0 because, if I were a non-resident, then the sell would be a non-CA source?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

No, you should put the full amount of the loss or gain because if you were a California non-resident the whole year that is how much you would have lost wherever you were.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

The question is really confusing. Is there a need to amend the return if 0 is entered for this field for Part Year CA residents?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

@RobertB4444 So in the following example of a -$16 loss outside CA, I would put:

- 0

- Not Taxable to CA

- 0

- 0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

Yes, that would be correct. The Capital Loss on a Stock Sale had nothing to do with California-source income.

@josalvatorre

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

so what if I moved from TX to CA in June, and I sold stocks Aug for $5 gain. How do I answer these - is the below correct?

| Earned/Rec'd from CA Source as if Nonresident for Full Year | 0 |

| Allocation Type | RES - Earned/Rec'd While a CA Resident |

| Earned/Rec'd While a CA Resident | 5 |

| Earned/Rec'd from CA Source While a CA Nonresident | 0 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

That is correct. You sold some stocks right after you moved to CA. Allocate the gain to CA

You received that income while you were CA resident.

For more information on how to allocate your income: How do I allocate (split) income for a part-year state return?

Edited[02/28/2023, 06/26 AM, PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

How to report stock A and stock B transactions in this example in VT tax return?

Also, what if transaction B is actually a selling of the primary CA residence with profit but sold after moving to VT?

Thank you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Earned from CA source as if CA nonresident for full year? Earned while a CA resident? Earned from CA source while a CA nonresident? What do I fill for above lines?

You have posted in and referenced a thread that has been inactive for over two years. Please clarify your question if this response doesn't resolve it. You sold a California home after moving to Vermont? and you sold stock?

To enter the sale of a personal residence in TurboTax Online:

- Click on Federal Taxes

- Click on Wages and Income

- Scroll down to Less Common Income

- On Sale of Home (gain or loss), click the start or update button

If your gain on the sale will be less than the applicable limit, and if it was never used for business or as a rental, and you didn't receive a Form 1099-S, you don't need to report the sale on your return at all. Not having to report the sale could save you from needing to upgrade your TurboTax product.

See this article for more information on determining the gain on the sale of your home.

Prepare your part-year California return first, then prepare a Resident return for Vermont if that was your state of residence at the end of the year. Answer the questions in TurboTax about your income in both states. You may be able to get a credit on your Vermont return for taxes paid to California.

When you have multiple state returns, you should usually enter the earlier part-year resident or nonresident state return first, then enter the state where you resided at the end of the year, in order to get the correct results. The state where you are currently a resident may be able to give you a credit for taxes you paid to other states. There are some exceptions; for example, Arizona credits California residents for taxes expected to be paid to California on Arizona income.

Several states also have reciprocal agreements. See here for more information.

Please also see this TurboTax tips article for more information on filing returns with multiple states.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

diaolilin

Level 3

Eskomao

New Member

user17712108350

New Member

Kool Virdee

New Member

vidis12

Returning Member