- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Delaware Unemployment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Delaware Unemployment

For the 2022 tax year, Delaware is again taxing unemployment compensation. TT Delaware is incorrectly subtracting unemployment. How to get that fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Delaware Unemployment

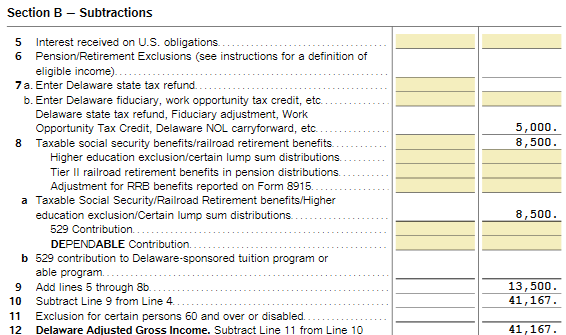

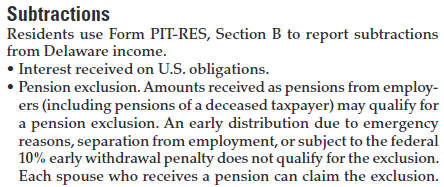

Federally taxable unemployment compensation is subtracted on Delaware PIT-RES Section B line 7b.

Unemployment compensation is listed as a Subtraction in Section B per The TaxBook page DE-3

Unemployment compensation is listed as a Subtraction in Section B per The TaxBook page DE-3

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Delaware Unemployment

Unemployment was not taxed in 2021 but is taxed in 2022

Delaware State Tax Refund, Fiduciary Adjustment, Work

Opportunity Tax Credit, Delaware NOL Carryovers

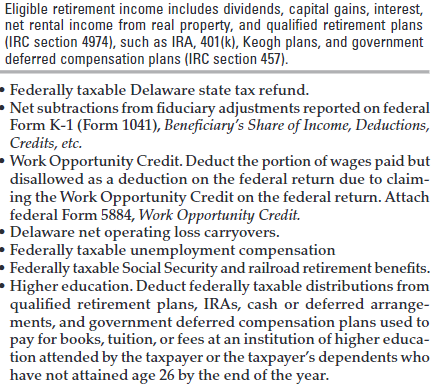

Delaware State Tax Refund

If some or all of your Delaware state tax refund was included in federal

adjusted gross income, include the amount on line 7 to reduce your

Delaware AGI.

LINE 1 WORKSHEET

ALLOCATION OF FEDERAL ADJUSTED GROSS INCOME BETWEEN SPOUSES (Filing Status 3 and 4 Only)

Federal/Pro forma Spouse Yourself

1. Wages, salaries, tips, etc 1. 00 00 00 1.

2. Interest 2. 00 00 00 2.

3. Dividends 3. 00 00 00 3.

4. Taxable refunds, credits, or offsets of state and local income

taxes

4. 00 00 00 4.

5. Alimony received 5. 00 00 00 5.

6. Business income or (loss) 6. 00 00 00 6.

7a. Capital gain or (loss) 7a. 00 00 00 7a.

7b. Other gains (or losses) 7b. 00 00 00 7b.

8. IRA distributions 7. 00 00 00 8.

9. Taxable pensions and annuities 9. 00 00 00 9.

10. Rents, royalties, partnerships, s-corps, estates, trusts, etc. 10. 00 00 00 10.

11. Farm income (or loss) 11. 00 00 00 11.

12. Unemployment compensation (insurance) 12. 00 00 00 12.

13. Taxable social security benefits 13. 00 00 00 13.

14. Other income 14. 00 00 00 14.

15. Total income. Add Lines 1 through 14 15. 00 00 00 15.

16. Total Federal Adjustments (Federal Schedules) 16. 00 00 00 16.

17. Federal Adjusted Gross Income. Subtract Line 16 from Line 15.

Enter on page 1, Line 1, columns A and B of your Delaware return 17. 00 00 00 17.

Page 7

Fiduciary Adjustment

Net subtractions from fiduciary adjustments derived from income received

from an estate or trust, as shown on your Federal Form K-1, Beneficiary’s

Share of Income and Deductions, should be included on Line 7.

Work Opportunity Tax Credit

The law allows a deduction for the portion of wages paid but disallowed

as a deduction for federal tax purposes by reason of claiming the work

opportunity credit on the federal return. That portion of the deduction

for wages, which is disallowed for federal purposes, should be entered on

Line 7. In order to claim this modification, you must attach Federal Form

5884.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Delaware Unemployment

so TT is not planning to correct for the error? Can I get a refund?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jh73

Level 3

silver607885

Level 2

russoreo

New Member

kdcwhitehead

New Member

frankdean2112

New Member